[ad_1]

[ad_1]

-

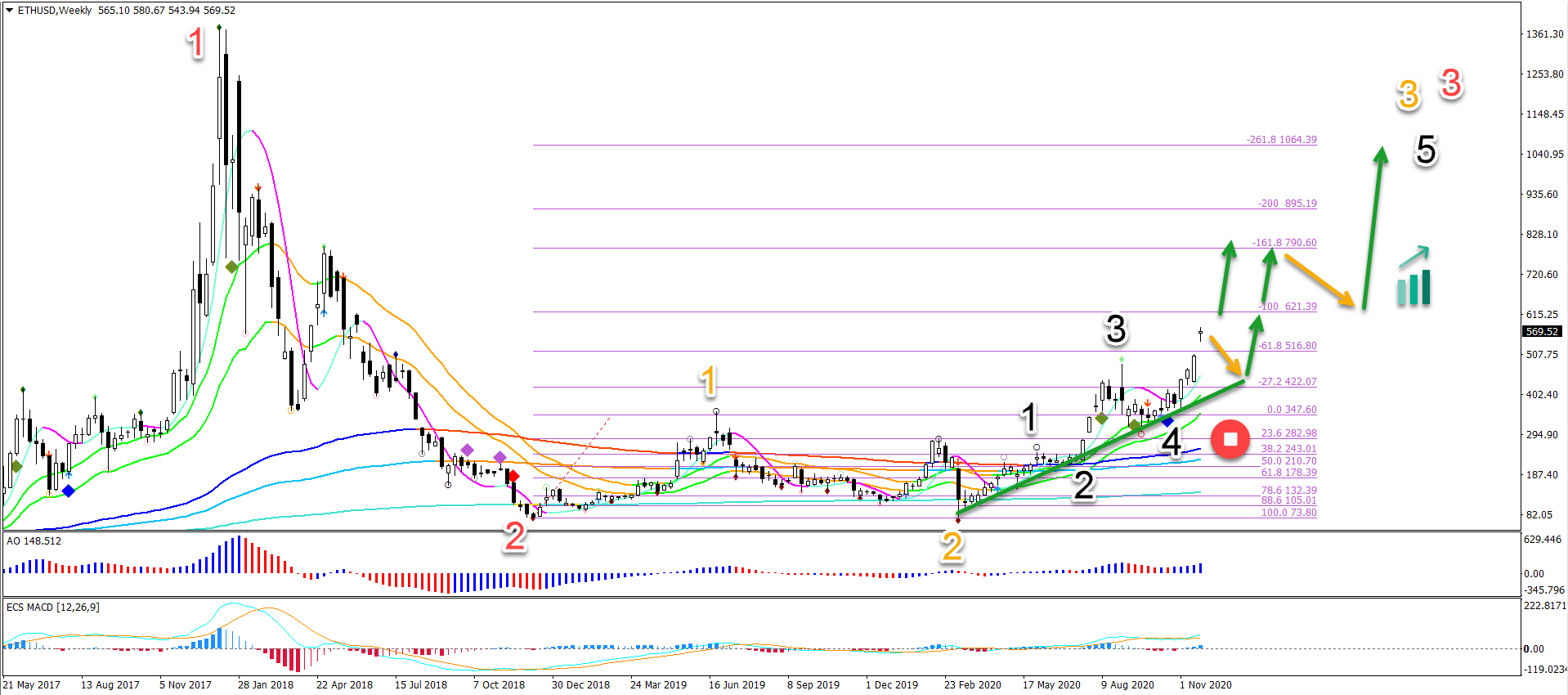

Ethereum (ETH / USD) is finally making a bullish breakout. The previous bullish swing was 3 years ago when the price action broke above $ 1,300.

-

The withdrawal and correction was strong and long. Will the ETH / USD bulls really manage to regain full control from the bears?

-

ETH / USD continued to rise over the weekend, breaking through the $ 500 mark. The new high is also breaking the Fibonacci target of -61.8%.

Price charts and technical analysis

ETH / USD continued to rise over the weekend, breaking above the $ 500 mark. The new high is also breaking the Fibonacci target of -61.8%. This is a typical target for a C wave, so a break indicates a 3 wave is becoming more likely.

