[ad_1]

[ad_1]

A new record for bitcoin will have to wait, if it ever comes.

Bitcoin BTCUSD prices,

BTCUSD,

They were pummeled on Friday, pushing the cryptocurrency into correction territory, commonly referred to as an asset’s drop from a recent peak of at least 10%.

On the last check, Bitcoin changed hands on CoinDesk, down 2.4%, to $ 16,714, representing a drop of more than 14% from its 52-week peak at $ 19,495, set in less than 24 hours earlier. of the Thanksgiving crash.

Bitcoin has been a traditionally volatile asset since its inception, but if those watching the closely followed cryptocurrency are looking for the reasons for its recent decline, market participants have pointed to at least three key factors:

-

Coinbase CEO Brian Armstrong has suggested stricter regulation in a Wednesday tweet

-

Bought in excess and ready for a drop

-

Bitcoin is volatility

Voices of Armstrong

Part of the decline of bitcoin and the larger cryptocurrency complex is attributed to a series of messages from Coinbase CEO Armstrong via Twitter. Armstrong hinted on Wednesday that the U.S. Treasury Department attempted to push through stricter regulation before the Trump administration leaves office.

The threat of tighter regulation has always loomed over the nascent digital currency industry, but the comments may have been enough to initiate a bearish bias on bitcoin which has enjoyed a gain of more than 130% year to date, experts said.

Prepare for a pullback

Charles Hayter, founder of CryptoCompare, told MarketWatch that the bitcoin withdrawal as “one of the fastest moves” he has seen, adding that it was not unexpected after the cryptocurrency had such a brisk run near its all-time high in December. 2017.

“This was one of the fastest moves that bitcoin has made. Of course there is a pullback at these points as the off exchange to on exchange shifts occur,” Hayter said in comments emailed to MarketWatch on Friday.

Bitcoin’s rise in the stratosphere comes as Dow Jones Industrial Average DJIA,

grew 5% this year, the S&P 500 SPX Index,

gained over 12% during the same period and the Nasdaq Composite Index COMP,

has grown by 35% in the year to date. Gold GOLD,

meanwhile, it has risen 19% so far this year and is planning a reversal of much of its rally with the emergence of viable COVID-19 vaccines.

“Some of the 10k buyers will collect their winnings and some who have been hiding at these levels since 2018 will be happy to get out of business,” he speculated.

Intrinsic volatility

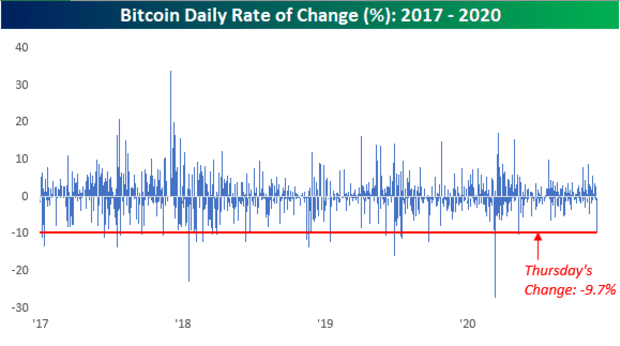

A chart released Friday by Bespoke Investment Group highlights a key fact that new bitcoins need to get used to: its traditional volatility.

Bespoke wrote that Thursday’s drops in magnitude aren’t particularly out of the ordinary throughout bitcoin’s history, noting that since 2017 bitcoin has seen 24 more heartbreaking one-day drops than Thanksgiving (see attached chart):

Tailor-made investment group

While the bears may use this current withdrawal as a warning as to why bitcoin is a problematic asset, many continue to hold the asset in hopes of a more bullish horizon for cryptocurrencies.

Libra is not dead

Facebook FB,

The digital currency network, Libra, could be launched as early as January, according to reports. If so, it would represent a major achievement for the story as a whole, even if critics claim that the Libra coin does not truly represent the traditional cryptocurrency market.

That said, it could be a flagship of digital asset advocates at a time when virtual currencies are attracting greater mainstream appeal.

Last month, PayPal Holdings PYPL,

claimed it would allow customers to purchase cryptocurrency through their accounts and use cryptocurrency for merchant payments, which also lent some legitimacy to the nascent asset.

Mainstream appeal

Major investors, including hedge fund luminary Paul Tudor Jones, have become proponents of the asset, describing its recent rally in a CNBC interview as its “first inning.”

These apparent confirmations highlight a growing attention from institutional investors towards bitcoin as a legitimate alternative to fiat currency or other assets used to hedge their exposure to conventional investment instruments.

To be sure, bitcoin and its counterparts, critics warn, could still drop to zero and herein lies the intrigue and potential danger of digital currencies.

.[ad_2]Source link