[ad_1]

[ad_1]

Major altcoins are struggling to post higher prices after Bitcoin hit a new 2020 high

Ethereum (ETH), Ripple (XRP) and Bitcoin Cash (BCH) are all trading over the course of the day, with Bitcoin’s notable leap to an all-time high near $ 20,000 appearing to shake the cryptocurrency bulls.

At the time of writing, most of the altcoin market is green, with the prices for the aforementioned altcoins likely to rise further if the momentum persists through the week. However, to reach the new 2020 highs, ETH / USD, XRP / USD and BCH / USD will have to overcome all major general resistances.

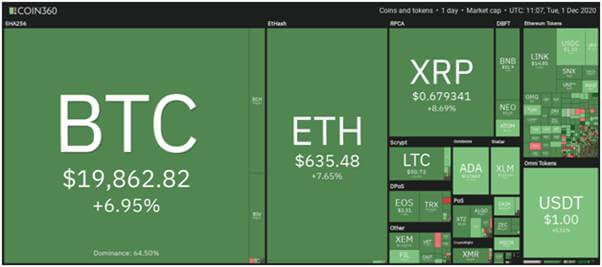

Cryptocurrency price action map. Source: Coin360

Cryptocurrency price action map. Source: Coin360

ETH / USD

Ethereum’s strong rebound from $ 488 lows continues as the bulls push ETH / USD above $ 600.

The aggressive buying seen last weekend has slowed as prices paused near $ 620. To resume the uptrend, buying pressure will need to pick up momentum, breaking above $ 640. This is likely due to optimism as the cryptocurrency approaches the launch of the ETH 2.0 beacon chain.

ETH / USD daily chart. Source: TradingView

ETH / USD daily chart. Source: TradingView

The RSI remains close to the overbought territory to indicate that the momentum is still with the bulls. The 20- and 50-day simple moving averages are also rising, suggesting a rise as the most likely short-term action.

If the bulls regain control, the next target is $ 645 and then $ 680. Beyond that, buyers would be aiming for a breach of the $ 800 resistance.

However, if the rejection above the $ 600 level continues, ETH / USD could drop to 20 SMA ($ 527) and then to 50 SMA ($ 452).

XRP / USD

The XRP bulls are struggling to keep prices above the 61.8% Fibonacci retracement level at $ 0.66. The level limited yesterday’s rebound from $ 0.45 lows, which suggests that bulls need to aim for a higher close to maintain the bullish trend.

XRP / USD daily chart. Source: TradingView

XRP / USD daily chart. Source: TradingView

While a dip is likely, the daily RSI remains imprinted within the overbought region, suggesting that the bulls are in control.

On the upside, the next resistance level is at the Fibonacci retracement level of 78.6% ($ 0.72) and $ 0.79 (previous high).

The reverse scenario will see the bears push XRP / USD below $ 0.66. In this case, the downside target would be at the 50% Fibonacci level ($ 0.62) and the 38.2% Fibonacci retracement level at $ 0.58. The 20 EMA provides further support at $ 0.49.

BCH / USD

The BCH / USD pair traded at highs of $ 322 yesterday, with the relief rally from $ 251 lows hitting resistance near the 61.8% Fibonacci retracement level at $ 326.

BCH / USD daily chart. Source: TradingView

BCH / USD daily chart. Source: TradingView

Currently, BCH / USD is struggling for an upside as the bears try to rally. If sellers push Bitcoin Cash’s price lower, the decline could see it drop to 20-EMA at $ 285 and then to the 23.6% Fibonacci retracement level at $ 280.

However, the bulls may still break out of the general resistance and aim for $ 347 and then $ 380.