[ad_1]

[ad_1]

- The US SEC has decided to postpone a decision on the approval of an ETF until 2019

- The move triggered a new sale, with Bitcoin, Ethereum, reaching new lows.

- Here are the levels to be observed according to our proprietary technical tool.

The US Securities and Exchange Commission (SEC) decided to delay, once again, its decision on the request for an Exchange Traded Fund (ETF) for Bitcoin. The request submitted by SolidX Partners and the asset manager Van Eck expired on December 29, but was postponed to February.

A Bitcoin ETF would allow traditional investors to enter the world of cryptocurrencies. Delays were key unfavorable factors in digital coin prices during 2018. Some other questions have been rejected, but this specific high profile has suffered infinite delays.

Bitcoin lost the previous trough on November 24, Ehtereum fell below $ 100 and even Ripple suffered a fall, even if it has not touched new annual lows.

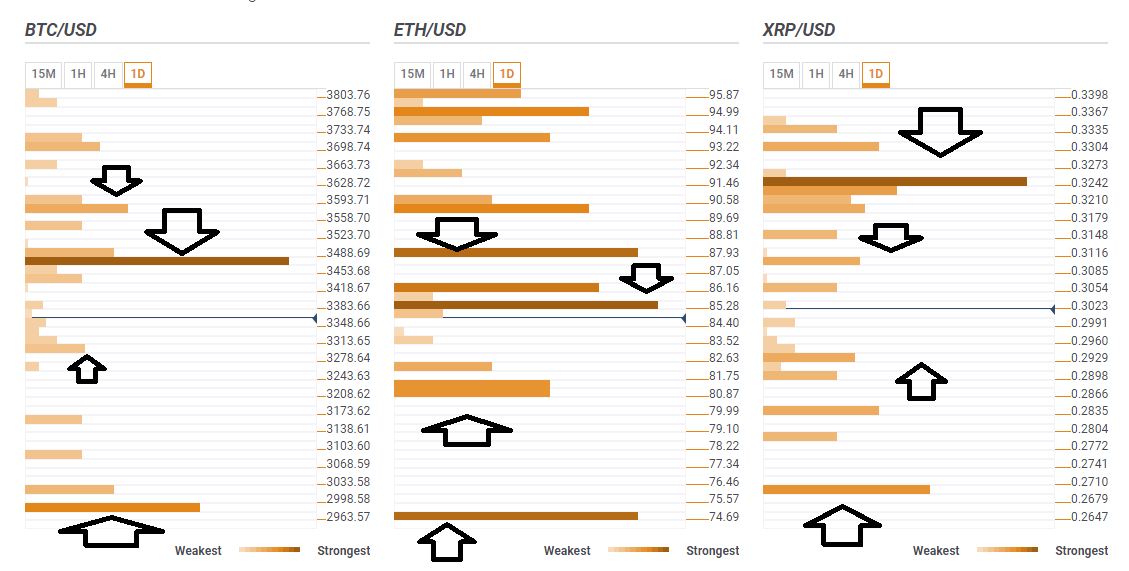

Here are the levels to watch on Bitcoin, Ethereum and Ripple.

The low point of BTC / USD is less than $ 3,000

The previous TNT for Bitcoin was $3,456 and registered at the end of November. Now it turns into resistance, since we see a group of not only the monthly lows, but also the previous 4h-High, the Simple Moving Average 10-1h, the Pivot Point 1 month of support 1 and the Bollinger Band 4h-Lower.

Some support is waiting for around $3,295 where we see the PP one-day S1, the BB 15m-Lower and the BB 1h-Lower.

There are several lines of support distributed during the descent, but the most significant level to look at is only around $2,975 where we find the last year's minimum, followed by a week's Pivot Point support 2.

If BTC / USD exceeds $ 3,466, the next cap to watch is $3,580 which is the convergence of SMA 5-4h and BB 1h-Middle.

ETH / USD targets $ 75 but has support in advance

Ethereum lost his second place and fell below $ 100. He faces a lot of hurdles before the round number.

$85.30 is the confluence of the Fibonacci 161.8% to a week, the SMA 5-15m, the SMA 10-15m, and is followed closely by $ 86.16 where we see the PP of a day Support 3, the previous 1h-high , and the 15m-Middle Bollinger Band.

Higher, $87.93 has only one technical cap, but it is quite significant: support for a week Pivot Point 2.

Looking down, we see a support group at around $81.20 where the one day Pivot Point S2 and the Lower Day Bolinger Band converge.

However, the goal is much lower: a $75 we see a month's support at Pivot Point 3.

The prospects for Vitalik Buterin's project do not seem so great.

The XRP / USD faces an uphill battle

Ripple has not yet reached its annual lows, but digital currency has more resistance than support.

A $.3210 deals with a tight group of resistance lines including BB 1h-Middle, PP one-month S1, last month's low month, SMA 5-4h, Fibonacci 38.2% one-day and others.

Before attempting a move on $ 0.3210, $00:31 it's a bit challenging as well. Includes the 4h-Lower Bollinger Band, the previous 4h-high and the 10-1h SMA.

Looking down, $.2929 is a support line with the Bollinger Band 15min-Lower, the previous 4h-Low, the Pivot Point One-day Support 1 and the BB one-day Lower.

The last downside target is $.2695 where we see a month's support for the pivot point 1.