[ad_1]

[ad_1]

- PayPal’s support for Bitcoin and other cryptocurrencies shoots the price to $ 13,200.

- Ethereum focused on gaining ground over $ 400 despite steam leak; $ 390 is provided as short-term support.

- The social volume of XRP also decreases after Ripple announced a possible move from the United States.

The bulls are finally returning to the market and regaining full price control across the board. According to data from CoinMarketCap, a whopping $ 22 billion entered the market amid Bitcoin’s fetching over $ 13,000.

Selected digital assets followed in the footsteps of the flagship cryptocurrency, adding credit to the bullish cycle. For example, Ethereum touched $ 0.26 while Ripple closed at $ 0.26, as explained earlier. Litecoin is among the best daily performers, earning over 12% earnings.

Bitcoin takes a break, aiming for $ 14,000

Bitcoin rallied above $ 13,000 for the first time in 2020. A broader look at the 4-hour chart shows that the flagship cryptocurrency has been in a long-term bullish cycle since the March crash. However, the ups and downs were an integral part of the price action, which is reminiscent of most bullish trends.

Meanwhile, BTC / USD is trading at $ 12,800 after a drop from $ 13,230. The Relative Strength Index (RSI) is in the overbought region, accentuating the influence buyers have on the price. BTC is trading above the selected moving averages, including 200 SMA, 100 SMA and 50 SMA.

BTC / USD 4-hour chart

(51)-637389518755875009.png)

InToTheBlock’s IOMAP model reveals the absence of substantial barriers that could hinder growth above $ 13,000 in the near term. However, for earnings of $ 14,000, seller congestion between $ 13,170 and $ 13,556 must be overcome.

On the downside, the model shows that failure below $ 12,000 is unlikely. On the other hand, the most robust support lies between $ 11,258 and $ 11,644. Here, around 2.24 million addresses have previously bought around 1.1 million BTC.

-637389519309202371.png)

Bitcoin’s rally above $ 13,000 is attributed to the news that PayPal now allows users to buy and sell Bitcoin and other digital assets via their accounts. The service will begin with a partial implementation in the United States.

