[ad_1]

[ad_1]

Mati Greenspan, Senior Market Analyst at FX broker eToro, provided his daily commentary on traditional and cryptographic markets for January 15, 2019.

The highlights include:

- Institutional cryptographic adoption: Things are going ahead as seen with the Wall Street support service, Bakkt, which yesterday announced it has acquired Rosenthal Collins Group.

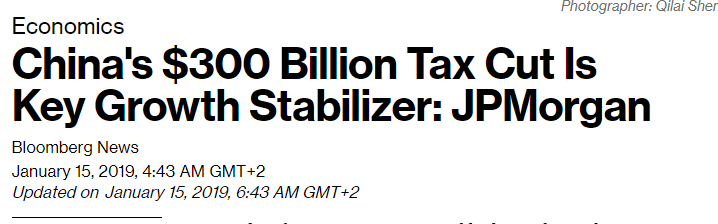

- Global tax cuts: The shares are rising on the news that China, following the leader of the United States, will stimulate their economy and stabilize growth with massive tax cuts.

- Brexit Vote Day: Brokers are preparing for the vote to have a huge impact on the markets and are limiting leverage to reduce the impending volatility.

- Ethereum update: The network will endure a bad ugly tonight, at this time Thursday we will have a faster, cheaper and 33% less inflated Ethereum.

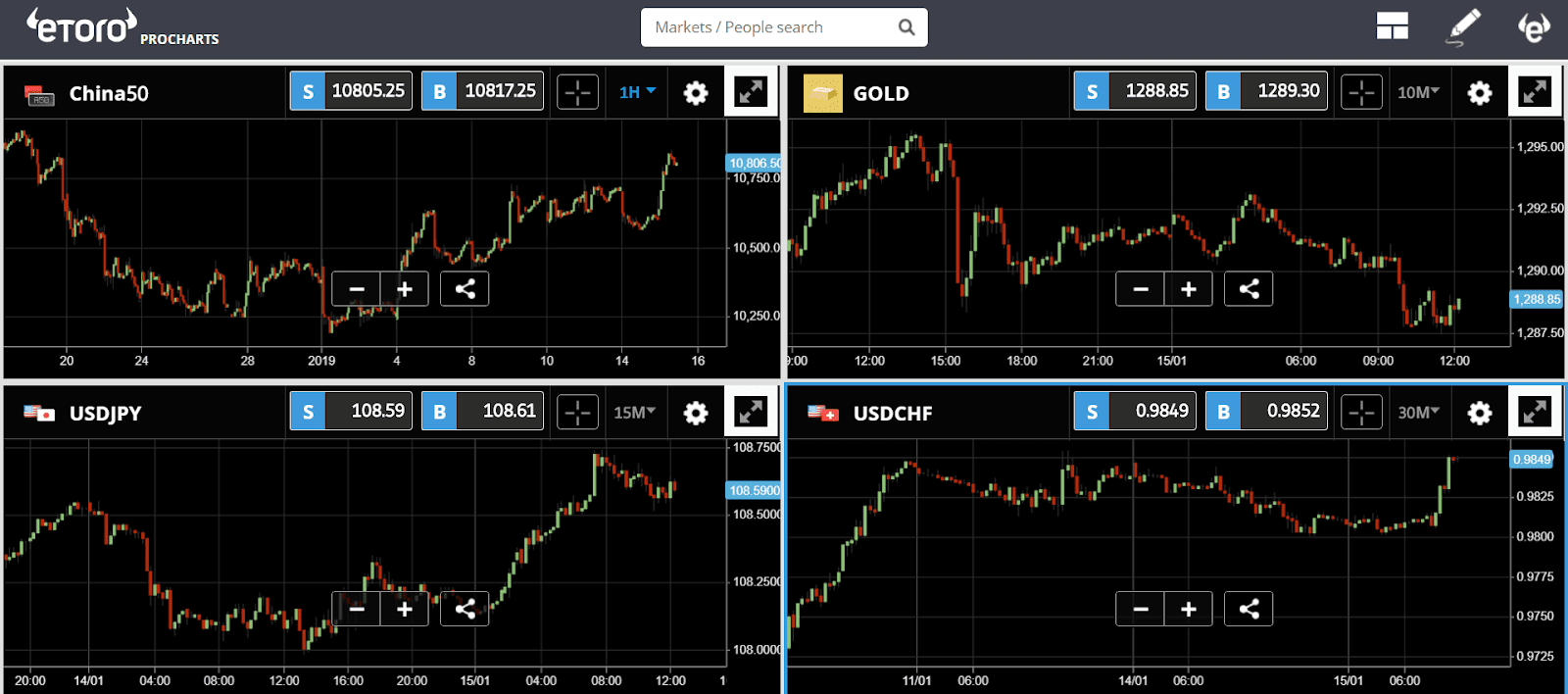

Traditional markets

The actions are underway today on the news that China will follow Trump's footsteps and stimulate their economy with massive tax cuts.

