[ad_1]

[ad_1]

-

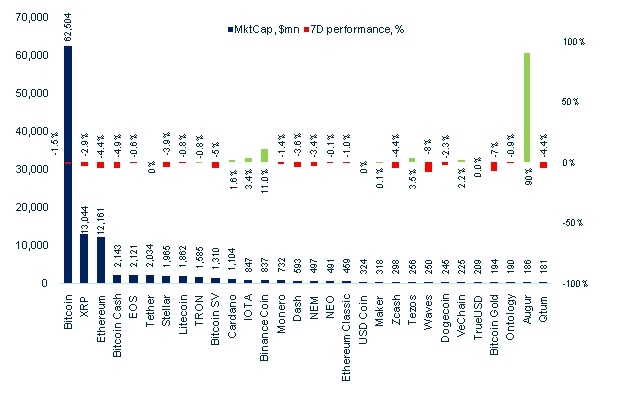

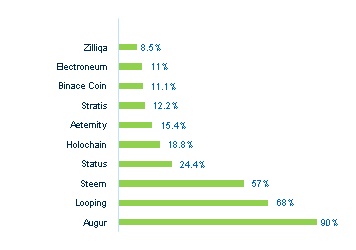

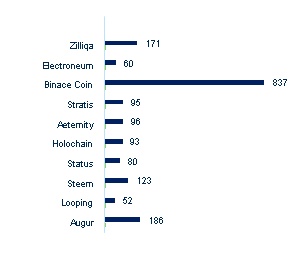

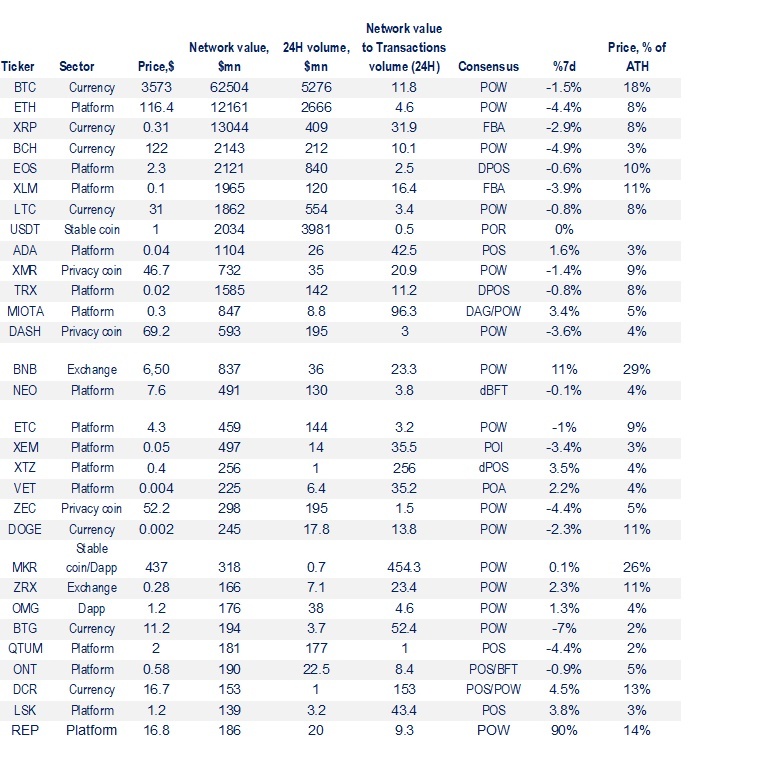

The Bitcoin domain fell 0.2% to 52.6%. ThetotalcCryptomMarketshrankinkedby almost 14% and total volume is down 8% from last week. Bitcoinis decreases by 1.5% Ethereumisdown by 4.4%, XRP is down 3% and EOS is down 0.6%. The best performers in the first 40 crypto were Augur (90%) Binance Coin (11%) and Zilliqa (8.5%).

