[ad_1]

[ad_1]

One of the great advantages of Bitcoin is its international nature. Wherever you are in the world, as long as you have an Internet connection, you can use Bitcoin to send and receive money. That said; some parts of the world are much friendlier to Bitcoin users than others.

Anyone who is trying to create a Bitcoin business will naturally avoid those rare countries that actively discourage its use, through heavy regulations, hostile taxes, hostile banks or even definitive bans.

The good news is that such hostile nations are rare. Most governments are still deciding on how to deal with Bitcoin and still have to approve decisive legislation. The usual approach is to classify Bitcoins based on a pre-existing category, so that permanent laws can be applied to it, usually for tax purposes.

However, some nations are making a concerted effort to embrace Bitcoin, as they realize that Bitcoin could be of enormous benefit to their economic future. By encouraging the adoption of Bitcoin and attracting Bitcoin companies, these nations seek to position themselves at the forefront of financial innovation.

This article examines the best possible countries to establish a new cryptocurrency activity. Let's look at the tax rate on Bitcoin and the attitude of legislators and banks towards it. Because these facts are subject to change, the sources are dated.

Countries order them from the best to the worst, based on how low their taxes are, then the clarity of the regulations, then the friendliness of the banks and finally the kindness and ease of business of the country.

Tax tip: If you are interested in tax treaties between your country and one of those dealt with below, this page of PwC's Worldwide Tax Summary should be enlightening.

Bank Tip: To discover banks around the world that have been rated by users as friendly or hostile to cryptography, check out the Moon Banking website. Share your experiences with the banks to improve the site.

List of countries:

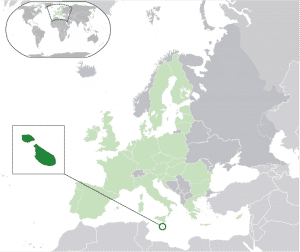

- Malta

- bermuda

- Switzerland

- Gibraltar

- slovenia

- Singapore

- Estonia

- Georgia

- Belaurs

- Hong Kong

- Japan

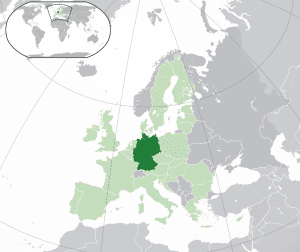

- Germany

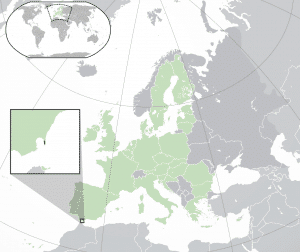

# 1 – Malta

# 1 – Malta

Malta is an island nation of southern Europe of about 450,000 people. With an area of only 316 km2, Malta is one of the most densely populated countries in the world. Malta is part of the euro area and uses the euro (EUR) as a currency.

The economy of the country is historically based on port trade. However, the Malta Financial Services Authority (MFSA) successfully attracted the registration of aircraft and ships, bank card issuance licenses, fund administration and gaming activities.

There is a bright prospect for cryptocurrencies in Malta. Binance, the largest exchange encrypted by volume, has recently announced that it will relocate its headquarters to Malta. Furthermore, getting a residence in Malta is quite easy thanks to its Global Residence Program.

Maltese taxes on Bitcoin

NoMoreTax.eu describes Malta as a crypto EU leader thanks to its favorable and detailed legislation.

Malta is one of the few EU countries that does not impose a property tax. Corporate taxes for "global residents" are 35%.

According to the No More Tax, foreign residents are not subject to Maltese income tax on income generated outside Malta, provided they are not returned to a Maltese bank account. If brought to Malta, this income is taxed at 15% according to Chetcuti Cauchi Advocates (March 2017), a law firm based in Malta.

In addition, foreigners residing in Malta are not subject to income tax on any foreign capital gains, even when they forward these gains to a Maltese bank account. This includes the profit made in the equity markets and therefore should also extend to the encrypted gains, at least until such time as specific laws are passed.

Finance Malta, an almost governmental information site, reports that Malta still has no laws in place for cryptocurrency taxation.

