[ad_1]

[ad_1]

Podcast: Play in new window | Download

One of the newest and most exciting topics in payments is cryptocurrency. Bitcoin, the first decentralized cryptocurrency, arrived in 2009 and soon exploded in value. Its decentralized nature, made possible by blockchain technology, promised to disrupt the status quo in the heavily regulated payments industry.

Within years of Bitcoin’s introduction, the number of different cryptocurrencies expanded by the thousands and Virtual Asset Service Providers (VASPs) have set up cryptocurrency exchanges to allow people to buy and sell various cryptocurrencies. As of January 2020, the cumulative market capitalization of cryptocurrencies amounted to over $ 271 billion.

Although the growth of cryptocurrencies has been remarkable, many consumers and financial institutions remain reluctant to buy and sell crypto assets due to security concerns. If VASPs want to become a part of people’s daily financial lives, they must adopt reasonable and responsible regulations, especially regarding Know Your Customer (KYC) identification and authentication.

To learn more about how VASPs can secure crypto exchanges through better KYC solutions, PaymentsJournal sat down with Anatoly Kvitnitsky, VP of Growth at Trulioo, and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group.

PaymentsJournal

Cryptocurrency and Compliance: How KYC Can Help Cryptocurrency Exchanges Grow

PaymentsJournal Cryptocurrency and Compliance: How KYC Can Help Cryptocurrency Exchanges Grow

Most VASPs have weak KYC requirements

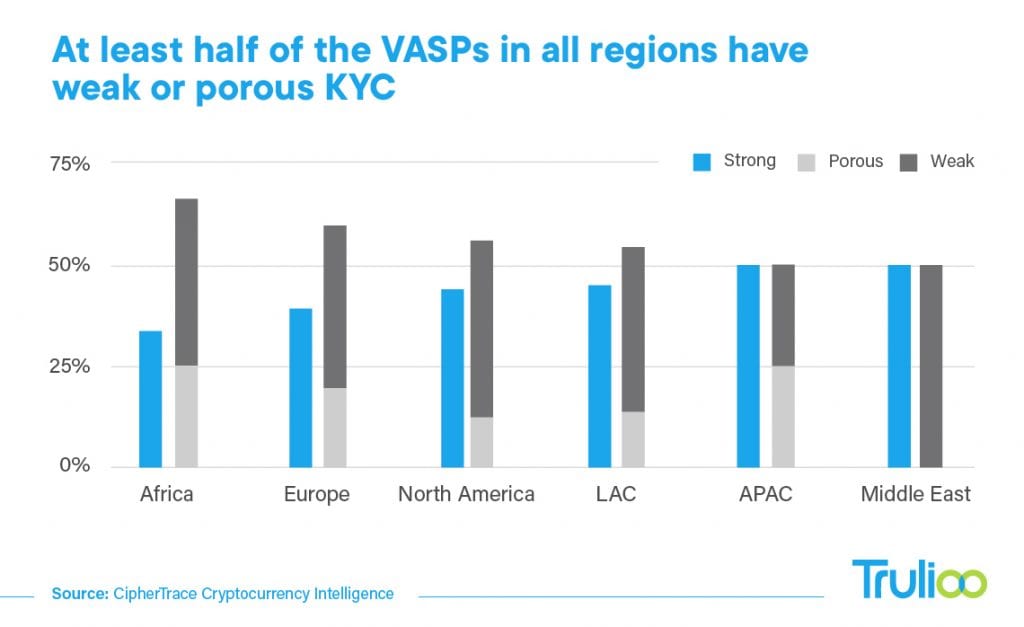

The current state of KYC compliance among VASPs around the world is weak. As the graph below indicates, at least half of VASPs in all regions of the world have weak or porous KYC standards.

“That’s worrying enough,” Kvitnitsky said, but “to be honest, I’m not surprised as a participant in the cryptocurrency ecosystem.” He explained that of the dozen initial coin offerings – which are commonly known as ICOs and refer to when a cryptocurrency goes public – that he participated in, only one performed the proper KYC procedures.

