[ad_1]

[ad_1]

Bitcoin, Ethereum and TRON are posting small gains in midweek trading, while the TRON Foundation is preparing for the August 31 launch of the TRON Virtual Machine

The cryptocurrency market has shown some signs of recovery this week, with Bitcoin to drive the way. However, we have also seen assets such as TRON making steady gains, in the wake of a major event taking place this week. So with the renewed optimism of the market that has been witnessed this week, what are the prospects for cryptocurrencies when we reach the mid-point in the last week of August?

BTC / USD

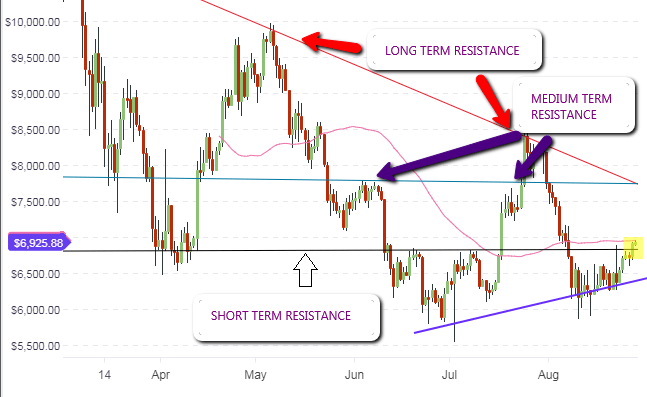

The outlook on the long-term weekly chart for BTC / USD remains unchanged. Bitcoin continues its gradual rally from the $ 5,700 long-term support and is gradually approaching the $ 7,000 mark. Currently, BTC / USD is testing short-term resistance at $ 6,800. This level has been violated intraday, but with the daily candle still active, it is still too early to know if this level has been broken.

The daily chart captures the image more clearly. We see that BTC / USD has three key resistance levels that will come into play in the coming days. First, we see the short-term resistance that is currently being tested. Next, we see a medium-term resistance at the value of $ 7,800, and we also see the downward resistance of the long-term trend line that is very visible on the weekly chart, which served to further limit the uptrend of Bitcoin.

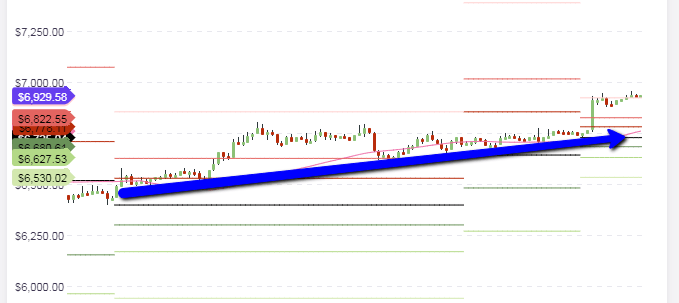

If the daily candle closes with upward penetration of 3%, the break in short-term resistance would be confirmed, paving the way for a further advantage of medium-term resistance at $ 7,800. [19659003] Turning to the intraday time table, we see that the price of Bitcoin pushed upward at the start of the day to break the support pivots R1 and R2. We see a price action that currently flirts with the R3 resistance at $ 6,929.

The intraday bias for BTC / USD is bullish. So we could see prices slightly withdraw from R3 to probably make a further rebound on R2, or we could see R3 completely broken while trading activity for the day evolves. Intra-day trading will therefore be based on the trading of pivot points, with a bullish bias.

– – Outlook for BTC / USD

- Long term: bearish

- Middle term: neutral

- Short term: bullish

ETH / USD

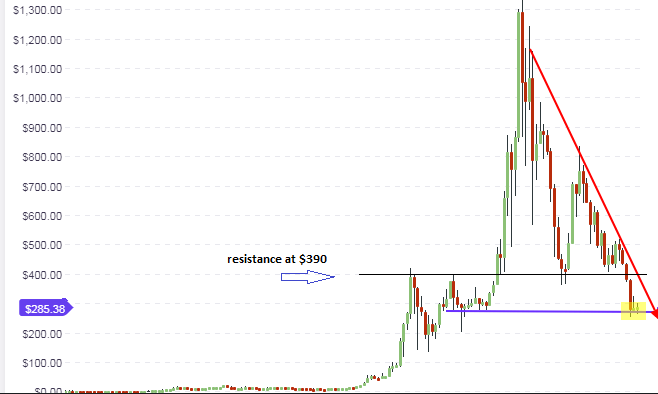

The weekly chart for ETH / USD it shows that the weekly bar / candle seems to have found support for the horizontal support line identified at $ 280. The new open candlestick / bar is also trending upwards, which confirms that the level of price of $ 280 is now a long-term established support line.

The way is now open for ETH / USD to start pushing up towards the next resistance area, which is the price level of the previous support that was finally broken at the beginning of August . It is therefore expected that the price action will verify this price area.