Government position on Bitcoin activities

In February 2018, the Maltese government created the new Malta Digital Innovation Authority, which provides a complete regulatory framework for encrypted businesses. MDIA tries to certify the blockchain platforms used by companies. It will also improve verification processes for cryptographic platform users.

The Prime Minister of Malta welcomed Bitcoin and blockchain technology, explicitly mentioning Malta's goal of becoming "a global pioneer in the regulation of blockchain-based businesses and the jurisdiction of quality and choice for world-class fintech ".

As of January 2018, the Maltese Financial Services Authority is drawing up plans to enable regulated investments in cryptocurrencies and ICOs.

A Maltese economy minister recently announced (April 2018) that Malta wants to become known as "The Blockchain Island".

Finance Malta reports that the Prime Minister of Malta has told the European Parliament that EU governments should double blockchain technology. The PM also said that "the increase in cryptocurrencies may be slowed but can not be stopped".

As the banking sector of Malta considers Bitcoin

Starting from November 2017, the oldest bank in Malta, the Bank of Valletta (BOV) has suspended cryptocurrency transactions. The government has stated that these delays with the banking sector will be resolved once official legislation is in place.

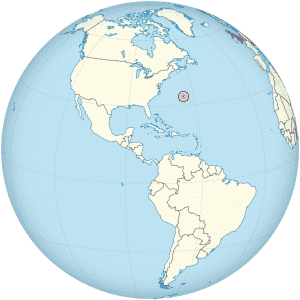

# 2 – Bermuda

# 2 – Bermuda

Bermuda is a small Caribbean island with a population of about 65,000. It is a former British colony and remains a part of the Commonwealth. As a currency, use the Bermuda dollar, which is pegged to the US dollar. In fact, USD is frequently used in Bermuda.

Many financial companies operate from Bermuda, particularly in the insurance sector, and there are 4 major banks located there. Apparently, Bermuda has the highest per capita GDP in the world, as its favorable tax rates and island lifestyle attract individuals with high net worth and large corporations.

Bermuda is renowned as a tax haven. It has no VAT, no corporate tax, income, wealth or capital gains. Bermuda has only a minimum wage tax, which is around 10% on the high end, as well as high consumption taxes on goods and services. There are also high duties levied on all imports. The capital of Bermuda is at the top of the cost of living index.

Google is one of the most famous companies to take advantage of Bermudan's tax law. Google has sent over $ 10 billion to its Bermudan branch. This allocation allowed the company to avoid $ 2 billion in fees in 2011.

There are more than 15,000 companies registered in Bermuda that have no physical presence or employees there.

Bermudan taxes on Bitcoin

Bermuda's taxation policies extend to Bitcoin and to cryptocurrencies in general. Bitcoin is not recognized as legal tender in Bermuda, which explains its tax-free status.

Government position on Bitcoin activities

The Bermuda government website has a formal statement by the Minister of Finance on the government's cryptocurrency initiative, published in November 2017. The reason is that the country is trying to attract encryption, but it is introducing regulation to prevent crime.

Following a cryptocurrency survey launched in November 2017, the monetary authority of Bermuda, the Bermuda monetary authority (BMA), published a paper in April 2018 on the proposal of "regulation of the virtual currency business". This document is known as the Virtual Currency Business Act (VCBA).

Bermuda intends to implement anti-money laundering standards (AML) and provide a reasonable and friendly structure for cryptocurrency businesses and startups. The rules are not prohibitive but are intended to promote a safe and predictable operating environment.

ICOs will receive special attention, which will require explicit approval from the Minister of Finance before they can operate in Bermuda. Registration of customer identity information (KYC measures) will be mandatory for ICOs.

The largest business encrypted with links to Bermuda is Binance, currently the main crypt for volume. The managing director and founder of Binance signed a memorandum of understanding with the finance minister of Bermuda in April 2018. Binance has so far invested $ 15 million in the island nation.

As the Bermuda banking sector sees the Bitcoin

Bermuda banks could reasonably expect to comply with the new government regulations and the welcoming attitude towards cryptocurrency.