Most of the time, KYC will consist of having a photo taken of himself holding his ID and an employee who will approve or reject that photo. This “is not meeting KYC, no matter what country you are in,” Kvitnitsky said.

Sloane pointed out that by failing to adequately secure exchanges through effective KYC standards, VASPs have created an opportunity for scammers. “Exchanges are the most untrustworthy area of cryptocurrency out there. If you take a look at where the [fraud] there have been losses, almost all have happened in the exchanges themselves, “Sloane said.

Meet the most stringent requirements to operate anywhere

As cryptocurrency exchanges span the world, it can be difficult to understand which countries have which regulations. Some countries, especially European ones, have much stricter KYC standards, even for cryptocurrencies, while other countries are considerably more permissive.

To navigate the different regulatory frameworks, Kvitnitsky explained that VASPs should first aim to become compliant with the toughest regulatory markets. “We always recommend in Trulioo [to] choose one of the toughest markets in terms of regulatory compliance, “he said. If a VASP can meet the requirements there, then it can meet the requirements almost anywhere that allows for crypto exchanges.

Sloane agrees with this approach, adding that “I think you go to the highest ledge possible and the Bank Secrecy Act is probably that.” The act is intended to prevent criminals from hiding or laundering money. “If you want to protect your brand, it’s best to make sure you’re able to stand up to a terrorist financing investigation or some other bad deed,” he continued.

How to improve KYC standards

“It all starts with a level of education,” Kvitnitsky began. Too many exchanges are simply unaware that their KYC measures are inadequate. VASPs that ask users to take selfies with documents, for example, need to realize the problems with that approach and learn better alternatives.

So VASPs should focus on the legal level. As discussed, different regions and countries have different compliance rules. VASPs should determine which market they want to operate in and then plan accordingly. Once KYC solutions are implemented, VASPs need to focus on training and usability. Ensuring compliance can require a lot of engineering resources, so VASPs should keep this in mind too.

Best practices for identification and verification

As Trulioo currently supports 3 of the top 5 crypto exchanges in the world, it has some insight into what these exchanges are doing well when it comes to KYC.

The most successful exchanges are those that have built trust with users. They were able to do this by adopting a risk-based approach similar to the approaches taken by regular financial institutions. In fact, many of the largest and best-funded exchanges have hired former bankers and former employees of financial institutions to bolster compliance capabilities.

Consequently, these successful exchanges “adhere to the same type of KYC and AML [anti-money laundering] processes [that banks use]. And frankly, as users, it makes us feel better when the company takes these precautions, “Kvitnitsky noted.

Finding the right partner to improve KYC

Regardless of the solution a VASP uses, it is important to balance speed with safety. If the identification and verification process is too long or costly, users will likely leave the platform.

Fortunately for VASPs looking to make trading safer without adding too much friction, companies like Trulioo can help.

“We take a position that data rules everything when it comes to KYC,” Kvitnitsky said. The surest way to meet KYC requirements is to verify incoming data against data from government agencies, credit bureaus and other reputable sources. “We do this through a single API where we integrate over 400 different data sources,” he continued. Trulioo’s approach also combines artificial intelligence and manual reviews for document verification.

“What is important to us is that users can trust the VASPs and exchanges they are working with throughout the entire process,” Kvitnitsky concluded.

Summary

Item name

Cryptocurrency and Compliance: How KYC Can Help Cryptocurrency Exchanges Grow

Description

Although the growth of cryptocurrencies has been substantial, many consumers and financial institutions remain reluctant to buy and sell crypto assets due to security concerns. If VASPs want to become a part of people’s daily financial lives, they must adopt reasonable and responsible regulations, especially regarding Know Your Customer (KYC) identification and authentication.

Author

PaymentsJournal

Publisher name

PaymentsJournal