– Point and figure charts are an old but powerful form of technical analysis.

– Identify easily and easily the areas of purchase and sale.

Crypto Point & Figure Charts

Above: triangle breakout goals.

Point and figure charts are a form of graph analysis that does not use volume or time – just the price. While American Bar Charts and Japanese Candlesticks have a time element for bar or candlestick, the Point and Figure no charts. In this respect, they are very similar to the Renko, Gann Swing or Line Break rankings. Price action is the only factor that matters. It has been said that people who only use dot and pictorial charts are "purists" as a price action trader that you can get because all you care about is price. This means that a "box" (X or an O) or a series of boxes could form on a chart in a few minutes, or it could stay there for a week (which would represent a narrow trading interval using candles).

The Bitcoin chart shows an interesting area. There is a very clear triangle motif on the chart, which looks more like a downward pennant. In fact, the same continuation patterns that we see on the candelabra of the big moves (pennants and flags) are also applicable on dots and figures. One of the advantages of these charts is that we can see a clear level of where to go for a long time and where to go short. For Bitcoin, these price levels are when we get a clear break not only of the symmetrical triangle, but also of a shift above the previous high and / or low. A long position is generated when the price returns to the 4400 value area while a short exchange is generated in the 3200 value area.

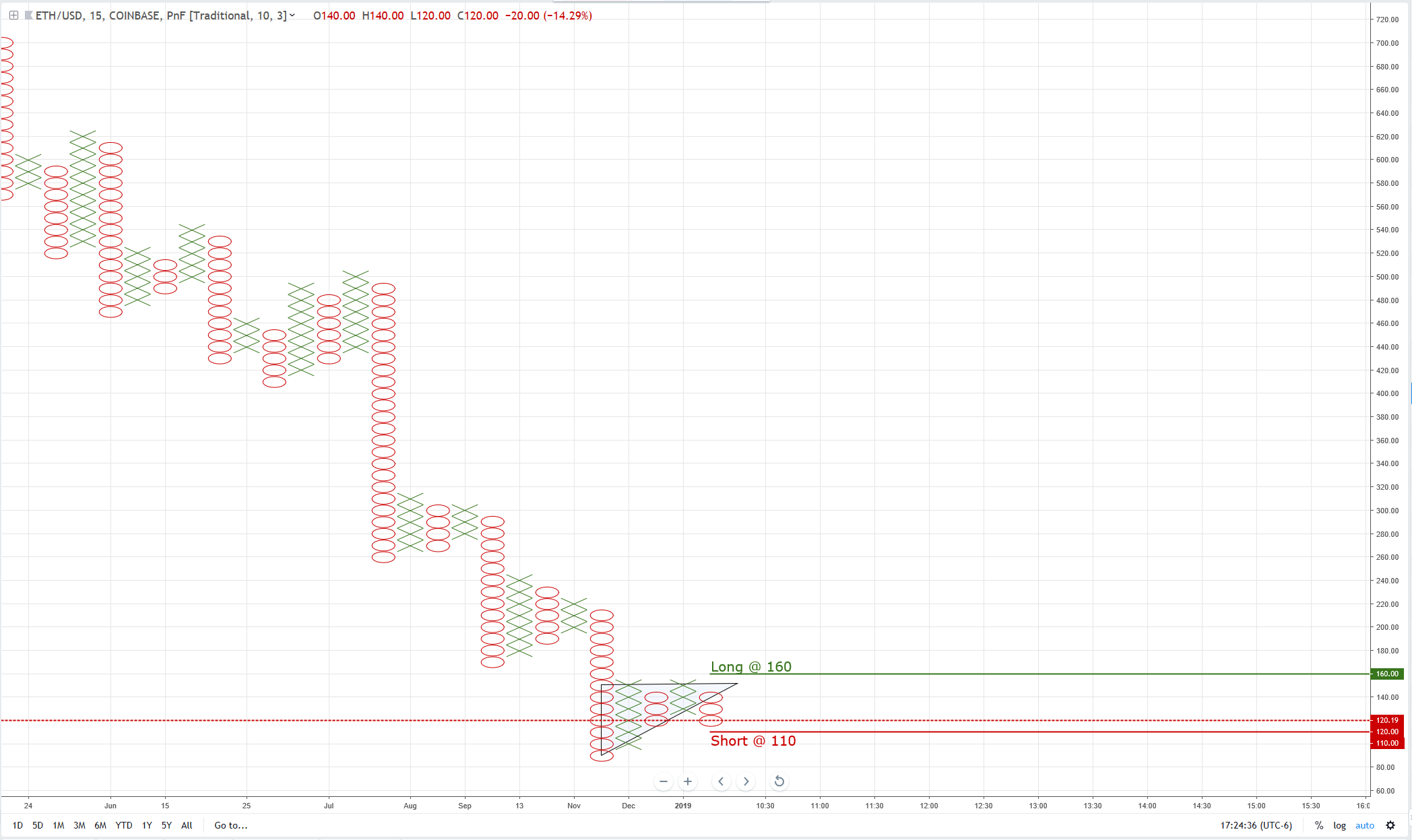

Above: ETH shows some short-term bearish weakness.

Ethereum shows a similar scenario. Let's see another triangle on this chart. The triangles in the point and figure charts are only a normal part of the progression and analysis of the graph. And really every form of technical analysis, the triangles are the geometric model in which the markets move. We can see that on this chart for Ethereum the short zone is located in the area of 110 values. The reason for this is due to the fact that there is a double bottom formed at 120 (two "O"), so we always take the box of a voice under that double bottom. Likewise, long conditions are fulfilled when the price reaches 160, which is a box above the double roof at 150. When I look at Ethereum's char, however, it looks ugly. The current short model seems ready to collapse lower after coming out of that triangle. And the bias for every bullish momentum seems very difficult to achieve. To reach the area at 160 values, we should retrace the entire movement of price action from November 14, 2018 to today, which is a good dose of bullish pressure against a very bearish market. The path of least resistance here remains lower … according to this graph.

Advertisement

Save on your currency transfers with TorFX, voted on Provider of international money transfers of the year 2016, 2017 and 2018. Their goal is to connect customers with ultra-competitive exchange rates and a unique dedicated service, which choose to trade online or by phone.

Find out more here.