[ad_1]

[ad_1]

- Ethereum 2.0 is seen by experts as a catalyst for a price hike in 2021.

- Furthermore, EIP-1559 could also trigger a strong upward trend, as the network will receive a deflationary mechanism once implemented.

The price of Ethereum rose sharply after the announcement of the official commencement of the deposit contract on November 4 and has stabilized around the $ 460 mark. Over the past 24 hours, ETH has recorded a 2.72% gain at a price of $ 461.80. The market capitalization is $ 52.71 billion.

The immediate launch of Ethereum 2.0 is seen as a catalyst for a rapidly rising ETH course. So far, 52,993 ETH of 524,288 ETH have been deposited so that the Beacon Chain can begin as planned on December 1, 2020. The Community shows with further optimism that this start date can be maintained. However, in addition to these upcoming milestones, Pentoshi analyst also sees great potential in EIP-1559, which could catapult next year’s ETH prize to over $ 1,000.

ETH award over $ 1,000 in 2021

EIP-1559 is a proposal to change the charging mechanism used to validate transactions on the Ethereum blockchain. The current model works the same way as Bitcoin by paying a fee that encourages miners to validate a transaction. The higher the commission, the faster the transaction is validated.

EIP-1559 proposes to modify the model to implement a specific parameter for the prime rate calculated by the protocol. For each completed transaction, part of the commissions should be distributed to the miners, the other 50%, the so-called “space tax” should be burned.

This would provide the Ethereum network with a “deflationary mechanism” that could have a long-term positive impact on the ETH price. The more the network is used, the more ETH would be burned. Industry insiders, such as Ethereum Core developer Eric Conner, note that the proposal would benefit all investors and not just ETH whales.

Pentosis complaints that, if the proposal were accepted and implemented, the annual expenditure would be reduced from 4% to 1.5%, and that this alone could lead to a sharp increase in the price of ETH shares:

EIP-1559 in 9 months $ ETH has the potential to become deflationary Current issuance is 4% per year, like $ BTC Eth 2 will drop to 1.5%. A halving of its own without the label. Eth is needed for all gas. DeFi. #Alts. Stake out. Uniswap $ 1,000 + in 2021.

Ryan Sean Adams shares a similar view and says on Twitter that Eth2.0, ETH staking and many other technical developments are not yet “priced” on the current price.

Eth2 does not come with a price

ETH staking is priceless

ETH as money has no price

Ethereum DeFi doesn’t come with a price

EIP1559 ETH burn is priceless

ETH at $ 400 is fun

– Ryan Sean Adams – rsa.eth 🏴 (@RyanSAdams) November 5, 2020

The implementation of EIP-1559 in combination with the launch of ETH 2.0 could therefore strongly favor a further increase in prices in the coming months and in 2021.

Additional factors for an ETH price increase

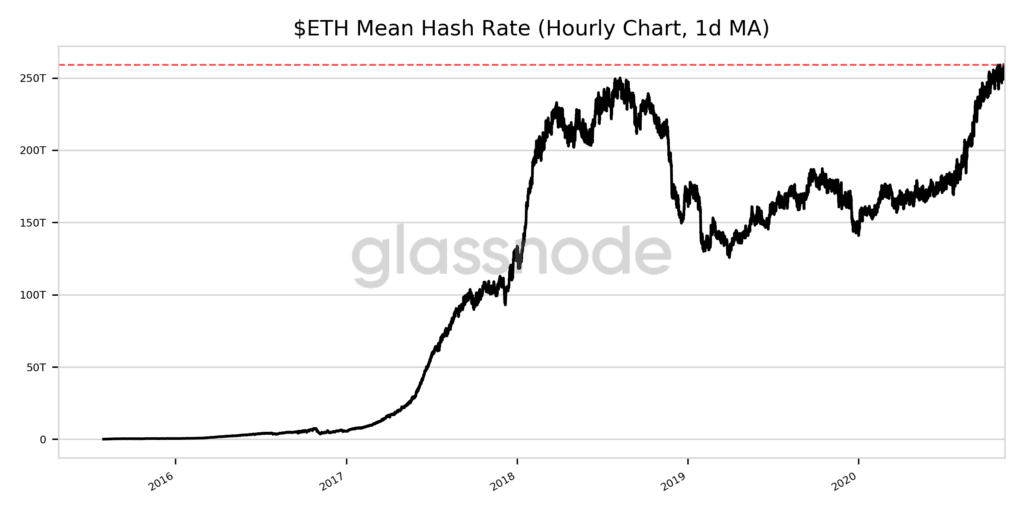

As Crypto News Flash has already reported, analysts like Josh Rager are also optimistic about Ethereum. According to him, ETH could rise to over $ 800 by the end of the year. Data from analyst firm Glassnode also shows that the hash rate for Ethereum has risen to an all-time high of 259 T / Hash per second.

Source: https://twitter.com/glassnodealerts/status/1325064366979506176/photo/1

Furthermore, the number of active ETH addresses interacting with the network has risen to a new record since October 2020. For this reason, Santiment forecasts a further increase in the ETH share price.

[ad_2]Source link