# 3 – Switzerland

# 3 – Switzerland

Switzerland is a prosperous country in Central Europe, synonymous with political neutrality and bank secrecy (although this has recently been degraded). Switzerland is not part of the euro zone, having kept the Swiss franc (CHF) as currency. The country ranks first in the world for economic productivity and competitiveness and has an extremely high standard of living.

Several major cryptographic companies, such as Shapeshift and Xapo, have settled in the Swiss city of Zug. This region, nicknamed "Crypto Valley", has approved some very progressive laws regarding encryption and related activities, also approving Bitcoin as payment for bills. Other Swiss regions are following, like Chiasso. The Swiss state railway company also accepts Bitcoin for ticket payments nationwide.

Swiss taxes on Bitcoin

The cantons of Zug and Lucerne have detailed their approaches to bitcoin taxation in German-language documents dating back to the fourth quarter of 2017.

The Swiss law firm Vischer wrote an excellent overview (December 2017) of Bitcoin's fiscal situation in Switzerland, as well as the GoldenVisa website.

Crypto participations must be declared and are subject to wealth taxes. They must be assessed on the basis of the average annual prices of the Federal Administration of Federal Contributions, if available. Otherwise, they are valued according to the purchase price.

Capital gains and losses compensation apply only to those who trade cryptially on a professional level.

Crypts perceived as wages are subject to income tax, even for self-employed workers. Mining profits are also subject to income tax.

Switzerland is an "unofficial" tax haven of cryptocurrencies, according to an expert published (February 2018) on CoinTelegraph.

Government position on Bitcoin activities

The Minister of the Swiss economy has proclaimed (January 2018) the intention of Switzerland to become a large crypto nation before journalists in a private conference on cryptocurrency. With Bitcoin's activities, Switzerland may be able to regain its reputation for financial privacy.

An article (February 2018) published on RT.com has characterized Switzerland as the adoption of Bitcoin, altcoin and ICO while most of the rest of the world is analyzing them.

The ICOs will be considered as securities within Switzerland, according to the regulatory guidelines approved by the Swiss Financial Market Supervisory Authority in February 2018.

Although no license is required to send or receive Bitcoins, companies must comply with Swiss anti-money laundering legislation (AML), according to an article published in February 2018.

As the Swiss banking sector sees the Bitcoin

Swiss bank Vontobel offers "mini futures" Bitcoin on the Swiss stock exchange since November 2017.

Falcon Private Bank, a boutique investment company, has purchased and retained Bitcoin on behalf of its clients with high net worth since July 2017.

Vontobel and Falcon declared (December 2017) that "the best days of cryptocurrency are ahead".

Swiss online bank, Swissquote, launched a financial product in December 2017 that allows users to allocate holdings between Bitcoin and USD.

# 4 – Gibraltar

Gibraltar is a small town located in the south of Spain. It hosts only ~ 33,000 people. While it is autonomous, Gibraltar is part of the territory of the United Kingdom. The British and Gibraltar pounds are legal tender, even if the euros see frequent and informal use.

Online gambling and financial services and are two of the main sectors of Gibraltar. Many banks, intermediaries, investment and insurance companies are based in Gibraltar. Blockchain-based companies, including many ICOs, have also been attracted to the area as an attractive place to do business.

Gibraltar tax on Bitcoin

The tax rate on Gibraltar companies has been set at 10% since 2011.

Gibraltar is developing a legal framework for cryptocurrency firms (first quarter 2018), which should bring further clarity on tax issues.

Government position on Bitcoin activities

In January 2018, Gibraltar formulated the rules of the regulatory framework for Distributed Ledger technology, granting a formal license to the encrypted companies in the region.

With the DLT regulatory framework, the Gibraltar Financial Services Commission became the first financial ombudsman in Europe to draft the regulations governing ICOs. Because ICOs exist in a legal gray area in most countries – with the exception of those in which they are banned – these rules could attract many ICOs to the jurisdiction.

As part of the Brexit, Gibraltar will leave the European Union in 2019. This could affect the banking and legal relationships between Gibraltar and the rest of Europe.

