[ad_1]

[ad_1]

Source: Inked Pixels – Shutterstock

- Former Goldman Sachs employee Raoul Pal predicts the possible migration of gold investors to Bitcoin (BTC).

- MicroStrategy CEO reveals he owns 17,332 BTC which he bought for $ 9,882.

The past few months have been bullish for Bitcoin in terms of adoption. Some of the largest companies in the S&P 500 and the payment processing industry have adopted cryptocurrency. Among them, PayPal is one of the most important. Since its announcement, BTC has started an uptrend that has pushed it to its maximum price in 2020.

At the time of publication, Bitcoin is trading at $ 13,260 with a sideways move of -0.73% in the past 24 hours. In the weekly and monthly charts, Bitcoin is at 12.04% and 23.95% respectively. In the latter figure, Bitcoin is the biggest winner of the last 30 days followed by Litecoin (25.87%) and Binance Coin (18.16%).

One of the most optimistic investors in Bitcoin is former Goldman Sachs employee Raoul Pal. Since the start of the pandemic, Pal has been studying the impact the crisis will have on the world economy. In this sense, he indicated that “we are in a transition from the phase of hope to that of insolvency”. Growth in major American and European economies will require more than a “post-election stimulus package”, Pal She said.

Most international exchanges and international currencies are in crash trajectory. According to the analysis he has been doing for months, Pal believes that Bitcoin is the only asset that offers a way out of the crisis. Comparing Bitcoin’s performance to that of US Treasuries, Pal said:

You can buy bonds and dollars or you can take the life raft – Bitcoin. Or, to dampen the volatility of a risk-free event (we can and will see strong BTC corrections), you can have all 3 for a near-perfect portfolio for this phase … Good luck. Look see how it ends …

Pal added that Bitcoin is the best trading and investment opportunity he has seen. Referring to cryptocurrency as a “supermassive black hole”, he expects BTC to become the primary asset to hedge against inflation caused by Federal Reserve measures. Maybe also to attract the attention of gold investors:

Bitcoin’s performance is so dominant and so all-encompassing that it will suck in every single asset narrative and spit it out.

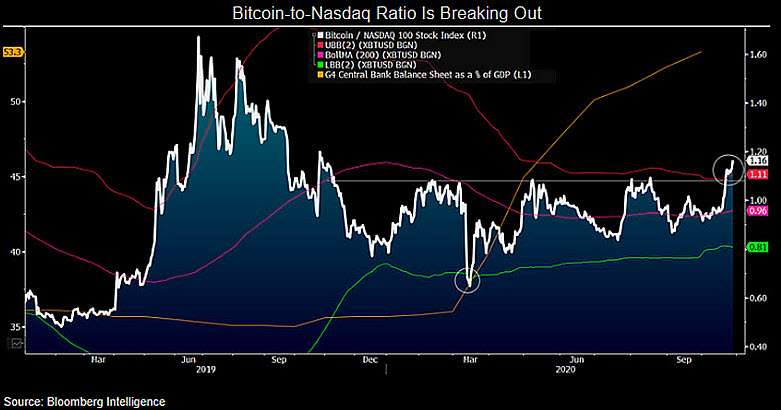

Bitcoin outperformed gold and major exchanges in the traditional market. Mike McGlone, senior commodity strategist for Bloomberg Intelligence, indicated that Bitcoin could reach $ 14,000 before the end of 2020. Additionally, Bitcoin has started decouple from the Nasdaq 100 index, as shown below.

Source: https://twitter.com/mikemcglone11/status/1321424407894626305/photo/1

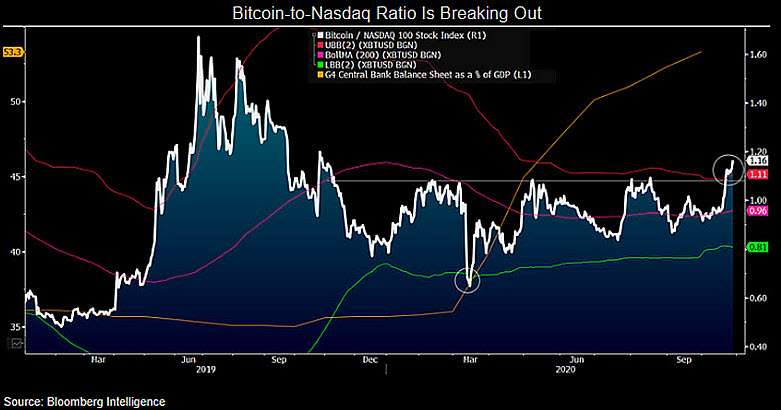

Bitcoin trader Josh Rager is also optimistic about Bitcoin’s performance. Sharing the chart below, the trader stated that Bitcoin is close to breaking the $ 13,880 resistance and thus “the sky will be open”. Rager added:

If I look from the outside, this chart is a positive sign with a new high monthly potential.

Source: https://twitter.com/Josh_Rager/status/1321215475804753921/photo/1

MicroStrategy records the best quarter after buying Bitcoin

Explaining the results of MicroStrategy’s investment in Bitcoin, its CEO reported that the company has had one of its best quarters in the past 10 years. The company posted earnings of $ 19.8 million compared to earnings for the same period in 2019 of $ 11.6 million.

The company’s Bitcoin profits exceed reported revenues. His 38,250 BTC investment priced at $ 11,100 is estimated at $ 525 million after Bitcoin passed the $ 13,000 mark. This represents a profit of $ 100 million in less than a quarter. The company’s CEO became a cryptocurrency advocate and revealed that he bought 17,732 BTC at a price of $ 9,882.

Some have asked how much #BTC I own. I personally #hodl 17,732 BTC which I bought on average at $ 9,882 each. I notified MicroStrategy of these holdings before the company decided to buy #bitcoin for himself.

– Michael Saylor (@michael_saylor) October 28, 2020

[ad_2]Source link