[ad_1]

[ad_1]

- The cryptocurrencies are moving slightly higher after ticking lower.

- The prospects of a Bitcoin ETF in Japan and Ethereum await in Constantinople.

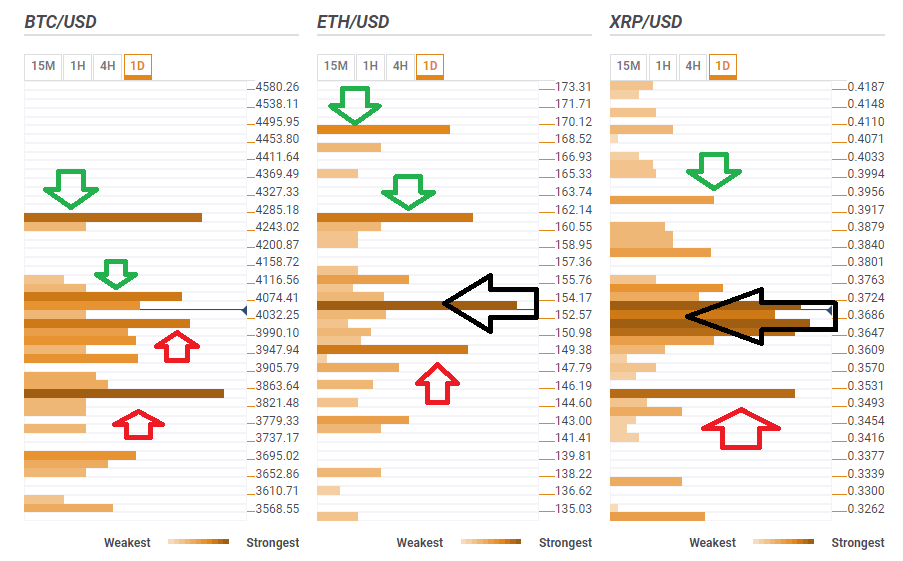

- Here are the levels to be observed according to Confluence Detector, our proprietary tool.

The first full week of 2019 is in full swing and the markets are on the move. The US Securities and Exchanges Commission (SEC) may take time with the approval of a Bitcoin ETF and is blocked due to government shutdown. However, the Japanese regulators are contemplating an Exchange Traded Fund for the grandfather of cryptocurrencies: Bitcoin.

The coin of Satoshi Nakamoto (whether it's a Japanese individual or a group of developers outside of Japan) celebrates his tenth birthday and an ETF would be a nice present. Our cards show that there is room to move one step forward.

Another positive factor is the updating of Ethereum in Constantinople. The consensual swingarm is scheduled for January 16 and the current King of Altcoins retains its earnings. Can you push higher? You may need to get rid of a difficult area of resistance.

What do you think of Ripple? The third cryptocurrency in market capitalization is surrounded by technical barriers, but the path of least resistance is on the upside.

BTC / USD has a clear upward target

Bitcoin has an initial resistance line at $4,074 that is the convergence of the Simple Moving Average 5-15m, of the Pivot Point one day Resistance 2, of the Bollinger Band 15m-Upper, of the PP 1w-R2 and of the Fibonacci of 161.8% of a day.

The upside target is around $4,265 that is the meeting point of last month's high, the PP 1w-R3 and the PP 1m-R1.

Looking down, BTC / USD has immediate support for $4,010 where we see the Fibonacci 23.6% in one day, the SMA 50-15m, the Fibonacci 38.2% of a day, the BB 1h-Middle, the SMA 10-1h, the SMA 5-4h and the SMA 100-15m.

Significant support awaits for $3,840 where we see the confluence of SMA 50-4h, SMA 200-1h, Fibonacci 61.8% at one month, SMA 10-1d and BB 1d-Middle.

The ETH / USD must escape the $ 153 magnet

Ethereum is stuck around $153 which is a magnet for the genius of Vitalik Buterin. It is a dense group of lines that includes 38.2% of Fibonacci of a day, the previous 4h of height, the SMA 10-15m, the SMA 100-1h, the Fibonacci 23.6% of a week and the Bollinger Band 4h-Middle.

If it were to go up, the next level to look at is $161.20 where the PP 1d-R3, the BB 4h-Upper and the last high monthly converge.

Higher, $170 it is the target as it is the meeting point of the BB 1d-Upper and the PP 1m-R1.

Support waits for $149.30 which is the confluence of the Fibonacci 382.% of a week and previous of 4 hours at the bottom.

XRP / USD mired in the interval

Ripple is stuck in a thick forest of technical levels ranging from $From 0.3647 to $ 0.0.3724. These woods include the SMA 100-4h, the previous 1h-high, the BB 15 minutes Upper, the Fibonacci 61.8% one-week, the SMA 5-1h, the SMA 10-1d, the SMA 10-15m, the BB 1d -Middle, 61.8% Fibonacci one day, SMA 5-15m, SMA 200-1h, Fibonacci 38.2% of a day, BB 15m-Middle, the very important Fibonacci 23.6% of a day, SMA SMA 50-4h, SMA 10-4h and many others.

If XRP / USD is free, an initial goal is $.3956 where we notice the Fibonacci 61.8% at one month.

On the downside, substantial support awaits for $.3513 which is the confluence of Fibonacci's 38.2% to a month and last week.

Because the resistance is weaker than the support, the bulls may have a better chance of climbing.