[ad_1]

[ad_1]

Investors in gold are becoming anxious, as the prices of the precious metal have fallen sharply since a number of vaccine companies revealed drugs to fight the coronavirus. The price of one ounce of fine gold is valued at $ 1,770 per unit after the precious metal posted its third consecutive weekly loss. Additionally, gold saw its largest weekly outflow ever last week as investors appear to be selling off the safe haven asset in large numbers.

Gold (Au) prices per ounce continue to spiral down in value, as the price of the precious metal dropped more than 14.5% from its all-time high last August. The reason for the low value over the past few weeks may be due to advances from vaccine manufacturers who claim to have produced medicines that will help fight Covid-19. Craig Erlam, analyst at the forex exchange OANDA, believes the latest vaccine news is likely the engine.

“The news of the vaccines has led to a lot of optimism in the market and we are seeing some outflows of safe haven assets such as the dollar, Treasuries and the same is reflected in gold prices,” Erlam said in an interview Monday.

Meanwhile, gold has also seen the largest weekly outflow ever as analysts suspect gold investors are cashing in. For example, The Gold Observer’s independent financial researcher Jan Nieuwenhuijs, shared a chart last week showing massive gold outflows.

In parallel to this, in a note to investors on Monday, Activtrades chief analyst Carlo Alberto De Casa said that “the short-term trend for bullion has been undermined by the fall in the price through the support level at $ 1,850” . Activtrades chief analyst further added:

Investors have shifted to other businesses, seeking faster gains, although they haven’t forgotten that central banks will be forced to print money for many years to help the economy recover from the Covid-19 crisis.

Obviously, many investors and analysts see the flow of precious metal money entering the cryptocurrency economy. Furthermore, traditional market sentiment has greatly improved and this has put a lot of eyes on bitcoin and digital asset investments. Simon Peters, an analyst at Etoro, says that “sentiment is improving in traditional markets and around the world”.

“All eyes have been on bitcoin over the past week with raging debates over whether or not we’ve hit a new all-time high,” added Peters. Etoro’s analyst continued:

After the dizzying rush of the past eight weeks, a price correction was inevitable and this week’s drop is more than a coincidence. With bitcoin finally reaching a three-year high on Tuesday, just days before Thanksgiving and the successful Black Friday sales, it appears that many investors who have held since December 2017 have chosen to take their profits.

Additionally, macro strategist Raoul Pal told his 282,000 Twitter followers that he planned to sell all of his cryptocurrency gold holdings. “I have a sell order tomorrow to sell all my gold and scale it to buy BTC and ETH (80/20)”, the macro strategist tweeted. I don’t own anything else (except some bonds and some $). 98% of my net worth is liquid, ”added Pal.

Three Arrows Capital co-founder Kyle Davies also discussed the gold money flowing into the crypto economy this week.

“Nobody gets gold -> $ BTC -> alts This year has seen large inflows of equity from USD or gold to BTC. This isn’t retail. These guys aren’t going into ripples,” Davies tweeted on Sunday.

While cryptocurrencies such as bitcoin are in crisis and gold prices are seeing weekly lows week after week, as usual, gold bug Peter Schiff felt the need to attack bitcoin on Twitter. Schiff is not very happy with the fact that a number of CNBC news hosts such as Brian Kelly are optimistic about the future value of bitcoin.