-

Wyoming passes the Blockchain regulatory sandbox

-

Malaysia to regulate ICOs as security offers

-

Bitmain is closing plans of Texas and the Amsterdam office

-

Vontobel launches the regulated Crypto Custody

-

Genesis works with BitGo to facilitate trading for institutions

-

Less centralized Bitcoin Mining and increase in transaction volume by 63%

-

Forcella Costantinopoli Postponed

-

Cryptophan exchange that claims Hack

-

Belarus Startup launches the Tokenized securities trading platform

-

HSBC solves $ 250 billion using Blockchain technology

Market moment

The cryptocurrency market started last week with a 5% peak that pushed the cap. Total crypt of over $ 124 billion on Monday. After nearly a week of inactivity, digital assets showed a decent momentum until the end of the week, initially returning the price to over $ 125 billion on Friday, which subsequently fell back below $ 120 billion for the fourth time since the end of November. Bitcoin has dropped nearly 5% from its mid-week high of $ 3,760 and is currently in the bottom of the range at $ 3,580. Ethereum is down 6.4% to $ 118 and the gap between ETH and the second largest business, Ripple, has expanded to $ 1 billion since the XRP has declined only slightly more than 4% at $ 0.318. As usual, the rest of the top-level activities have just followed the price action of their larger peers, where both BCH and EOS were down by 5%, Litecoin by 6%. The overall volume remains roughly the same, around the $ 16bn line. The activities with the best performances last week were Augur (+ 90%), Steem (+ 58%) and Binance Coin (+ 11%).

Figure 1. Performance and market capitalization of top-30 cryptocurrencies (by MktCap)

Source: coinmarketcap.com, from 21 January 2019 to 09:00 AMGMT

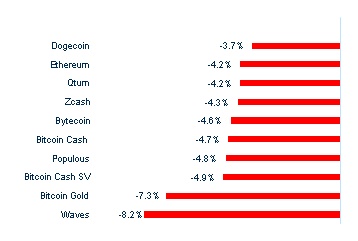

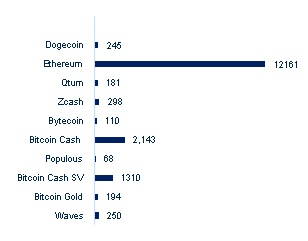

Figure 2. Worst digital resources * (7 days)

Source: coinmarketcap.com, *) MktCap> = $ 50m

Figure 3. MktCap of the worst digital assets *

Source: coinmarketcap.com, *) MktCap> = $ 50m

Figure 4. Digital resources with better performance (7 days)

Source: coinmarketcap.com, Mkt Cap> = $ 50 million

Figure 5. MktCap of the most performing digital resources

Source: coinmarketcap.com, Mkt Cap> = $ 50 million

Figure 6. The best digital resources for MktCap evaluation

Source: Coinmarketcap.com, NKB Research * to 21 January 2019, 10:30 GMT

Regulatory news

Wyoming moves to the Blockchain / Cardano Move to Wyoming regulatory sandbox

According to the bill entitled "Digital assets – existing law", virtual assets fall into three categories: securities, assets and currencies and bitcoins fall into the currency category, providing the same legal status as money. Furthermore, the bill aims to create a framework for banks that act as qualified depositaries of digital resources. In addition to the aforementioned bill, Wyoming is also considering other positive blockchain laws – "Equity Securities – Share Certificates" – that would allow companies to issue blockchain-based share certificates. A Twist representative from Wyoming, Caitlin Long, summarizes very well what is happening in the "etern west" state, which has already attracted the mother company of Cardano IOHK, who is moving from Wyoming to Hong Kong.

Russia could introduce 20 Crypto Bills in 2019

The digital economy will be the main priority of the upcoming spring session of Russia with over 20 draft bills presented in parliament, according to lower house president Vyacheslav Volodin, who stated:

"The creation of a favorable legal framework for the development of the digital economy should, in many respects, provide us with a competitive position among the other countries".

Malaysia to regulate token sales security offers

As of Tuesday, January 15, the watchdog of Malaysia has had the power to regulate sales of tokens and crypto trade, according to the law on the securities in force. Any person or entity offering a token or managing an encrypted exchange without approval, faces 10 years imprisonment and a fine of $ 2.4 million.

EU bank regulators ask for United Crypto regulation

The European Banking Authority (EBA) has published a report calling for uniformity in encryption across the continent. The report argues that the current lack of balance means that companies can move operations to "crypto paradises" and thus face easier regulation. If approved, countries like Malta or Gibraltar will most likely lose their advantageous position.