As the banking sector of Gibraltar sees Bitcoin

On 25 July 2016, the Gibraltar Stock Exchange announced an Exchange Traded Instrument (ETI) based on Bitcoin, called BitcoinETI. This is the first such tool in Europe and means that the financial sector in Gibraltar is fully integrated with cryptocurrency.

While Gibraltar International Bank accepts the crypt a lot, its British partner bank is not. In January 2018, the Royal Bank of Scotland (RBS) refused to process orders from an encryption company based in Gibraltar. This surprise move has shaken many Gibraltar encrypted companies. What this incident highlights is Gibraltar's vulnerability to British business decisions or even regulations.

# 5 – Slovenia

# 5 – Slovenia

Slovenia is a nation of Central Europe with a population of around 2 million and an advanced and strong economy. It is the richest Slavic nation, measured by GDP per capita. As a member of the euro area, Slovenia uses the euro. The economy is mostly service-based and quality of life is valued at the 14th place in the world.

Important international stock exchange, Bitstamp, was founded in Slovenia in 2011. Slovenia has considerable hydro power and the well-known cloud mining service, NiceHash, operates from there. Similar to Estonia, Finland and Lithuania, the Slovenian government is very supportive of cryptocurrency.

Slovenian taxes on Bitcoin

The Ministry of Finance of Slovenia has published a document on cryptocurrency at the end of 2013, although unfortunately it is not available in English.

Bitcoin and cryptocurrencies are classified as virtual coins according to an article (published 2017 or later). This means that Slovenia would not tax Bitcoin as money or as collateral.

Individuals who are taxed on crypto profits according to income tax laws, based on the value of the crypto at the time of acquisition. However, Bitcoin trading is not taxed under these income tax laws.

People who buy Bitcoin as part of their business or mining activities will pay income tax.

Bitcoins and crypts are tax exempt on capital gains and mining is exempt from VAT.

The corporate tax rate for cryptology activities in Slovenia is not well defined, but taxation should certainly be expected. The financial administration of Slovenia stated that "the accounting treatment depends … on the circumstances." Capital gains of 19% may be taxed on profits.

Government position on Bitcoin activities

The Slovenian city of Kranj inaugurated what is perhaps the first public monument in the world for Bitcoin in March 2018. This symbolizes the acceptance by the Slovenian government of cryptocurrency.

The Slovenian prime minister promoted the country as a friend of the blockchain in October 2017. He praised the encrypted startups in the nation and revealed that the government is studying the application of blockchain technology for its own purposes. The prime minister continued saying that the government "wants"[s]to position Slovenia as the most recognized blockchain destination in the European Union ".

The Minister of Finance and Economy and Technology reiterated the nation's commitment to blockchain technology during a meeting between government and industry players, held in February 2018.

Slovenian cryptographic companies cooperate with each other and regulators within the Blockchain Alliance CEE.

As the Slovenian banking sector sees the Bitcoin

In September 2017, the Slovenian LON bank became the first regulated bank in the world to sell Bitcoin (indirectly, through the issuance of coupons) from its 15 national ATMs. The bank recorded a turnover of half a million euros realized in less than four months.

Unfortunately, the revolutionary approach of LON to Bitcoin was discontinued in February 2018 by the Slovenian Central Bank. The ban came one day after the central bank warned of the risks of cryptocurrency, saying it could undermine financial stability if it continued to expand.

According to NoMoreTax.eu, companies in the country must have a regulated bank account and can not operate exclusively in cryptocurrency.

# 6 – Singapore

# 6 – Singapore

Singapore is an island nation of 5.6 million people in Southeast Asia. The country has a highly developed market economy, with historical roots as a commercial port. The country uses Singapore dollars (SGD) as a currency. It is known as a tax haven and a global financial center. Singapore has been judged the most "technologically ready" nation in the world.

Singapore's economy has been judged to be the most innovative, freest, most dynamic, most competitive and most conducive to business in the world. It is rated as the 3rd highest per capita income in the world. Singapore is also considered one of the least corrupt countries in the world.

