[ad_1]

[ad_1]

Bitcoin has seen highs near $ 16,000 and ETH has finally rallied to $ 460, but volatility is still possible in the markets.

ETH

Ethereum was struggling to see strong movement during Bitcoin’s recent rally through the $ 12k level, but the second largest cryptocurrency project finally saw some traction this week. Despite that, there are still risks to the rally as markets remain volatile with electoral confusion and a potential coronavirus vaccine.

The first problem for cryptocurrencies is the current confusion over the US election, where the media has announced Joe Biden as the winner, but the process awaits the legal challenges from the Trump campaign and this is affecting the value of the US dollar. The electoral process could drag on and today we also heard that US pharmaceutical manufacturer Pfizer had seen positive results in a phase 3 trial for a coronavirus vaccine and this would also affect the path of government spending and stimulus, which have been also catalysts for the BTC rally since the summer.

The other question would be what stance Joe Biden would take on cryptocurrencies, but it would likely be positive, where the Democratic Party was trying to pay stimulus checks via a digital dollar and digital wallets, so it’s clearly a technology they’re trying to embrace.

Ethereum is also approaching its long-awaited V2.0 update and this could be a catalyst for a move higher, with the launch of Phase 0, also known as Beacon Chain, set for December 1st. The deposit contract required for the upgrade was opened and more than 14,000 ETH were wagered in the first 12 hours.

Ethereum refused to follow Bitcoin’s rally in an exceptional way, but as of last Tuesday the coin has risen from the $ 380 level to test $ 460. The key resistance overload is at $ 480 and this will be the obstacle for ETH. if it wants to reach $ 500. Bitcoin is only 30% off its all-time highs, while Ethereum is 200% off its highs. This could mean that Ethereum has hidden value, especially with the upcoming update and the rise of DeFi projects.

AAVE

The AAVE token was the best-performing coin of the week with a 72% gain as the DeFi space has seen a rebound from a recent slump. AAVE announced on Medium that they are forming a partnership with Axie Infinity, which is a Pokemon-inspired digital pet universe. Players can fight and collect fantastic creatures called Axies. Players can also earn tokens by playing, and the partnership with Aave creates an interesting new perspective for welcoming new players into cryptocurrencies.

Aave’s protocol is a transparent and open infrastructure for decentralized finance, which has created loan pools and the project’s unique “flash loans”, which enable fast cryptocurrency loans for developers looking to lock in a token’s value. extract.

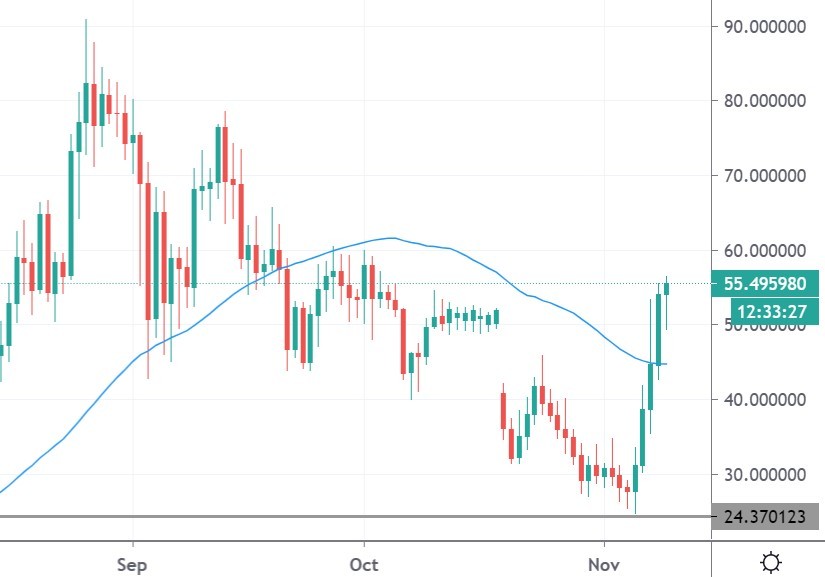

AAVE has been on a downtrend with the rest of the DeFi coins from their late August highs, but the coin found support at the $ 24.37 level and rallied strongly to break out of the 50-day moving average and the coin. is now trying to test $ 60.00. AAVE is currently ranked at number 33 on the list of coins by market cap with a project valuation of $ 600 million.

SNX

SNX was another high-performing DeFi coin this week as the token rose 40%. Synthetix is a “derivatives liquidity protocol” and the project calls itself, “… the backbone for derivatives trading at DeFi, which allows anyone, anywhere, to gain on-chain exposure to a wide range of activities “. The platform was built on Ethereum and issues synthetic assets in the style of a smart contract.

Synthetix supports a wide range of assets with synthetic fiat currencies, cryptocurrencies and commodities. SNX token holders are also incentivized to stake their tokens and receive a portion of the commissions generated by the activity on Synthetix. The project is currently testing Ether as an alternative form of collateral, where traders can borrow Synths against ETH and start trading immediately, rather than having to sell their ETH holdings.

The token followed the path of DeFi valuations with a late August high and a strong correction from $ 8.00 to lows at $ 2.55. The rally from that level has given the potential for a low and the move above the 50-day moving average is positive. The coin can now try to start rebuilding the bullish path and the $ 5.50 level is the first resistance ahead. SNX is currently ranked at number 40 in the list of coins with a market capitalization of $ 420 million.

YFI

Yearn Finance also grew 40% as the project follows DeFi’s rebound. The project offers a suite of products in the decentralized finance space that offers loan aggregation, investment return and insurance on the Ethereum blockchain.

A risk to the coin was the news that a YFI whale had transferred more than 2,500 million YFI tokens (approximately $ 13.8 million) to a new address. This represented the fourth largest transaction for the token and could be a sign that large investors might be dumping the token.

The YFI token has found support at $ 8,000 and the coin is looking to test the 50-day moving average where it can begin repairing recent damage and try to return to its mid-September high at $ 4,400. The project currently ranks number 38 on the coin list with a valuation of $ 440 million.

Equity markets have seen a positive rebound from vaccine news, but watch out for a turn in the election in the next few weeks or two as markets may still be volatile.

Disclaimer: The information contained herein is provided without consideration of personal circumstances, therefore it should not be construed as financial advice, investment recommendation or offer or solicitation for any cryptocurrency transaction.

.[ad_2]Source link