[ad_1]

[ad_1]

In the letter

- The volume of decentralized trading has decreased over the past month.

- One analyst thinks it’s because DeFi incentives have declined.

- A saving grace? The price boom this week.

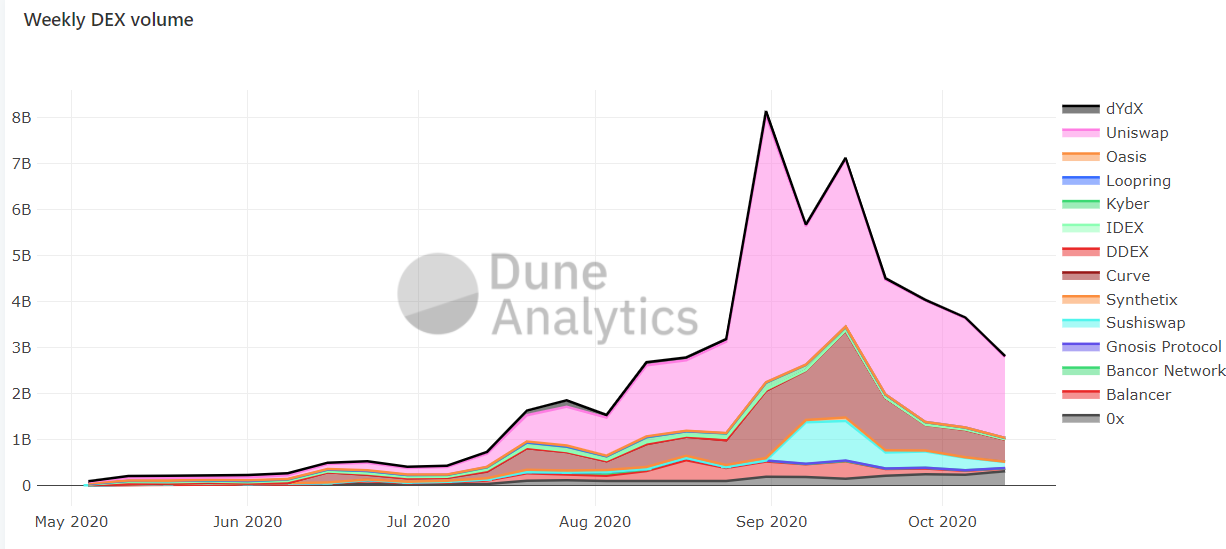

Volumes on Ethereum-based decentralized exchanges fell off a precipice this month. Trading volume has dropped 41% over the past 30 days, according to data from a dashboard on the metrics site Dune Analytics.

Weekly trading on decentralized exchanges peaked at just over $ 8 billion on August 31, and then hit a monthly high of $ 6 billion on September 14. But weekly trading volumes have dropped to just under $ 3 billion, as of October 12, the most recent data the Dune Analytics platform holds data for. That’s a decrease of more than 62% from that late summer peak.

Decentralized exchanges are unsecured cryptocurrency exchanges. Protocols don’t have custody of your cryptocurrency. On some, such as market leader Uniswap, any token can be listed; it’s decentralized, so regulators can’t shut it down.

DEXs exploded in popularity during this year’s decentralized finance boom; As of the end of June, people have invested billions of dollars in DeFi lending protocols and exchanges to take advantage of the high incentives offered to users, sometimes with returns exceeding 1000%.

But the boom wasn’t going to last and everyone knew it: to keep the magic alive, protocols offered more and more incentives to entice people to use their platforms; many didn’t stay around once the protocols ran out of track for their incentives, the data show.

The volume of trading on the decentralized exchange Uniswap has also decreased, despite its increasing dominance in the market. Daily trading volumes peaked for Uniswap at just under $ 1 billion on September 1 to $ 234 million yesterday.

“I believe the volume of DEX is highly correlated with the DeFi market in general,” said Johnson Xu, director of research at Huobi DeFi Labs. Decrypt.

Of the drop in trading volumes, Xu said there are various factors at play, but that “one of the main reasons is that people aren’t earning as much return right now, just because these crazy ‘returns’ aren’t sustainable, and often involves significant risks “.

Now, things have cooled down: “The market is now returning to a more rational level, hence the lower DEX trading volume,” he said. “When the market cools down a little, these returns will be adjusted accordingly to reflect the consolidation of the market in a healthy way.”

The amount of money still wagered in DeFi smart contracts has not faded along with the decline in trading activity on decentralized exchanges.

Uniswap’s liquidity – the amount of money its users have wagered on the platform to facilitate token exchanges (and earn commissions) – has increased, from around $ 1 billion in mid-September to around $ 3 billion today.

Some of this can be attributed to the recent boom in cryptocurrency prices, but the amounts of ETH, BTC and DAI stuck in the exchange have increased, according to data from DeFi Pulse; at the end of August, when trading volumes were at their highest, there were 800,000 ETH stuck in the trade (which was then worth around $ 381 million). Now, there are about 3.2 million ETH ($ 1.3 billion).

And the amount of money invested in DeFi smart contracts is also on the rise; that’s about $ 12.3 billion, according to metrics site DeFi Pulse, and it’s never been higher.

Some of this, however, is also attributable to the recent price hike. Ethereum, which spent most of last month and most of this month at around $ 360, jumped above $ 400 yesterday for the first time since early September. The amount of ETH frozen in DeFi, however, dropped from about 9 billion on October 20 to $ 8.9 billion today.

Xu said: “DeFi participants are still making a reasonable profit [higher] yields compared to the traditional market, with many yield agriculture projects currently [yielding] about 15-30% APY. Some market participants are still parking their funds in these relatively low-risk assets to achieve a reasonable risk-adjusted return, ”he said.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment or other advice.