Singapore Taxes on Bitcoin

The Singapore Revenue Agency has decided that Bitcoins must be considered as assets and not as money.

Any Bitcoin company is required to pay the GST (tax on goods and services) when it trades Bitcoin or uses it for purchases. This tax is currently set at 7%.

Tech in Asia reported in January 2014 that Singapore will not apply any taxation to online gaming worlds, which probably includes online gambling.

Companies that buy or sell Bitcoin to or from customers will be responsible for GST for transactions and commissions.

Capital gains taxes apparently do not imply long-term investments in Bitcoin. Indeed, Singapore currently does not have a system for taxing outstanding capital gains.

Government position on Bitcoin activities

In February 2018, the Deputy Prime Minister of Singapore and the Minister of the Monetary Authority of Singapore (MAS) replied to parliamentary questions concerning the prohibition of trade in Bitcoin and other cryptocurrencies.

The deputy prime minister stressed that cryptocurrencies are experimental, host many illicit transactions and pose a great risk to consumers. He also said that the MAS is closely monitoring cryptocurrencies and tries to warn consumers of their risks.

MAS is also trying to bring Bitcoin under a singular regulation in combination with other monetary services.

However, the vice president also said that there are no foreseeable reasons to ban Bitcoin at this stage and that Singapore can tolerate the use of cryptocurrencies.

As the Singapore banking sector sees Bitcoin

In November 2017, Singapore's largest state-owned bank, DBS, accused Bitcoin of being a "Ponzi scheme". This contrasts with the monetary authority of Singapore's most neutral position on Bitcoin.

Bitcoin companies were in a difficult situation in September 2017, when Singapore banks closed several bank accounts of cryptocurrency companies. For example, CoinHako, a company linked to cryptocurrency, had its own bank accounts close to DBS.

While the DBS was clearly hostile to Bitcoin, Moon Banking reports many banks in Singapore that are crypto-friendly. However, there are only a few votes in most cases. Recent ratings suggest that DBS has become more open to Bitcoin.

7 – Estonia

Estonia is a country in Northern Europe and a member of the euro area. It has a small population of 1.3 million people. Estonia is technologically advanced, being the birthplace of the famous Skype service. The country is generally prosperous and valued for economic freedom (4th in Europe) and the ease of doing business (12th in the world).

The country is also known as a leader in e-government, having implemented internet voting in 2005. Estonia is even contemplating the launch of its national cryptocurrency, Estcoin.

Estonian taxes on Bitcoin

A probably outdated (second quarter 2014) summary of the Estonian tax laws on bitcoin discloses that Estonia ranks Bitcoin in the same way as the ECB. Bitcoin is seen as an alternative currency, but not as a security. Individuals or companies conducting Bitcoin transactions must be registered as business service providers.

According to an article (4th quarter of 2017) of the founder of Incorporate.ee, Bitcoin profits are subject to capital gains tax (around 25%), but are exempt from VAT (20%).

The European Court of Justice, the highest court of the European Union, decreed in October 2015 that transactions with Bitcoin are exempt from VAT. The court considers Bitcoin a currency rather than a property (this is ultimately subject to VAT).

A fairly recent article (2nd quarter 2017) of a Bitcoin operator reports the capital tax of 25% of Estonia and its social tax of 33%. Such rates may not apply in all cases – a merchant based on Estonian reports (1st trimester 2018) that only pay an income tax of 20%.

Potential companies should conduct their own surveys on the rate that will be charged on their particular activity, as it is likely to be significantly lower than this declared maximum. A good starting point would be the Estonian Tax and Customs Commission and this guide regarding the taxation of cryptocurrency transactions in Estonia.

Note that "e-residents" (described below) are only taxed on income derived in Estonia.

Government position on Bitcoin activities

Estonia's pioneering e-residency program facilitates the access of foreign citizens to the legal and banking presence in the country and, by extension, to Europe. Combined with the positive attitude of the nation towards cryptocurrency, this makes it an excellent entry point into the European market.

