[ad_1]

[ad_1]

Latest Bitcoin news

Eliminating Bitcoin prices does not just mean surrendering to companies and businesses that have built empires around Bitcoin, but the impact is now being felt by adopters and cryptographic payment processors. While we expect this drop to strengthen participants, shaking speculators and saving enthusiasts to see the network flourish, the strength of the platform is top priority.

Conduits like BitPay and Edmonton's Coinpayment are gears that not only stimulate adoption but are platforms through which crypto-curious can experiment in real time while demonstrating how Bitcoin is an efficient and resistant alternative to fiat. censorship. In the end, many experts expect to recover Bitcoin prices and this will certainly increase investor confidence by allowing them to spend rather than maintain.

To read: Chainalysis: the value of Bitcoin payments (BTC) falls of 80% from January 2018 maximum

As volumes are declining, our focus shifts to Bakkt and their announcement that they will have to postpone the long-awaited launch of Bakkt Daily Bitcoin Futures to January 24, 2019. However, this largely depends on the approval of US regulators. Through a post, Bakelly CEO Kelly Loeffler said the platform is taking this time to integrate as many customers as possible, while ensuring that the final platform is reliable and secure.

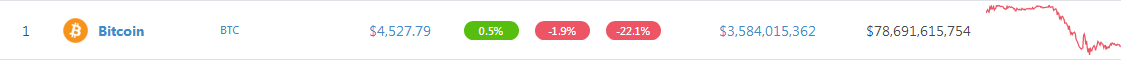

BTC / USD price analysis

It seems that BTC / USD is stabilizing as slowdowns slow down. Obviously, from a top-down approach the dents in the weekly charts are down 22%. In the daily chart, BTC / USD is down 2.5 percent in the last 24 hours. But after a clear imbalance, prices will naturally livell. For the balance, the prices of BTC / USD will consolidate by the 20th month up or down.

Trend: bearish

After the consolidation periods, BTC / USD is now bearish thanks to last week's drops below $ 6,000. Not only the weekly and monthly double-digit losses confirm this trajectory, but a simple trend line linking the highs of the last six days prints a perpendicular line. Here's how cuts have been decided.

Volumes: growing but bullish

Even if we maintain a bearish position thanks to the formation of candles and the resurgence of the sellers, the volumes paint a different story. Of interest are the bear bars of 14-69k Nov Nov, 19-74k Nov and Nov 20-117k. Note that the volumes have increased, but on November 20, despite the relative high trading volumes – 117k almost four times the normal average of 37k, the resulting trading range was close to $ 750. This is nothing comparable to the losses of the November 14 and 19 with an average of $ 800. On the back of these growing volumes we expected broad ranges of trading that could have seen traded BTC / USD under $ 4000. However, this did not happen. Instead we had a bear bar with a long supporting lower wick and the next bars were tight and going.

Candelabra formation: Bear Breakout

After three months of accumulation, last week's falls under our $ 5,800- $ 6,000 supports printed a bear-breaking pattern. Although the losses are huge, we expect a retreat as the demands of the break pattern. In that case, we could see a new test of the November 19 highs of $ 5,000 and if buyers accumulate enough momentum now that prices are down +80 percent from the peaks of 2017, BTC / USD could close above $ 6,000 by the end of the year.

Conclusion

Too much, Bitcoin fundamentals paint a rosy picture and prices would increase if Wall Street was involved. Since we expect Bakkt to be launched next year and the SEC will follow a month later with their decision on Van Eck Bitcoin ETF; retailers have to deal with the retail demand until December. Drawing conclusions from the chart, we expect BTC / USD to recover and perhaps print over $ 5,000 by the end of the week, all thanks to the imbalance of the last nine days.

All graphics courtesy of Trading View

This is not an investment tip. You have the research