With the contraction of economic conditions all over the world, one of the few solutions left for many countries to encourage spending is to cut taxes.

Obviously, the long-term effect of this type of action is usually to increase the national deficit as the major world economies sink further into an incredible debt. But this does not necessarily have to be a problem as long as they continue to make their payments on the debt.

The rally seems to hold in the European session and also safe havens such as gold, Swiss francs and the yen are coming back.

Today is the 25th day of the partial closure of the US government with no end in sight. We will also hear Mario Draghi at 16:00 in France. We are hoping for some strong reports on the profits of the financial sector today and tomorrow.

Brexit rating

Bigger than all this, however, at least in the United Kingdom, is the critical vote on Theresa May's Brexit plan, which should take place around 19:00 London time.

The consensus seems to be that the vote will not hold up and some even predict the worst disturbance of a prime minister in British history, which seems a little exaggerated.

Because of the potential impact on the markets, many brokers have limited the maximum leverage allowed in the event on all UK equities and major currency pairs.

But something tells me that it may not be as big as people are preparing for. Firstly, the fact that brokers restrict leverage by itself should reduce volatility. Secondly, if the ad is already set to upset, there should not be much surprise for the markets. You never know though.

Update time for ETH

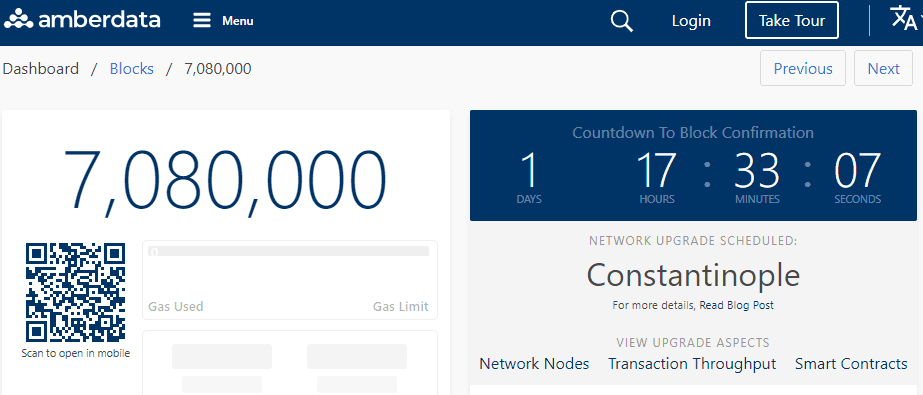

At block n. 7080000, which is expected to happen tomorrow night, the Ethereum network will suffer a severe heel.

The hard forks might seem difficult to understand because we are so used to centralized computing, but in a decentralized world, the only way to make an important update is to fork.

For example, when Microsoft wants to upgrade from Windows 9 to Windows 10, it has its development team writing the code, so users are updating one at a time in their time. In decentralized computer science, the entire network must be updated together.

A hard fork is like a copy-paste action, where a new blockchain is born and if all goes well, the old man dies.

Sometimes, when there is a disagreement between the community on the upgrade, some members will choose to keep the old version of the blockchain alive and see a rift. The most famous case was when Bitcoin Cash separated from Bitcoin on August 1, 2017 and Ethereum was split with Ethereum Classic in 2016.

However, the updating of Constantinople has already received widespread support from the whole community and so we hope everything goes smoothly. It is important to note that there is no action required by end users.

On Thursday, we should have a new Ethereum, which is faster, cheaper and has 33% less inflation.

This content is provided for informational and educational purposes only and should not be considered as an investment advice or recommendation.

Past performance is not indicative of future results. All trading involves risks; only venture capital you are willing to lose.

The presented perspective is a personal opinion of the analyst and does not represent an official position of eToro.

Please note that CFDs are complex instruments and present a high risk of losing money quickly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this supplier. You should consider if you understand how CFDs work and if you can afford to take the high risk of losing your money.

Cryptocurrencies can fluctuate widely in prices and are not appropriate for all investors. Cryptocurrency trading is not controlled by any regulatory framework of the EU.