[ad_1]

[ad_1]

Of Ethereum, Tezos and Maker, only the king of altcoins has a positive performance over the past month. ETH saw an increase of 14.34% while XTZ and MKR are -15.76% and 8.49%.

Let’s take a look at these coins individually and whether they are bullish or bearish.

Ethereum [ETH]

Source: ETHUSD TradingView

Ethereum 2.0 is very close to live, perhaps, this is what is causing the altcoin to surge. Indeed, ETH outperformed BTC not in terms of price but in terms of social volume.

Regardless, ETH has formed an ascending channel, which is bearish. However, it is important to note that Bitcoin is currently exploring a new high, last seen in 2018. So if FOMO intervenes, we can expect this bearish pattern to be invalidated.

The RSI has fallen perfectly in line with the price movements which indicate the momentum of buyers with this surge. We can expect ETH to return to $ 450 + if BTC starts to rise.

Tezos [XTZ]

Source: XTZUSD TradingView

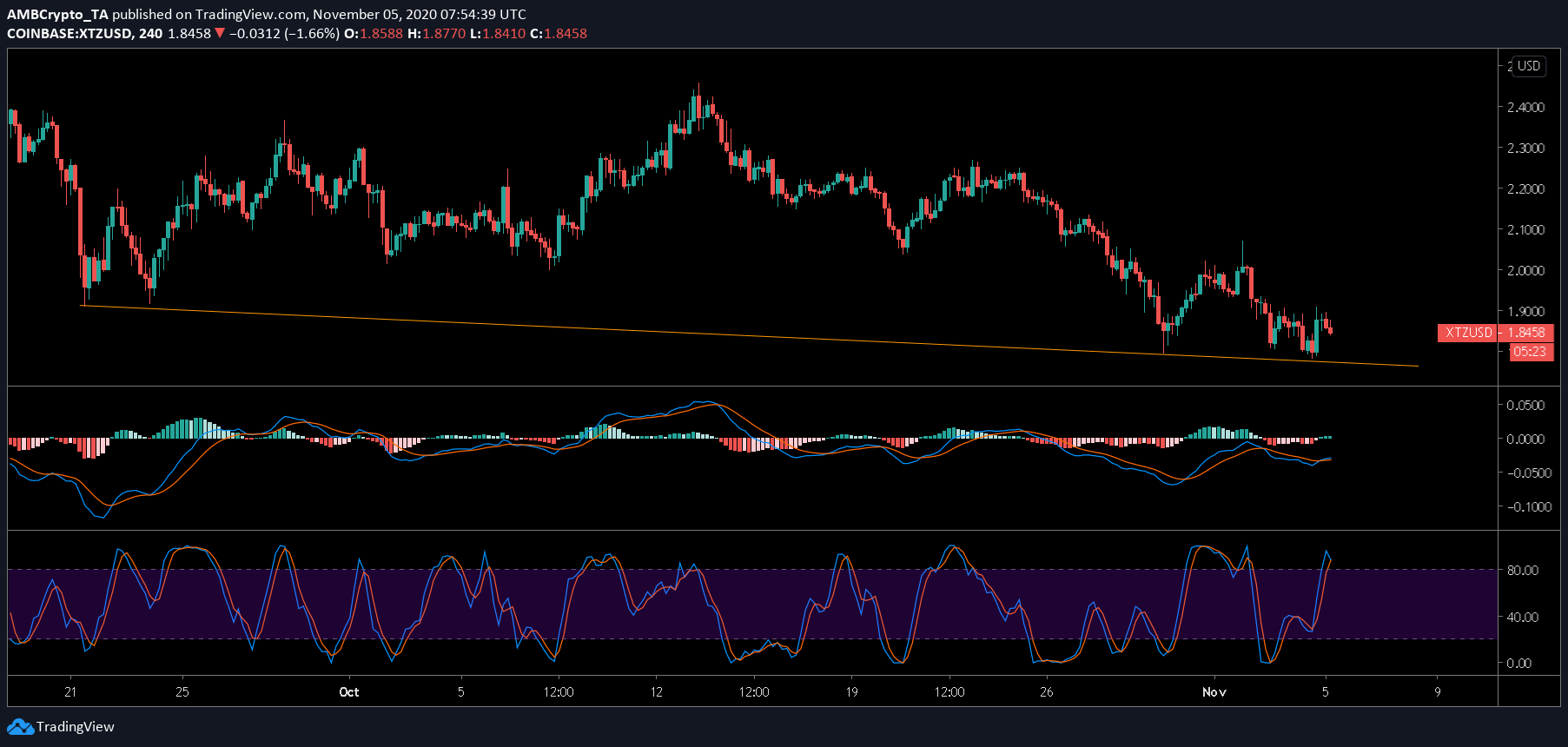

Tezos, unlike ETH or BTC, is constantly falling, however, despite its bearish trend, it appears to be supported by a descending line [orange]. At press time, XTZ was trading at $ 1.848, however, indicators point to a bearish scenario for XTZ.

The MACD indicator showed the lines below the zero line. Despite its bullish crossover, the rally does not appear to be cemented. Adding more to this is the Stochastic RSI which indicates a bearish crossover.

Maker

Source: MKRUSD TradingView

Maker is trading at $ 527 with a market cap of $ 480 million. Regardless of its high price, the governance token has seen a brutal 3.1% drop in the past 7 days. At press time, MKR is in a rounded top pattern and has started its downtrend.

Also, it is forming a descending wedge, therefore, this is a short term bullish indicator. Furthermore, the downtrend appears to be losing strength, as indicated by the Aroon downline [red line] as the uptrend gains momentum [Aroon up-line, green].