[ad_1]

[ad_1]

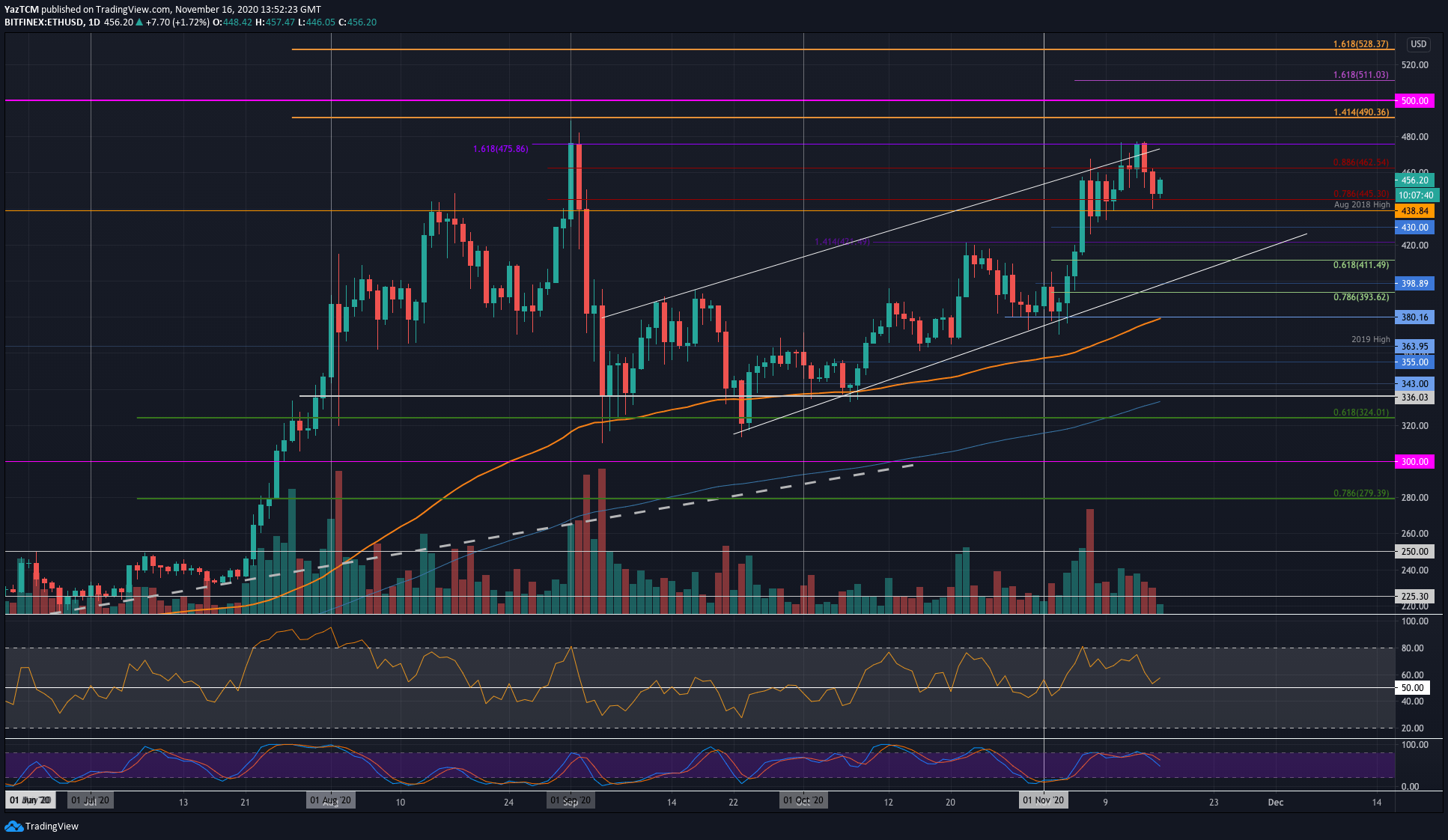

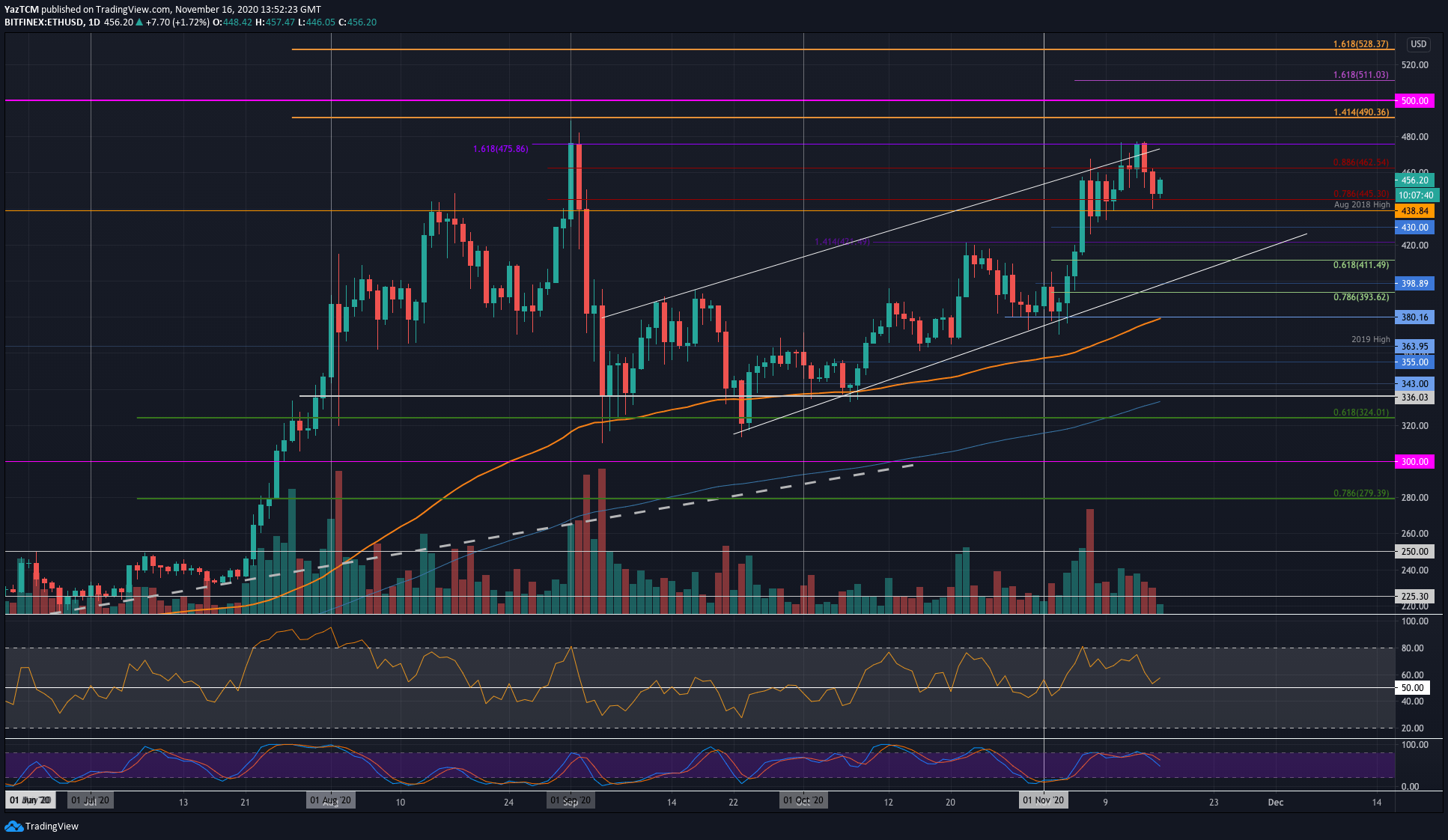

ETH / USD – Ethereum blocked by the September high closing price

Key Support Levels: $ 445, $ 439, $ 430.

Key Resistance Levels: $ 462.50, $ 475, $ 490.

Etheruem reached a high of $ 475 last Friday, where it reached resistance at the close of the September high. From there, it declined over the weekend, largely due to Bitcoin returning below the $ 16,000 level and some divergences we highlighted in the latest analysis.

As a result, Ethereum fell as low as $ 439 yesterday (August 2018 high). The coin continued to close above the $ 445 support. It has since rebounded slightly to trade at $ 456 today.

ETH-USD Short Term Price Prediction

Looking ahead, if buyers can push up again, the first resistance level is at $ 462 (bearish retracement .886 Fib). Following this, major resistance is expected at $ 475 (September high) and then $ 500.

On the other hand, the first support level is at $ 445. Below that, support is found at $ 438, $ 430, and $ 420.

The RSI has rebounded from the midline to indicate that buyers are not yet willing to give up control of the market momentum. However, the Stochastic RSI has produced a bearish crossover signal, which is a bad sign for the bulls.