The subsequent confirmation of a 3 wave occurs if the price action is able to exceed the Fibonacci target of -100%. A bull flag may also develop (orange arrows) but eventually a breakout is expected (green arrows).

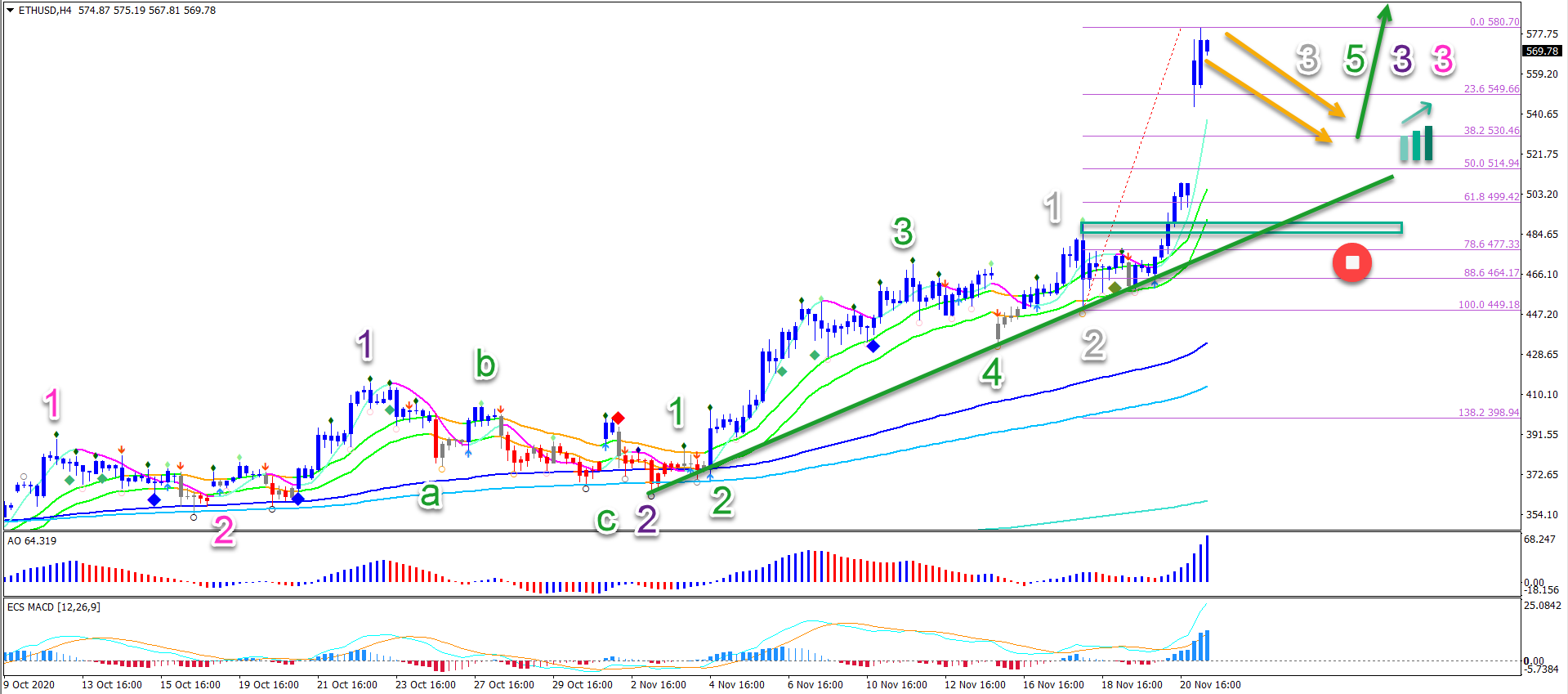

On the 4-hour chart, the bullish momentum remains strong. Price action appears to be in a 3 (gray) wave. Once this wave 3 is completed, we expect a correction to wave 4. Usually waves 4 are long and wavy (orange arrows) as a continuation graphic pattern of the bull flag.

A break below the top of wave 1 (green box) invalidates the 5-wave pattern (gray) (red circle). But it does not invalidate the entire uptrend due to the expected support for the long-term moving averages.

The analysis was performed with the ecs.SWAT and ebook method.

.[ad_2]Source link