[ad_1]

[ad_1]

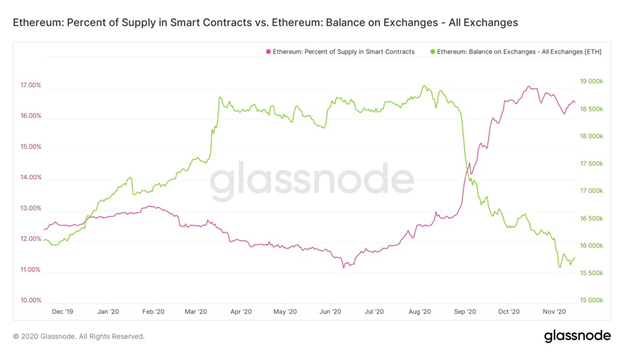

Ethereum held in smart contracts has risen while that in exchanges has declined in recent months

ETH sitting in smart contracts increased between June and October, climbing around 5% over this period. The percentage of ETH currently in smart contracts is 17% from 11% in June. Traders have invested more Ethereum in smart contracts as it is more likely to generate interest in DeFi protocols.

Meanwhile, crypto data measurement site Glassnode shows that the amount of ETH in the hands of exchanges has decreased since late July. The supply of Ethereum in centralized exchanges plummeted from 19,000 ETH to 15,500 ETH.

Glassnode chart showing Ethereum’s offer in exchanges versus smart contracts. Source: Anthony Sassano

Ethereum’s supply in smart contracts slowed and remained unchanged in October and November, a trend explained by the lack of significant activity in the DeFi sector. Even in this period, however, more and more Ethereum continued to exit centralized exchanges.

Analysts on the subject explained the trend by saying that it is similar to what is happening with Bitcoin. They say many coins are mined from centralized exchanges by traders and then deposited into private wallets, adding that these traders are likely not in a rush to sell in the short term.

The overall result is felt in markets where a drop in supply can lead to higher prices due to increased competition between interested buyers. This is almost the same case with Bitcoin as the Chainalysis details.

The difference between Ethereum’s and Bitcoin’s situation, however, is that while ETH’s supply in smart contracts has leveled off, it’s still in the same range as its record highs.

“ETH is becoming more liquid, moving into portfolios that not only trade frequently, but are also quite new […] Over 8 million ETH were transferred into liquid wallets less than a month old at the time of the acquisition, “explains Chainalysis.

However, the plateau of using smart contracts doesn’t seem to be a problem for ETH holders. They seem to be comfortable with the current situation as long as ETH prices continue to rise.

[ad_2]Source link