Electronic residence is not equivalent to tax residence, nor does it work for registration purposes with cryptographic exchanges.

The government has a favorable position on Bitcoin and cryptocurrency in general. Estonia is considered the easiest Baltic nation in which to open a Bitcoin business. A recent discussion on the forum (Q1 2018), concerning the establishment of an activity related to cryptography in Estonia by "foreign" e-residents, outlines the order in which to proceed. While the process appears simple and cheap, note that it is necessary to guarantee specific licenses for the legal activity of any activity related to cryptography. This shows that the normative clarity on the crypt certainly exists in Estonia.

The Estonian government is still considering the possibility of launching Estcoin, despite the criticism (Q3 2017) of the project by the European Central Bank. This shows that Estonia exercises at least a certain degree of independence in promoting cryptocurrency, even if the ECB opposes the cryptocurrency to protect its fiat monopoly. The Estonian government is even contemplating a sovereign fund (Q3 2017) based on Bitcoin.

The cost of opening a Bitcoin business in Estonia is low, according to reports (Q4 2017) of around 8,000 euros.

How the Estonian banking sector sees the Bitcoin

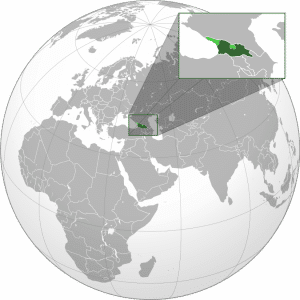

# 8 – Georgia

# 8 – Georgia

Georgia, the country (not to be confused with the US state) is a nation of Eastern Europe of nearly 4 million people. He is not a member of the euro zone and uses the Georgian Iari (GEL) as a currency. In order to attract foreign investments in its IT sector, Georgia established the Poti free industrial zone near its capital, Tblisi, in 2015.

The post-Soviet Georgian economy is one of the fastest growing in Eastern Europe, thanks to economic reforms and modernization. In 2017, Georgia ranked fourteenth in the world for ease of doing business and 13 for economic freedom. However, in 2016 Georgia was poorly evaluated among European nations for the development of its IT sector (although this is constantly improving).

According to the Global Benchmarking Study, published in 2017, Goergia has the second highest mining excavation of Bitcoin in the world after China. This is largely due to the presence of a Bitfury mining facility near Tblisi.

Georgian taxes on Bitcoin

Taxes in Georgia are relatively low, as described on the Company Formation Georgia website.

Only revenues generated by geographic sources in Georgia are taxed.

The companies located in the industrial area of Poti free benefit from a preferential tax regime. Within this area, there is no VAT, dividend, profit or property tax. Taxes on leases and salaries will still be applied.

Government position on Bitcoin activities

In February 2017, the Government of Georgia approved a system under which state-owned transactions will be recorded via the Bitcoin network. This will be developed in collaboration with Bitfury.

In April 2016, Bitfury and the Georgian government launched a blockchain-based land registry project.

The government welcomes investments related to encryption and has close ties with the great miner Bitcoin, Bitfury.

Cryptocurrency is not seen as legal tender in Georgia.

The co-founder of Georgia's encrypted business, Spotcoin, said in May 2018 that he believes it is likely that the Georgian government will soon investigate the regulation of cryptocurrency.

As the banking sector of Georgia sees Bitcoin

The National Bank of Georgia has issued a Notice regarding the volatility of the cryptocurrency in December 2017. However, no regulatory action was taken.

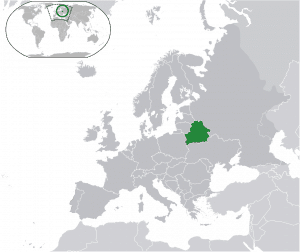

# 9 – Belarus

# 9 – Belarus

Belarus is a country of Eastern Europe of about 10 million people. The economy of the country is mostly based on production and uses the Belarusian rubles (BYR) as currency. The government has recently adopted cryptocurrency as part of its program to develop the IT industry and attract foreign businesses, investments and talent.

