[ad_1]

[ad_1]

As things stand, Bitcoin and Ethereum follow their respective 2017 peaks of 10% and 150% respectively. Clearly, one is further away than the other, but both cryptocurrency markets are closer to the infamous bull market than you think.

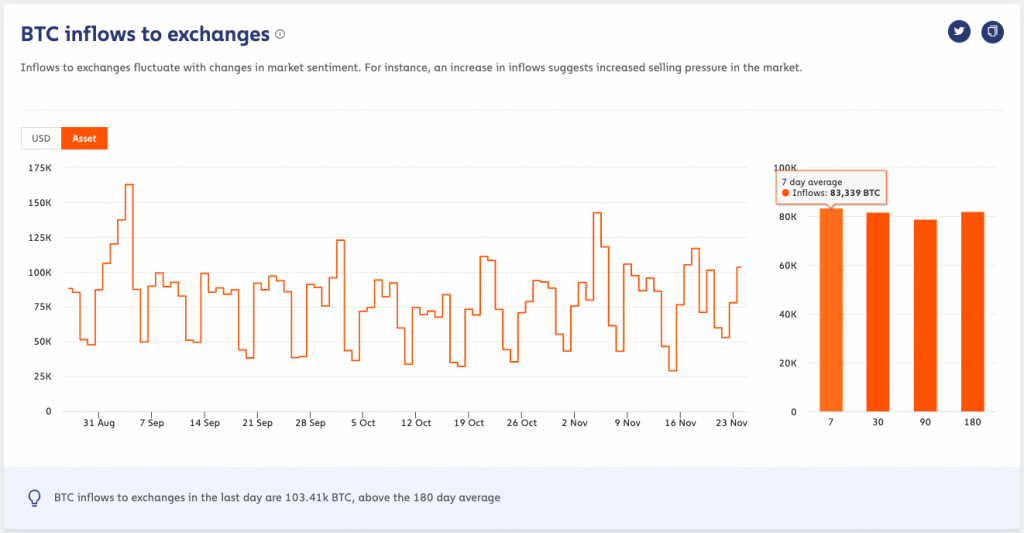

According to the market intelligence report from blockchain analysis firm Chainalysis, while Bitcoin may have seen some “ foam ”, the fundamentals remain strong. Even with the falling price of BTC dropping from $ 19,000 to as low as $ 17,000, inflows to the exchanges are above their long-term average as hodlers are still selling their cryptocurrencies, despite the falling price.

Outflows are attenuated relative to inflows as the BTC balances held in the exchanges rose to 11,900 Bitcoin. According to the aforementioned report, the narrative has changed to speculation on exchanges, rather than taking Bitcoin for self-custody as an investment given the rapid rise in prices over the past week.

BTC Exchange Inflows | Source: Chainalysis Markets

Under the radar, given the rise in the price of Bitcoin, is Ether, the native token of Ethereum. With the blockchain speeding towards Ethereum 2.0, the inflows have also increased. At the time of writing, approximately 670,000 ETH were held on the stock exchange, a 40% increase from the 30-day average. These inflows have been driven by crypto-fiat exchanges, rather than fiat-cryptocurrency exchanges, with the report suggesting ETH hodlers are shifting from DeFi to fiat.

Trade intensity, a metric that measures cryptocurrencies flowing into an exchange versus order book trades, is also on the rise for ETH. This finding revealed that the price of the altcoin was “weaker” than that of Bitcoin as it served as a lagging indicator for the first $ 610 drop, a two-year high.

Looking back on the week, it started with shades of green 2017 before ending with deep cuts of red 2018. The report likened this week to a “ bull run ” initiated by a rapid rise in prices in the Bitcoin and altcoin markets. followed by the love / hate element of the market – FOMO.

Moving forward, with the ATHs to be tested soon enough, how will the market play out? Will the owners cash out at this two-year maximum or will resisting for an expensive life have a new definition? Do you resist even in a bull market? Time will tell.