[ad_1]

[ad_1]

Theoretically, cryptocurrencies like Bitcoin or Bitcoin Cash, for example, are meant to be decentralized in line with the dictates of the blockchain. But, apparently, this was not the case.

Decentralization in crypto is a myth. It is a more centralized system of North Korea: the miners are centralized, the exchanges are centralized, the developers are centralized dictators (Buterin is "dictator for life") and the Gini bitcoin inequality coefficient is worse than North Korea

– Nouriel Roubini (@Nouriel) 8 October 2018

A New York professor Nouriel Roubini is of the opinion that encrypted investors are on a big run and that decentralization is a myth. He gave the example of Vitalik who he says is a "developer dictator for life", and exchanges, multi-billion dollar mining companies that offer services but operate ironically under centralization.

Undeniably, ASIC mining and blockchain figures such as Vitalik, Roger Ver and Dan Larimer, for example, are minds and agitators in space. Positive comments from Ripple CEO Brad Garlinghouse or Jed MacCaleb may shift prices. However, there is a big problem that has been exacerbated by this bear market. And it influences the most precious currency in the world: Bitcoin.

Geographical centralization

In a recent Diar report, the research company found that Bitcoin's mining revenue is increasing. The miners in the first half of the year saw an increase in revenues of $ 4.7 billion from commissions and Bitcoin premiums alone. While this is positive, profitability has been a success. In addition to profitability, other miners joined the fray pushing the mining difficulties to the limit. At the same time, electricity costs have not decreased for the majority of miners, with the exception of those in China. And it is from here that Bitmain operates. The company has 11 mining plants with over 200,000 mining units. Assuming that these miners are S9 and distributed independently to extract BTC, this represents six percent of the network hash rates.

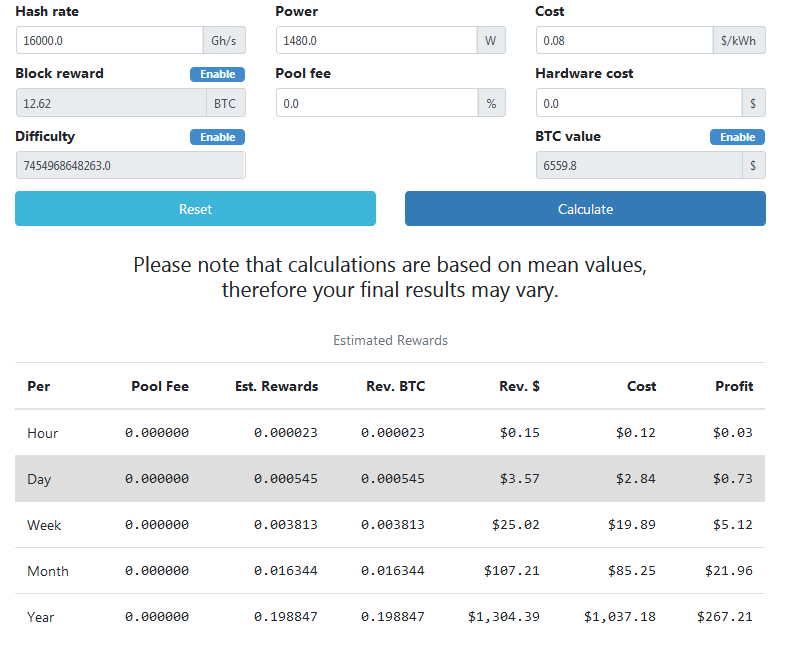

Demonstratively, according to the report, there is an element of geographic centralization with the cost of electricity that acts as the main determinant. In China, dealers pay only $ 0.08 per KWH and estimates reduce it for wholesalers. However, in other jurisdictions, electricity costs range from $ 0.1 to $ 0.12 per KWH, putting them at a disadvantage.