The ordinance on the development of the digital economy, signed by President Lukashenko in December 2017, sets out in detail the country's plans. Note that these new rules that regulate cryptography – perhaps the most progressive in the world – apply only to individuals or companies that are registered residents in Hi-Tech Park. This is a special economic zone located in the capital of Minsk.

While the Western media are discernibly negative in its coverage of Belarus, perhaps due to the close association of the country with Russia, Belarus offers an interesting opportunity for the right kind of Bitcoin business.

Belarusian tax on Bitcoin

According to the order, Belarus has waived all taxes on cryptocurrency transactions and income for five years (so until January 2023). In altre parole, nessuna tassazione delle attività minerarie, commerciali o di altro tipo che coinvolgono la crittografia. Anche le donazioni e le eredità di Bitcoin sono esenti da tasse.

Lo status di esenzione fiscale si applica anche alle attività condotte all'estero.

Il ministero delle finanze di Minsk ha creato nuove regole contabili che riguardano specificamente la criptovaluta. Ciò porta alla chiarezza tanto necessaria per il reporting fiscale.

Posizione di governo sulle attività di Bitcoin

Il Presidente della Bielorussia ha dato il suo nome a un decreto che legalizza completamente la tecnologia blockchain all'interno del paese. All crypto-related business activities, including ICOs, exchanges, mining, smart contracts, etc. are now considered legal in the country.

Note that cryptocurrency is not regarded as legal tender in Belarus, meaning there is no compulsion for any person or business to accept it in lieu of Byelorussian rubles.

Foreign companies may take advantage of Belarus’s favourable policies by registering a company there, according to an article from January 2018).

Foreign IT specialists may stay in Belarus without a Visa for 180 days.

How Belarus’s Banking Sector views Bitcoin

Given the legislation passed at the highest levels, banks in the country have no real choice but to fall in line.

In July of 2017, the National Bank of the Republic of Belarus gave local banks the green light to use blockchain systems for “transmitting bank guarantees.” This appears to refer to a permissioned blockchain to record credit agreements between banks and the state.

The central bank has also revealed plans to apply blockchain technology in the management of Belarusian currency and stock exchanges.

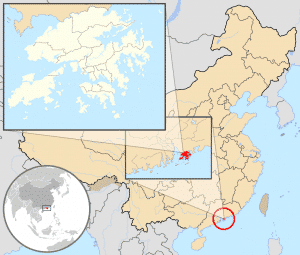

#10 – Hong Kong

#10 – Hong Kong

Hong Kong is a Special Administrative Region of China, located along its southern coast. Despite being a small territory, Hong Kong has a population over 7 million and a strong economy, largely based in finance and trade. Its economy, ranked the 44th biggest globally, has also been rated as the freest in the world since 1995 (although increasing Chinese influence may alter this in future).

Hong Kong has its own currency, the Hong Kong Dollar (HKD), which has a lot of trading volume. Hong Kong has lighter regulations than China and English is more commonly spoken there than in China, due to Hong Kong’s history as a British colony.

Hong Kong’s Taxes on Bitcoin

Bitcoin is exempt from both VAT and capital gains taxes in Hong Kong. However, income tax will still apply whether a business is receiving HKD or BTC. Reporting may be conducted in either currency.

Government Stance on Bitcoin Businesses

The Bitcoin Association of Hong Kong described (February 2018) the region as having reliable, predictable and hands-off regulations. Regulations are said to be simple and clear. The group gives a good overview of the evolution of Hong Kong’s Bitcoin regulations over the years.

Bitcoin is categorized as a virtual commodity rather than a currency. According to the Bitcoin Association of Hong Kong, this means it’s unregulated by existing financial watchdogs. The Association says that Bitcoin trading is not regulated by any of the organisations which oversee commodities trading either. Hong Kong’s legal status as a “free port” means that legislation of commerce is generally light.

In April of 2018, the Hong Kong Financial Services and Treasury agency published a report on money laundering and terrorist financing, which considered the role of Bitcoin and other cryptos in such activities. It was concluded that crypto had no “visible impact” in these areas.

