[ad_1]

[ad_1]

- Ethereum broke out of an ascending triangle on October 22.

- The price retested the new support level established at $ 390 for three consecutive days.

Ethereum had a huge breakout above a daily ascending triangle on October 22, jumping to $ 421 but getting very little continuation over the next three days. As usual with this type of model, the price has started to test the old resistance level at $ 390 again.

Ethereum bulls need to hold $ 390 to avoid further bearish action

The former resistance level at $ 390 now serves as a support level, however, the current price of ETH is still below $ 386. If the bulls fail to maintain this level, Ethereum risks falling towards the 50-SMA and the 100-SMA on the daily chart converging to the $ 370 area. MACD is also on the verge of a bear cross, for the first time since 21 September.

ETH / USD daily chart

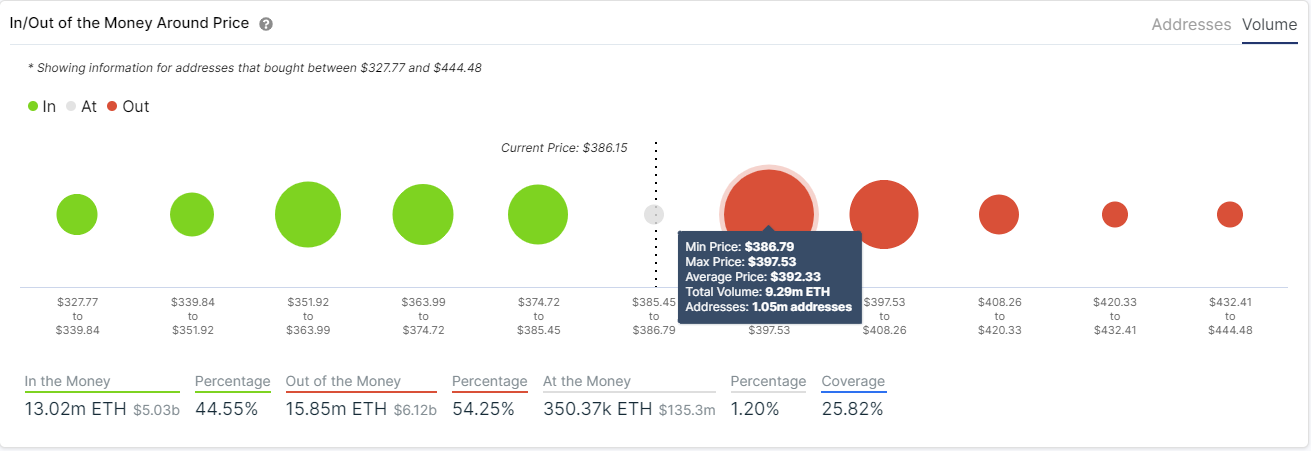

Beyond technical analysis, the In / Out of the Money Around Price (IOMAP) pattern shows strong resistance above between $ 386 and $ 397 but very little support on the way down, meaning more coins have been bought. above $ 386, increasing the selling pressure from investors who may want to cash out at their breakeven point.

ETH IOMAP chart

Some positive signs for Ethereum

On the other hand, the TD sequential indicator presented a buy signal, in the form of a red nine candle, on the 12-hour chart on October 28th. A successful defense of the support level at $ 390 can push Ethereum towards the last high of $ 421.

ETH / USD 12-hour chart

Furthermore, thanks to the statistics provided by IntoTheBlock, an increase in the number of new ETH addresses that have joined the network can be observed, as well as active addresses in the last seven days. This indicates that new and old investors are interested in Ethereum despite the drop in price.

New and active ETH addresses

.[ad_2]Source link