[ad_1]

[ad_1]

Latest news on Ethereum

Often, and this is well documented, Vitalik and Justin Sun do not bother to try. From the comments on Justin Sun he copies the glued parts of Tron's white paper to be a "god-like" shill master that is not worth listening to, these influencers illuminate the space.

To read: Director of the British Central Bank: cryptocurrencies are not a major concern

And while Vitalik is busy coordinating security checks to ensure that the next major Web 2.0 update or Constantinople is error-free, he responded to Sun's claims that Ethereum would become prominent due to its role in the ICO mania of late 2017 For some, this is an irrefutable fact, that we all agree and we have seen what happened to the ETH prices when regulators were involved in banning ICOs and repressing token markets.

Although Vitalik did not agree with this statement, he did not oppose Justin and instead, he continued to call him a "king of shill" and the success of TRX and Tron depend on Justin's ability to "launch <

Read also: The MIT professor thinks that Blockchain can lead to an economy without frontiers

Vitalik made this comment when a professor at Cornell University, Emin Gün Sirer He said Tron is not even close to a blockchain operating system marketed by Sun.

I know the operating systems.

I built operating systems.

Tron is not an operating system. pic.twitter.com/JhRhodijKl

– Emin Gün Sirer (@ el33th4xor) 21 January 2019

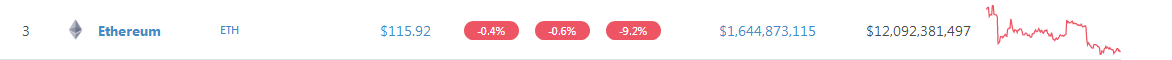

Price analysis of Ethereum (ETH / USD)

The more ETH prices are consolidated at spot rates or around those, the wider the XRP-ETH gap becomes. At current prices, the gap is 700 million dollars, but it could be worse if sellers fail to recover the losses of January 20 and the bulls are not able to push prices above $ 135 even with our optimistic price forecasts. As mentioned above, we are on the upside on ETH and the $ 170 rally largely depends on today's price action. If the bulls outweigh the contrary winds and come back on January 20, then buyers have a chance. Otherwise, ETH could spiral up to $ 100 or less by the end of the week.

Trend agreement and candlestick: short-term uptrend, bear-breaking model

Obviously, when we analyze the price of the last 12 months in higher periods of time, the trend is bearish. However, in the last few weeks, there is a clear ETH request in terms of shorter time. Part of this request came from the expectations of Constantinople and its significance for scalability. But it never arrived and now market participants are simply reacting. As a result, prices seem to be stopping, confirming the continuation of the trend of a classic bear breakout model set by the 19 November sellers. Unless there is a spring above the highs of $ 135 or 14 January, the Jan 10 sell-off is likely to continue.

Volumes: decreasing

Back to our objectives is the level of participation in the market. Unfortunately for buyers, bear volumes are increasing. Take a look at Jan 20-370k, compare them to 180k averages and Jan 10-684k averages. They are still low, but above recent averages and as they rise, today's closure will set the trend for the next few days. Ideally, we would like to see prices close to $ 120 when the main support line is confirmed.

All graphics courtesy of Trading View.

This is not an investment tip. Do your research

[ad_2]Source link