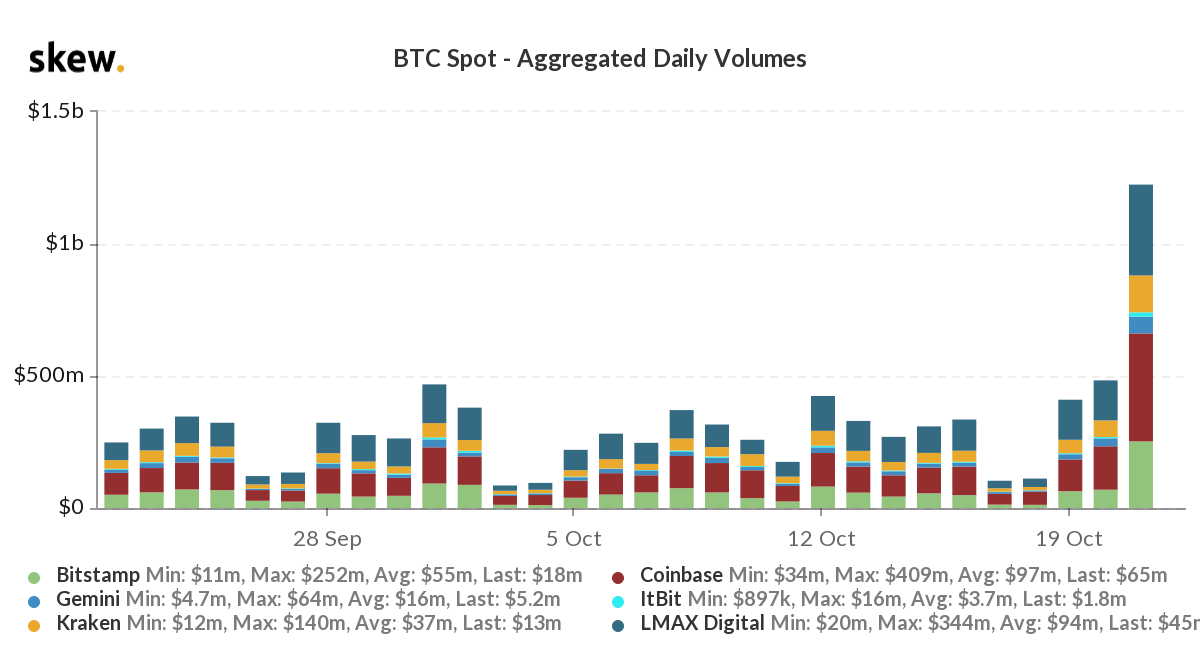

In addition to price action, activity within the Bitcoin network has also increased significantly, as Skew data suggests. Aggregate daily volumes of bitcoin increased in exchanges with Coinbase leading, LMAX Digital following closely and Kraken in third place.

Bitcoin spot: aggregate chart of the daily volume

Ethereum retests $ 400 again

The smart contract token capitalized on Bitcoin’s price action, even surpassing the crucial $ 400. The lack of sufficient volume failed to sustain gains above the critical level, allowing ETH to slide to $ 390. For now, ETH / USD is trading at $ 395 as buyers focus on raising the price.

Ethereum’s bullish outlook is reinforced by the Moving Average Convergence Divergence (MACD) stock above the midline. A vivid bullish divergence uncovers growing buyer influence. Trading above $ 400 could encourage more participants to buy ETH for fear of losing (FOMO).

Ethereum-hour chart

- 2020-10-22T112912.721-637389521658763523.png)

In the past few days, Ether-related mentions have increased across multiple social media channels. The rise shows that Ethereum is becoming attractive to investors looking to capitalize on immediate gains.

Similarly, the volume of transactions performed on the network has also increased in conjunction with the volume of social media. Whenever these two metrics peak at the same time, significant upside price action occurs.

Ethereum volume / social volume chart

VOlume chart-637389521940188310.png)

On the other hand, traders need to keep an eye on the same metrics because retracements usually follow peaks. The decline in network volume and social volume will negatively impact the price, indicating a potential correction.

Ripple is fighting relentlessly for the breakout of $ 0.3

Cross-border cryptocurrency continues to capitalize on recently established support areas. After bouncing off the anchor at $ 0.24, Ripple moved forward and turned the 200 SMA, 50 SMA and 100 SMA into support levels. The bullish action gained momentum towards $ 0.26, but XRP falters at $ 0.256.

Despite the stall, the RSI underlines the position of the bulls in the market as it crosses the overbought region. If speculation within the XRP community, mostly referred to as the XRP army, continues, the volume is likely to increase, giving the token a huge boost to $ 0.3.

XRP / USD 4-hour chart

-637389522985763138.png)

The bullish price action from $ 0.24 managed to spike in social volume, as shown by data provided by Santiment. Unfortunately, a retreat is underway from the peak of 43 on October 17 to the prevailing 19. If mentions on social media platforms continue to decline, the bullish outlook is likely to be invalidated.

Ripple social volume graph

[11.32.17, 22 Oct, 2020]-637389523464110637.png)

Daily takeaway

Bitcoin extends price action above $ 13,000 for the first time in 2020. Data on the chain shows increased activity within the network after PayPal announced support for buying and selling BTC. On the other hand, losses are unlikely below $ 12,000, but BTC could resume the uptrend.

Ethereum’s bullish action has stopped at $ 400, while $ 390 serves as initial critical support. A spike in network transaction volume and social volume suggests that the bullish trend will continue to gain ground.

On the other hand, Ripple must break through the barrier at $ 0.26 to open the door to gains aiming at $ 0.3. However, a drop in social media mentions highlights a potential reversal. Fortunately, there are a myriad of support areas to cushion the token from a massive fall.

.[ad_2]Source link