Cryptic market news

Bitmain is closing plans of Texas and the Amsterdam office

The problems of the Chinese mining giant Bitmain continue as the company announced the suspension of its mining operations in Texas and closed its office in Amsterdam.

Vontobel launches the regulated Crypto Custody

The Swiss private investment bank Vontobel has launched a digital asset custody solution, which enables the bank to purchase, transfer and store digital assets.

Bittrex launches OTC Desk offering 200 assets

US-based cryptographic exchange Bittrex is launching an OTC bank that supports more than 200 cryptocurrencies offered by the exchange.

LedgerX index to track the volatility of Bitcoin

LedgerX Volatility Index (LXVX) will track the expected volatility of bitcoins using data from its regulated bitcoin options. LXVX is similar to the popular measure of expected stock market volatility, the volatility index of CBOE (VIX).

Bakkt acquires part of the Rosenthal Collins group

After collecting $ 183 million, the bitcoin futures exchange, Bakkt is acquiring a portion of the Rosenthal Collins Group (independent futures commission) in order to improve risk management and treasury operations.

Cryptopia that attests significant losses from Hack

Cryptographic exchange based on New Zealand Cryptopia has suffered a significant attack that has led to no disclosure (rumors claim losses of $ 2.4 – $ 3.6 million).

Forcella Costantinopoli Postponed

The expected hard fork of Ethereum has been postponed and rescheduled for February 27 due to a potential vulnerability found in one of the software updates.

Bitmex closing US and Quebec accounts

Hong Kong-based bitcoin exchange Bitmex is closing trading accounts in the United States and the Canadian province of Quebec to keep pace with recent regulatory crackdowns on unregistered trade.

The dominant position of the Bitcoin mining pool indicates less centralization

A recent report by Diar indicates that the mining bitcoin domain of big players like Bitmain has shrunk and has shifted towards unknown miners; therefore the bitcoin network is currently less likely to suffer an attack.

Genesis works with BitGo to facilitate trading for institutions

The company OTC Genesis has partnered with the cryptographic BitGo to allow institutional customers to exchange coins without having to withdraw them from storage, which usually takes up to 24 hours, and also without the transaction being recorded on the public register .

Bitcoin chain transaction volume up 63%

The volume of Bitcoin transactions has grown by 63% in the last 10 months and is at the same level as the 2017 bull rush.

Giga Watt ceases operations

The US mining company Bitcoin Giga Watt has halted its operations, owing $ 7 million to its creditors, including a $ 800k bill to electricity suppliers.

HSBC solves $ 250 billion with DLT

HSBC has liquidated $ 250 million forex transactions using blockchain technology since February 2018. The amount represents over 3 million exchanges and over 150,000 payments.

Lower forecast of Delphi Digital Bitcoin

The Delphi Digital research and consulting group is attempting to calculate the bitcoin price fund by analyzing the age dynamics of unused transactions (UTXO) in current and previous market cycles. According to the report, the fund is close.

NEWS ON SECURITY TOKEN

The Aspen currency migrates for securitization

Coins representing the fractional shareholding in the St. Regis Aspen Resort, originally promoted by Indiegogo and released by Templum, are transferred to the Securitize platform, making tokens tradable on multiple platforms, leveraging Securitize DS Protocol.

Belarus Startup launches the Tokenized securities trading platform

The Minsk fixed currency has announced the launch of its regulated trading platform for tokenized securities. The company plans to issue more than 10,000 tokenized securities that will track and mirror the performance of common financial instruments; for example, a cryptic investor can buy a token linked to an Apple share on the Nasdaq.

Uzbekistan believes to bring the STOs to Central Asia

After legalizing the encryption exchanges in September and creating Digital Trust, a blockchain investment vehicle, the new president of Uzbekistan Shavkat Miriyev wants to take the STOs to Central Asia, according to Forbes.

Swarm announces the free tokenization service and the stakeout model

The security token infrastructure platform offers its customers a free tokenization service. "To meet the demand and scale the adoption of digital titles, we have designed a way not only to make free tokenization, but to reward leading issuers in the process," Swarm's CEO and co-founder announced, Philipp Pieper.