[ad_1]

[ad_1]

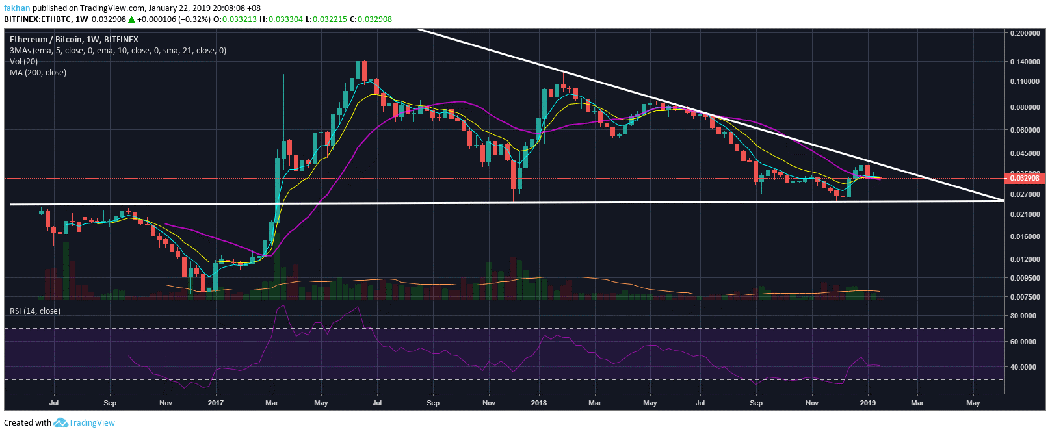

Ethereum (ETH) is ready to go out against Bitcoin (BTC) in the coming weeks. The weekly chart for ETH / BTC shows that the price is traded close to the 5 week EMA EMA. As soon as it stops above this level, we will see Ethereum (ETH) kick off the next altcoin rally where most cryptocurrencies will earn against Bitcoin (BTC). In December 2018 Ethereum (ETH) broke out against Bitcoin (BTC) and successfully passed the 21-week EMA. Since then, this level has had strong support. At the moment, the weekly candle is trading just above EMA at 21 weeks, but faces a strong resistance at 5 weeks EMA. RSI for ETH / BTC shows that there is a lot of space for a rally that could see the price breaking its resistance to the historic trend line.

The decline in trading volume over the past few weeks has made it easier to swing the price in both directions. Considering that ETH / BTC is negotiating close to its resistance to the trend line, any attempt to break out at this point has a high probability of success. The low volume means that such a move would not require much capital. As soon as Ethereum (ETH) breaks the resistance of the trend line, we will see many new cash flows in the market. Until recently, most blockchain projects including Ethereum (ETH) were in the experimental phase. Some of them have succeeded while others have failed, but very few of them have actually delivered the goods until now. Ripple (XRP) seems to be leading the race along with projects like Golem (GNT) but Ethereum (ETH) has just been a blockchain to raise funds.

Crypto Kitties, the Dapp that was built on Ethereum (ETH) to show off the potential of Ethereum's blockchain, ended up suffocating the entire network. Recently, the updating of Constantinople has been delayed due to some security flaws. This is what we have seen so far. However, things will change rapidly in 2019 as many of these projects are very close to providing functioning products. Ethereum (ETH) will be at the forefront of such projects primarily for its adoption, recognition and influence in the sector.

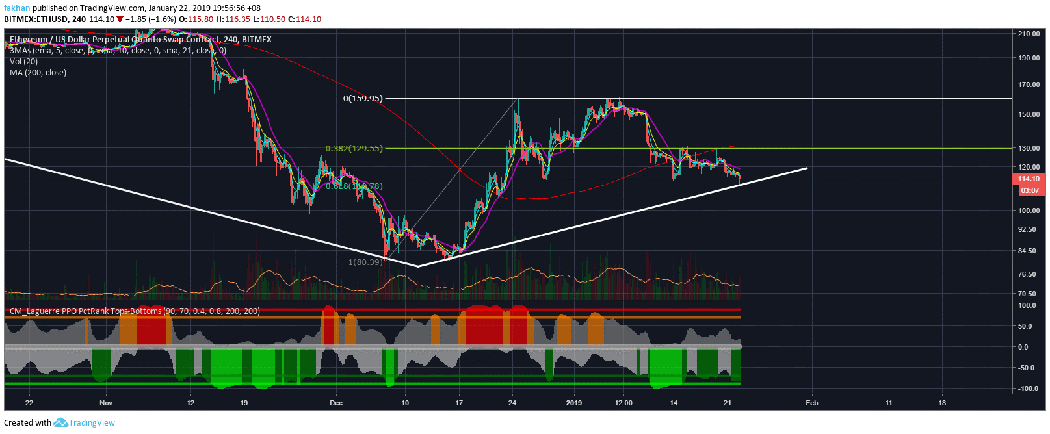

Corporations like Microsoft, Alibaba, Google and Amazon are a far cry from putting Ethereum (ETH) to use. This would see its adoption grow and could be the catalyst that could push its five-digit price in a few years. From an investment perspective, Ethereum (ETH) is at a point where risk / return is very favorable for long-term bullish income. The 4H chart for ETH / USD shows that the price has returned to the Fib 61.8% extension level, but it seems to have already hit the bottom. The next few weeks will see the ETH / USD formally start a new cycle and kick off the altcoin rally that would see Ethereum (ETH) along with many cryptocurrencies that will eventually reach new historical highs against Bitcoin (BTC).