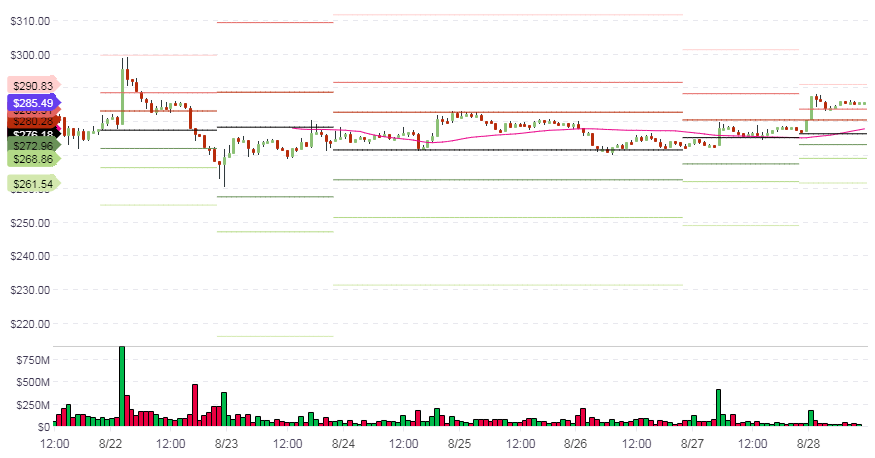

The intraday chart reveals that price action had broken the R2 level upwards but was unable to exceed the R3 level. The price returned to the R2 level and found intraday support there. I predict that price action will lead to another push at the R3 level to $ 290.83 from the current R2 levels. This should be the intraday game for today regarding ETH / USD.

– Market sentiment:

- Long-term – bearish

- Medium-term – neutral [19659014] Short-term – bullish

TRX / USD

Today the focus is shifted to the TRON, which is listed as TRX / USD. Good things have happened for this cryptocurrency. Recently, the CEO announced a partnership with the CoinPayments platform that will see TRX being used as an alternative payment method for the 22 million customers on that site. On August 31st it will also see another important event for the company, while launching the Tron Virtual Machine (TVM). The news was generally positive for TRX / USD.

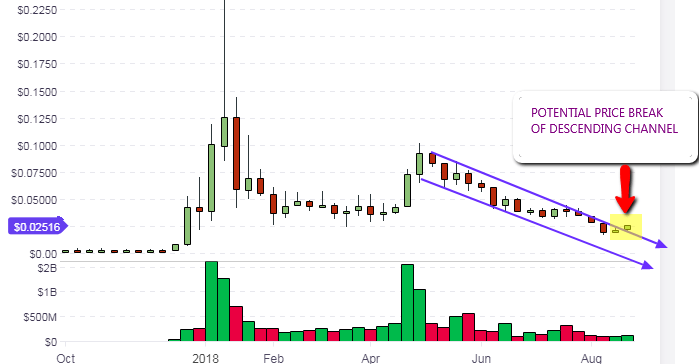

On the weekly chart, we see TRX / USD starting to break above the top channel line. This represents an important change in the long-term prospects for this currency. If the weekly candle closes above the upper channel line with a penetration of at least 3%, then the long-term upside reversal would be confirmed.

The daily chart reveals the presence of a downtrend channel, with the price starting to push towards the upper line of the channel. Price action will encounter some key areas of resistance. These are the upper line of the channel, as well as the medium-term resistance to just under $ 0.03. Beyond this point, we also see a medium-term resistance slightly above the value of $ 0.04. The price action must exceed the horizontal resistance of $ 0.03 before it attempts to hit the top line of the channel.

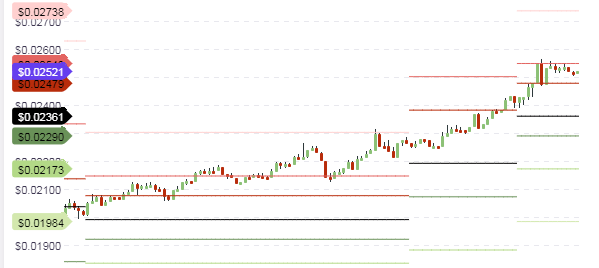

Intraday, we see that price action has continued in the strong upward trend that it has maintained throughout the week. Today TRX / USD has found resistance in the R2 support line. With the bullish day tilt, price action can be expected to retreat to R1 before making another upside toward R2. However, a break in resistance R2 will see prices push towards the R3 level close to $ 0.026.

– Prospects for TRX / USD

- Long-term: neutral

- Medium-term: neutral to bullish [19659014] Short-term: bullish

Disclaimer: the information contained in this document is provided without consider personal circumstances, therefore they should not be interpreted as financial advice, investment or offer recommendation or solicitation of cryptocurrency transactions. [19659036] (function (d, s, id) {

var js, fjs = d.getElementsByTagName (s) [0];

if (d.getElementById (id)) returns;

js = d.createElement (s); js.id = id;

js.src = & # 39; https: //connect.facebook.net/en_US/sdk.js#xfbml=1&version=v2.12&appId=345747552250368&autoLogAppEvents=1' ;;

fjs.parentNode.insertBefore (js, fjs);

} (document, & # 39; script & # 39 ;, & # 39; facebook-jssdk & # 39;));

[ad_2]Source link