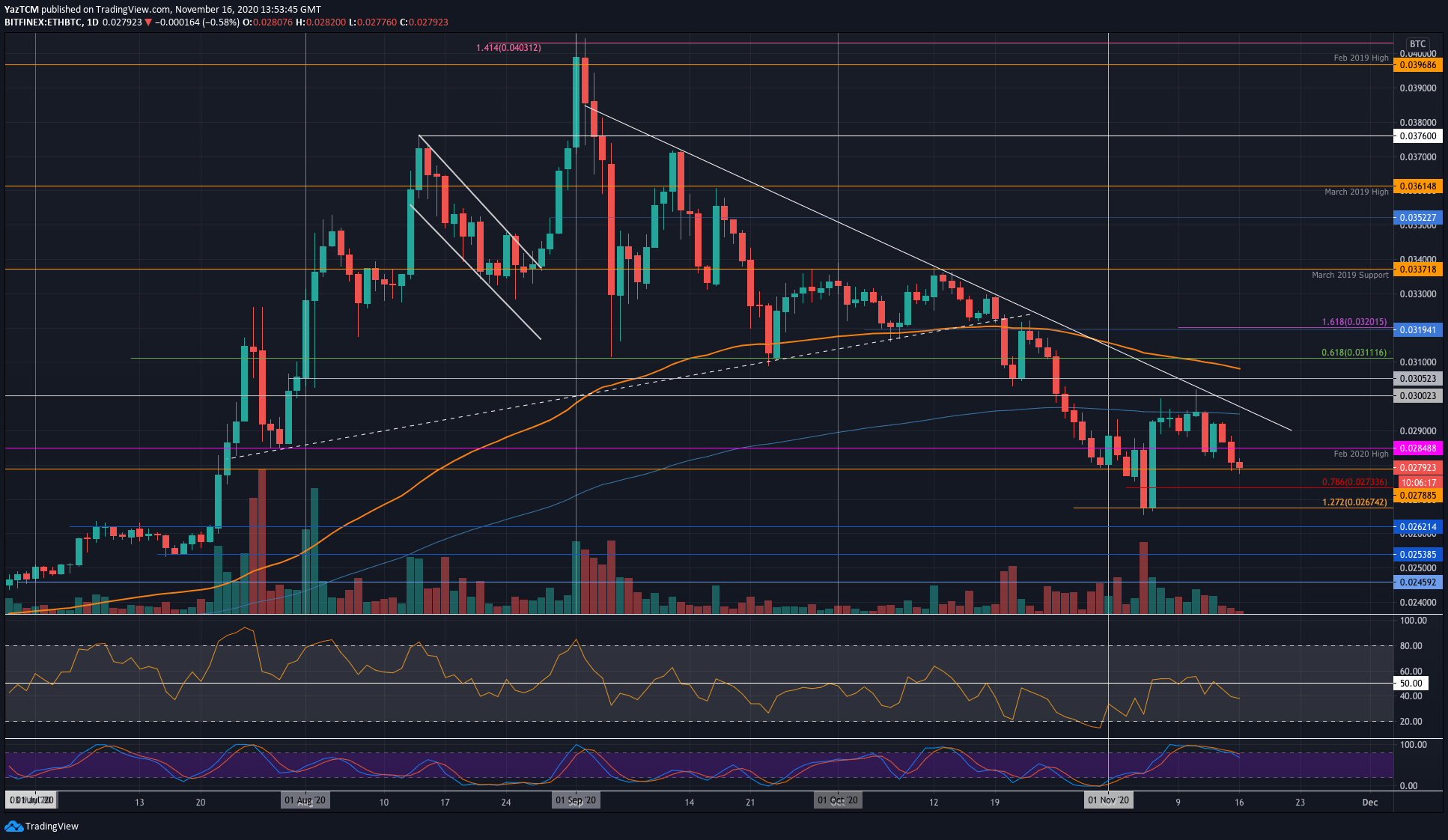

ETH / BTC – Bears push ETH up to 0.0278 BTC

Key Support Levels: 0.0278 BTC, 0.0273 BTC, 0.0272 BTC.

Key Resistance Levels: 0.0284 BTC, 0.029 BTC, 0.0295 BTC.

Against Bitcoin, Ethereum has fallen since it met resistance at the 200-day EMA last week. It had risen to 0.0293 BTC on Friday, but eventually dropped lower on Saturday.

Yesterday, Ethereum fell below the support at 0.0284 BTC (Feb 2020 highs) as it dropped to the 0.0278 BTC level where it is currently trading today.

ETH-BTC short term price prediction

Looking ahead, if sellers push below the 0.0278 BTC level, support is expected at 0.0273 BTC (.786 Fib) and 0.0272 BTC. Thereafter, the additional support is found at 0.0267 BTC (November lows), 0.0262 BTC and 0.026 BTC.

On the other hand, the first resistance level is located at 0.0284 BTC (February 2020 highs). Above this, resistance is found at 0.029 BTC (downtrend line), 0.0295 BTC (200-day EMA) and 0.03 BTC.

The RSI is below the midline to indicate that bearish momentum is dominating the market.

Binance Futures 50 USDT FREE Voucher: Use this link to register and get 10% commission discount and 50 USDT when trading with 500 USDT (limited offer).

Disclaimer: The information found on CryptoPotato is that of the writers mentioned. It does not represent CryptoPotato’s views on whether to buy, sell or hold investments. It is recommended that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

TradingView Cryptocurrency Charts.