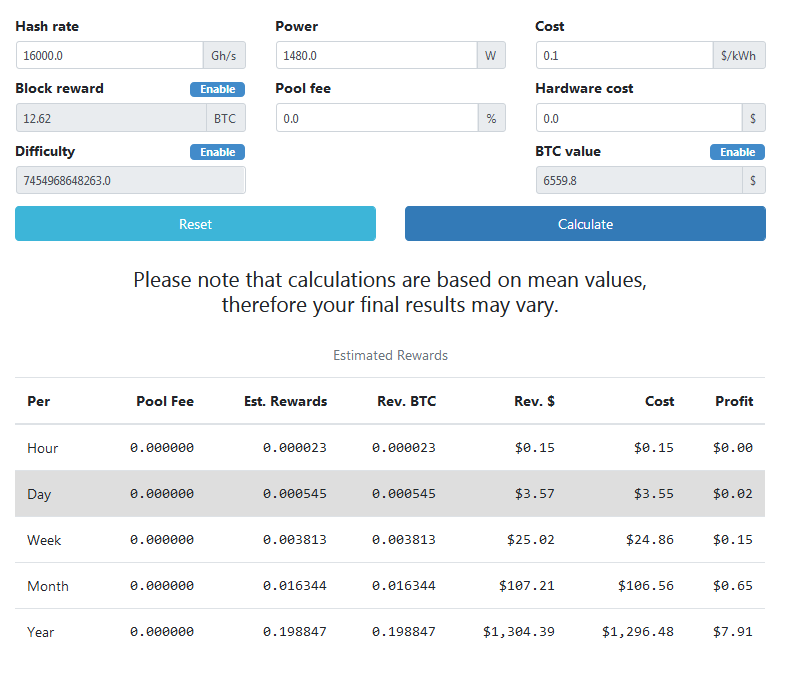

When we exclude pool and hardware costs and mine with Dragonmint 16T, profitability per year is $ 7.91 when the cost of electricity is a playground of 0.10 per KWH.

But, in China, where the cost of power is $ 0.08 KWH, profitability is 30 times as the data show:

Bitmain Muscling

Apparently, centralization is not just at the level of jurisdiction. Bitmain, the chip set producer, performs the mining show. Even when preparing for an IPO, the company whose profitability comes more from the sale of mining equipment has had to deal with centralization charges. Even if it will not serve their interests to launch a 51% attack on the Bitcoin Network critics, I think Bitmain can actually cause a double expense.

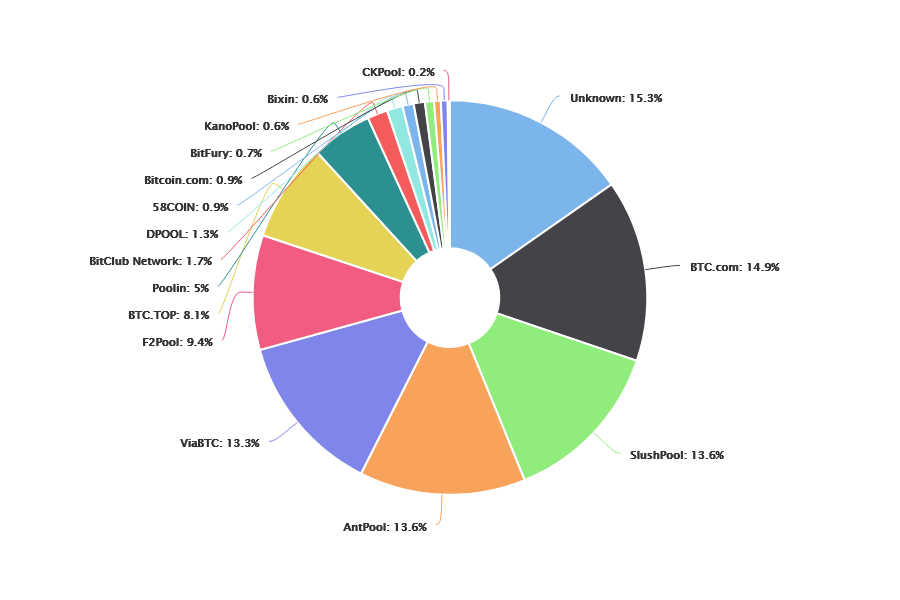

From Bitcoin.com, it is clear that Bitmain is dominant. Bitmain is behind Antpool, BTC.com and has investments in ViaBTC.

Begins to pay attention to the ASIC mining chips and in particular to the Bitmain producer. Bitmain controls ~ 39% of the Bitcoin hash rate from ~ 33% in the last year. This centralization of mining in China goes against the fundamental value of decentralized blockchain. #FairMining #Vertcoin pic.twitter.com/INjq2tRzf8

– Vertbase (@vertbase) March 28, 2018

Check for 42 percent of the total hash rate. Others speculate that it could be more, but there are no official documents to support this claim.

[ad_2]Source link