As an example of Chinese influence leading to stricter regulation, the South China Morning Post reported in February 2018 that lawmakers and brokers have called on Hong Kong’s government to pass stricter regulations on Bitcoin. This comes in the wake of China’s bans on cryptocurrency exchanges and ICO activity, as well as tightening restrictions in Germany and the USA.

How Hong Kong’s Banking Sector views Bitcoin

Banks in Hong Kong do not seem as friendly to Bitcoin as the government there. Hang Seng Bank closed the account of large crypto exchange, Gatecoin, in September of 2017 without warning. Gatecoin claims to have made every effort at anti-money laundering (AML) compliance. Several other crypto startups also had their accounts frozen.

HSBC (Hong Kong and Shanghai Bank), one of the world’s largest banks which was founded in Hong Kong but is now headquartered in London, stated that it has “limited appetite” for crypto exchanges but welcomes start-ups.

The central bank of Hong Kong, known as the Monetary Authority, said that the rejection rate for new business accounts is only 5%.

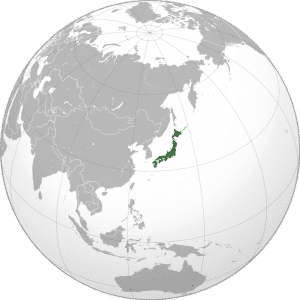

#11 – Japan

#11 – Japan

Japan is no laggard when it comes to Bitcoin. The world’s first major Bitcoin exchange, Mt. Gox, was based in Tokyo. The inventor of Bitcoin, Satoshi Nakomoto, even had a Japanese pseudonym.

Japan is certainly one of the nations at the forefront of Bitcoin adoption, legalization and integration. For example, Japan was the first country in the world to (arguably) approve Bitcoin as legal tender. The nation was also first to pass broad regulation of its 32+ cryptocurrency exchanges, aimed at improving their security.

While Japan is often reported (Q1 2018) as the world leader in crypto trading volumes, it must be borne in mind that many of their exchanges offer zero fee trading, which can greatly inflate volumes (as seen with Chinese Bitcoin volume), before and after their government’s imposition of mandatory trading fees).

Japanese Taxes on Bitcoin

In December of 2017, Japan’s National Tax Agency released guidance on the tax treatment of crypto profits. Essentially, anyone earning above 20m JPY (roughly $184k USD) annually or making profit in excess of 200k JPY ($1,840 USD) will be eligible for tax. Such profits are classed as miscellaneous income. Holders are not taxed, only those taking profits from selling coins or using them for purchase of goods and services.

Japan has a 7-tiered system of taxation. Tax rates range between 5 and 45 percent, based on annual earnings. There is also a residential tax on all income of 10 percent, for a maximum tax rate of 55 percent.

Business losses may not be used to offset crypto profits, nor may crypto losses be used to offset other gains.

Consumption tax was removed from Bitcoin in April of 2017, when it was declared legal tender.

Government Stance on Bitcoin Businesses

Japan’s Cabinet officially recognised Bitcoin as “real money” in Q1 2016.

Bitcoin is seen as legal in Japan and their regulation is not so strict as to stifle Bitcoin’s growth there.

Japan’s Virtual Currency Act went into effect on the 1st of April 2017. It mostly governs the capital requirements and security processes of exchanges.

The Nomura Research Institute issued a report on blockchain tech in May 2016. It suggests that further changes to the country’s banking laws are required to properly deal with cryptocurrencies, specifically the Banking Act and the Financial Instruments and Exchange Act.

The Accounting Standards Board of Japan is reportedly (Q1 2017) working on a framework for the treatment of cryptocurrency.

How Japan’s Banking Sector views Bitcoin

The largest bank in Japan, MUFG (Mitsubishi UFJ), is planning to launch its own cryptocurrency exchange, its own coin and segregated Bitcoin accounts for clients of other Japanese exchanges. This is according to news coverage from January 2018.

Japan’s largest crypto exchange, bitFlyer, received investment capital in early 2017 or late 2016 from all three of Japan’s largest banking corporations; Mitsubishi UFJ, Sumitomo Mitsui and Mizuho Banking Corporation.