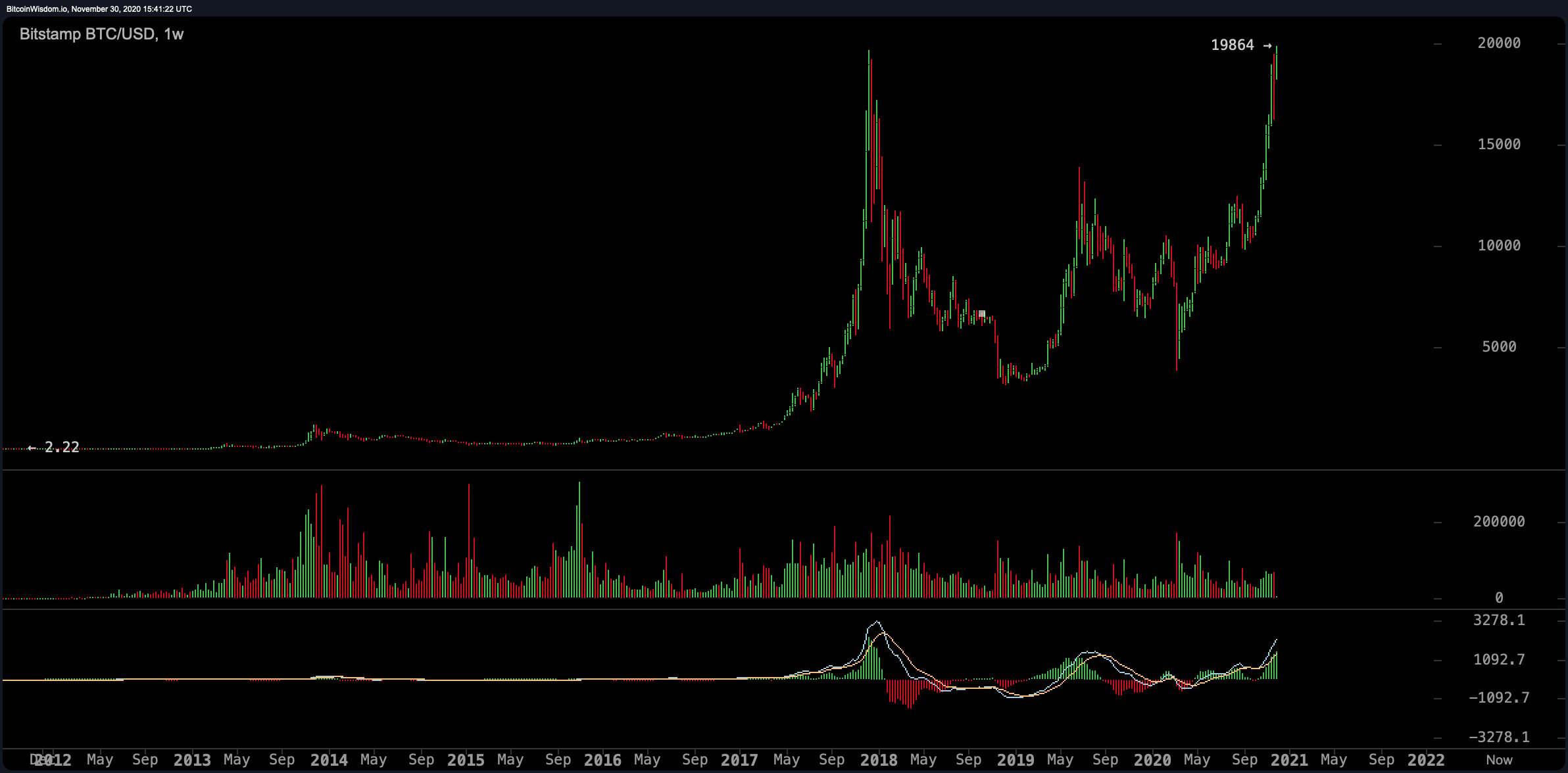

“The reason it’s so easy for bitcoin pumpers to trick CNBC’s anchors into buying the bitcoin craze is that their understanding of investing, fiat money, gold and the economy is so limited,” Schiff tweeted on Monday. “CNBC anchors are entertainers. At least sports hosts know something about sports, “he added. Meanwhile, on the Bitstamp exchange, bitcoin (BTC) hit an all-time high of $ 19,864 on Monday, November 30, 2020.

What do you think of the massive outflows of gold last week and the steeply falling price? Do you think gold investors are joining the crypto economy? Let us know what you think about this topic in the comments section below.

Image credits: Shutterstock, Pixabay, Wiki Commons, Goldprice.org, Bitcoinwisdom.io,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, nor a recommendation or endorsement of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or allegedly caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]Source link