[ad_1]

[ad_1]

- Cryptocurrencies see fresh drops after a weekend recovery.

- The paths of the less resistant digital coins are on the downside, but some are better than others.

- Here are the levels to be observed according to our proprietary technical tool, the confluence detector.

NASDAQ continues to proceed with plans to provide Bitcoin futures in the first quarter of 2019. Optimistic news for criptos helped stabilize over the weekend.

However, digital coins have been lowered in the wake of the new week. Some suspect this is a necessary correction. After all, cryptocurrencies have not reached new lows. Others suspect this is just a rebound from a dead cat before another fall.

According to one theory, the crypto-whales, or big boys, are downloading digital coins to cause panic and a sell-off, only to start accumulating again. Some think that this moment of purchase has already begun. However, even if the whales are not downloading other scrambled, they are not even buying and appear to be on the edge.

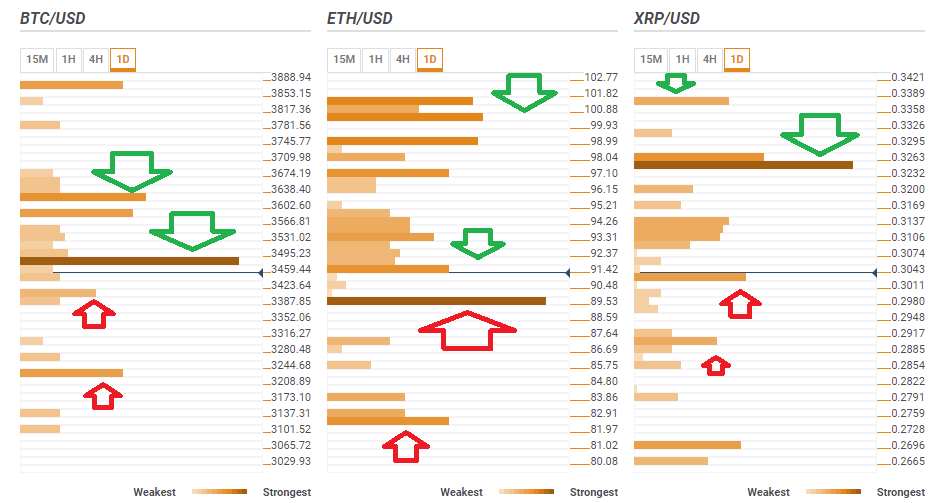

Technical levels are not auspicious for any of the 3 best cryptos. Here are the levels to watch on Bitcoin, Ethereum and Ripple.

BTC / USD faces an obstacle at $ 3,480

Bitcoin sees a significant obstacle around $3,480 where we see a dense cluster that includes the Bollinger Band 15 minutes average, the Fibonacci 23.6% a week, the Simple Moving Average 5 an hour, the previous month low, the SMA 10-1h and the Fibonacci 61.8% one-day .

The next substantial limit is around $3,585 where we see the convergence of the SMA 5 of a day, the Fibonacci 23.6% of a day, the Bollinger Band 4h-Upper and the BB 1h-Upper.

Looking down, weak support waits for $3,403 which is the meeting point of the 4h-low, the one day support Pivot Point 1 and the 15m-Lower BB.

$3,223 it is the last noteworthy support line, including last week's low and 161% one-day Fibonacci.

ETH / USD stands out with support for $ 89.53

Ethereum stands out from the crowd and enjoys significant support, but the bright side is not that easy.

A $89.53 we see the meeting point of the One Day Support in PP 1, the previous day and the minimum of four hours. Lower, to $82.50 we see the previous weekly minimum, 161.8% Fibonacci of a day and the one day support of Pivot Point 2.

Some resistance to ETH / USD waits for $91.42 where we see the Fibonacci 23.6% per week, the previous 1h-high, the BB 15 minutes average, the SMA 100-1h and the SMA 5-1h.

The road to the top is full of resistance lines and the most significant is the very round number of $100 which is the one day resistance Pivot Point 1, the previous maximum daily, the SMA 50-4h and the SMA 200-1h.

The prospects for the Vitalik Buterin project have improved slightly.

The XRP / USD continues to face the obstruction of $ 0.3250

Ripple has some support for $.3025 where we see the confluence of SMA 5-15m, the previous daily minimum, the one day support in PP 1 and the Bollinger Band 1h-Lower.

A $.3250 we continue to see a group of critical levels: the 38.2% Fibonacci of a week, the PP of a day R1 and the previous monthly and daily lows.

$.3374 we see the meeting point of the PP one-day R2 and SMA 10-one-day.

Low support is $.3030 that is the convergence of the previous weekly minimum, 161.8% of Fibonacci of a day and the PP of a day of S2.