[ad_1]

[ad_1]

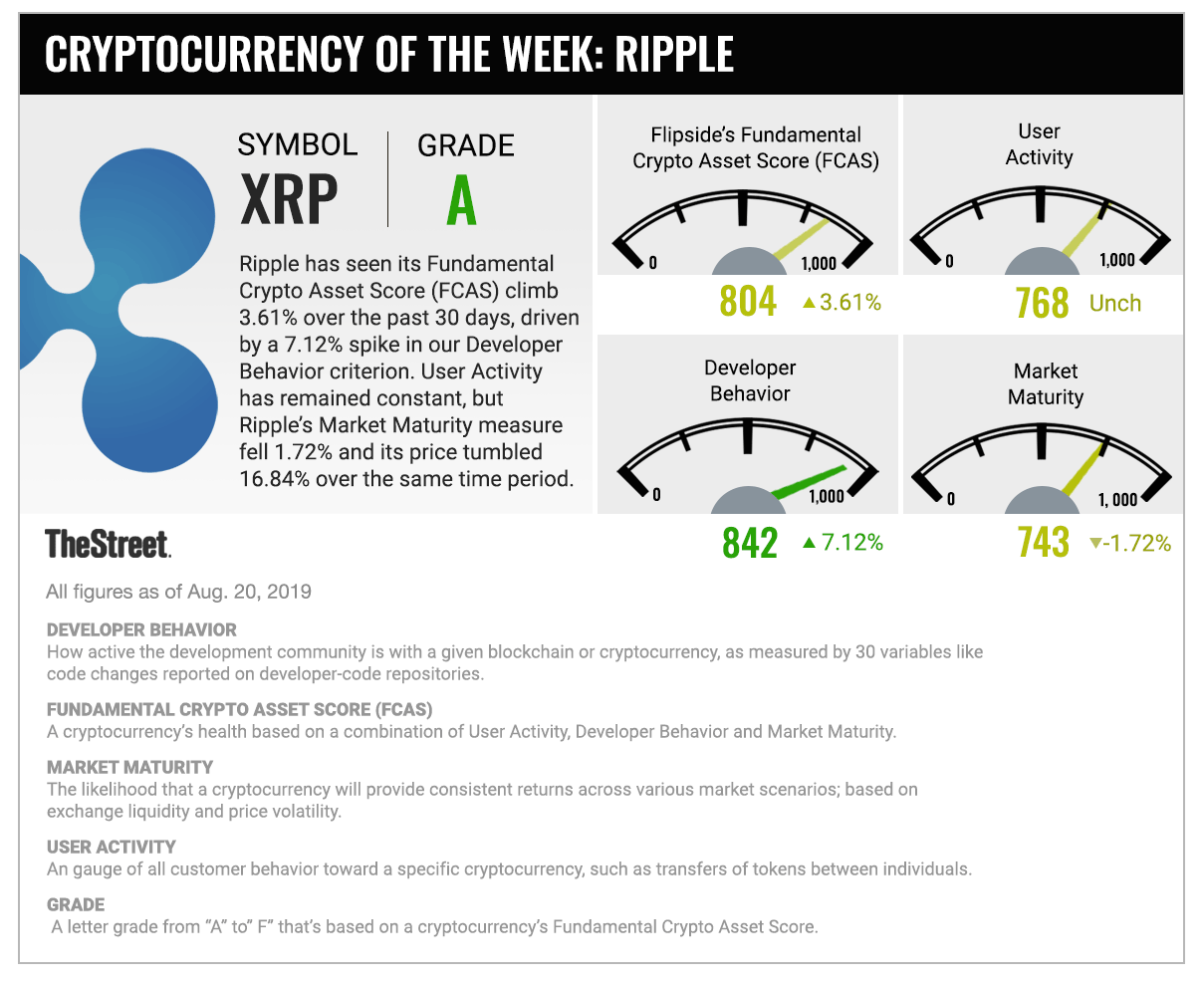

The cryptocurrency ripple (commercial symbol: XRP) has seen its Fundamental Crypto Asset Score (FCAS) rise 2.8% in the last three weeks, driven by a peak of 5.6% in our policy of behavior of developers. Also our measure related to user activity has increased by 0.1%, but the measure of maturity of Ripple's market has fallen by 1.6% and its price has fallen by 15% in the same period of time.

Let's take a look at XRP:

A two-pronged approach

The undulation is a growing force throughout the global financial landscape, which creeps into institutional finance while cultivating products in the cryposphere.

Presented as a currency exchange, a real-time gross settlement system ("RTGS") and a remittance network, the creator of Ripple Ripple Labs Inc. has adopted a two-pronged approach to enhance the adoption of cryptocurrency:

- xCurrent. This product, built on RippleNet, is a cross-border payment system based on traditional currencies such as the US dollar. It has upset consolidated solutions such as SWIFT, the Society for Worldwide Interbank Financial Telecommunication, a messaging network that facilitates international transfers of money and securities between over 11,000 financial institutions worldwide.

- xRapid. This product uses Ripple directly for payment solutions. Users purchase Ripple using traditional currencies on one end of the transaction, so they sell back the cryptocurrency for traditional currencies on the other. Ripple has enabled xCurrent customers to integrate xRapid, making it the ideal platform for traditional customers to adopt digital asset solutions.

The company also announced a $ 30 million partnership in June with money-order giant MoneyGram, acquiring a 10% stake in that company. Following the agreement, MoneyGram went live on August 3rd with Ripple's xRapid.

The transaction was publicized as a way for MoneyGram to improve settlements on its cross-border payments by giving Ripple access to consolidated payment channels. Our scores for Ripple's FCAS fundamentals have increased in the days leading up to MoneyGram's xRapid launch and have maintained their upward trajectory as development efforts on the platform have increased.

Our hot take

Ripple's strategy continues to evolve as the team draws on financial arteries in a growing number of corridors around the world.

The company offers conservative institutional clients a ramp to the Ripple platform through xCurrent, while at the same time xRapid evolves to offer refuge from the complexity of using foreign exchange markets to settle transfers. This effectively guarantees efficiency and cost savings to established market participants.

While Ripple Labs claims that it no longer has control over Ripple's cryptocurrency, it still has a substantial portion of the tokens in circulation. The company is also actively developing and promoting the adoption of its xRapid solution, which uses Ripple's cryptocurrency.

Therefore, it is likely that the Ripple Labs team will continue to strive to "integrate" institutional customers who are wary of the cryptic volatility in xCurrent, with a long-term vision to move these customers to xRapid over time. So keep an eye out for the new high-profile partnerships that will emerge from Ripple Labs during this year's budget.

Here is our general assessment for Ripple:

Get the Flipside core cryptocurrency score tracker

FCAS Tracker offers institutional and sophisticated retail investors a top-down approach to tracking over 500 cryptocurrency fundamentals. FCAS Tracker is currently free for a select group of new users as we continue to develop the product. Visit us here to access Flipside Analytics.