[ad_1]

[ad_1]

Bitcoin has shaken off the SEC's last waste of ETFs to close 4% more than the week. EOS reorganized overnight with a big $ 1 million purchase.

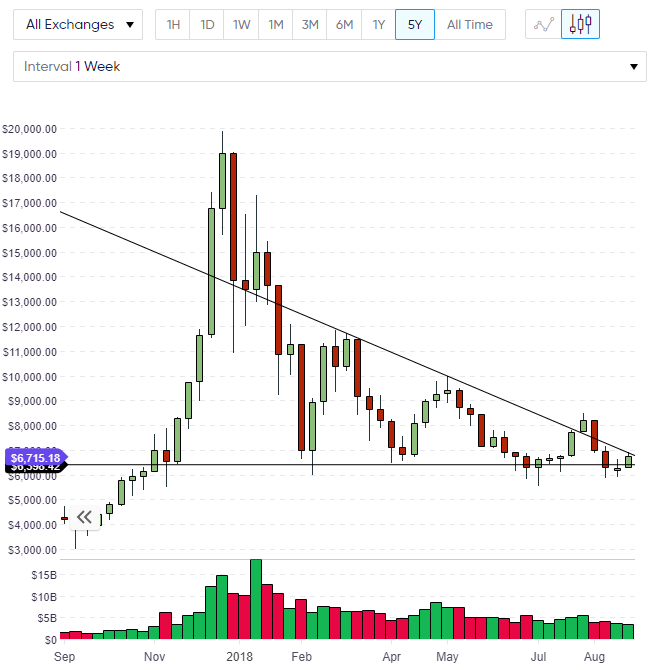

BTC

Bitcoin's price saw another positive week with a close neighbor of 4% more at the $ 6700 level. Despite the disappointing refusal by SEC of a Bitcoin ETF by of three companies, the declaration that the decision will be re-examined has probably provided some support until the matter is closed.

The SEC rules state that, in the event of a revision, they can "affirm, reverse, modify, set aside or postpone for further proceedings, in whole or in part".

Perhaps it is unlikely that they will cancel the decision because the Winklevoss ETF has undergone a one-year review process, but it is possible that the SEC is buying time to see how Bitcoin and its peers will perform. in the next months. They made their concerns about manipulation, etc. Very clear to the suppliers, so there is the opportunity to make some changes and convince the SEC that it is the right time for a listed Bitcoin retail product.

Bitcoin is once again outperforming some of its rival coins and the closing at $ 6,700 provides further gains with the $ 8,500 level still the first obstacle on the road to regaining $ 10,000. I scored a key level for this week for $ 6,400. This is the monthly support level and it is critical to keep this in the week to keep the monthly chart positive. The channel line down is our first resistance for this week and a weekly closing above $ 7,000 would again create a $ 8.500 level test.

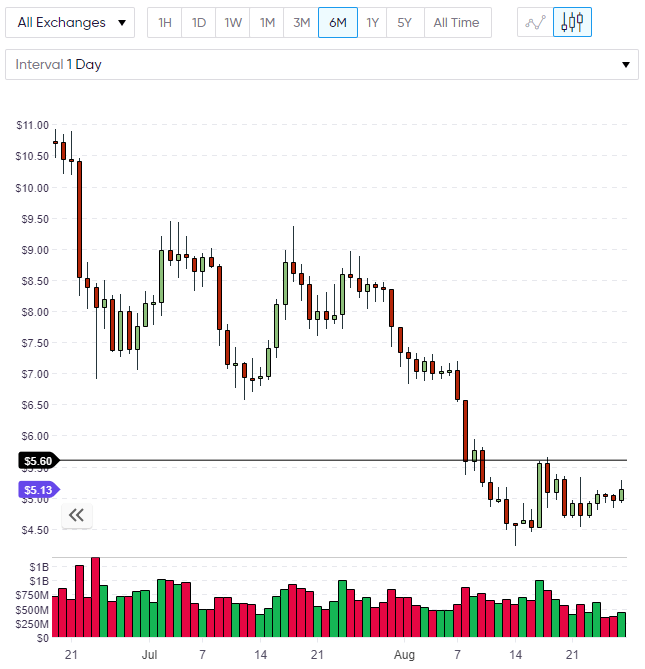

EOS

EOS is stronger on Monday after a great interest overnight in the fifth largest currency by market capitalization. The price of EOS is currently trading at $ 5.17 and an order to buy $ 1 million of EOS has been detected by traders overnight.

I noticed in a previous article that the moving average around $ 7.20 the weekly level would be the goal of an event. The resistance for this week comes to $ 5.30 and a close above would create EOS for further gains. EOS clings to the number five on the list of larger coins, however, the market capitalization is half of Bitcoin Cash and Stellar is closing with a value of only $ 500 million less, so it is important that EOS meets if it wants to keep that position.

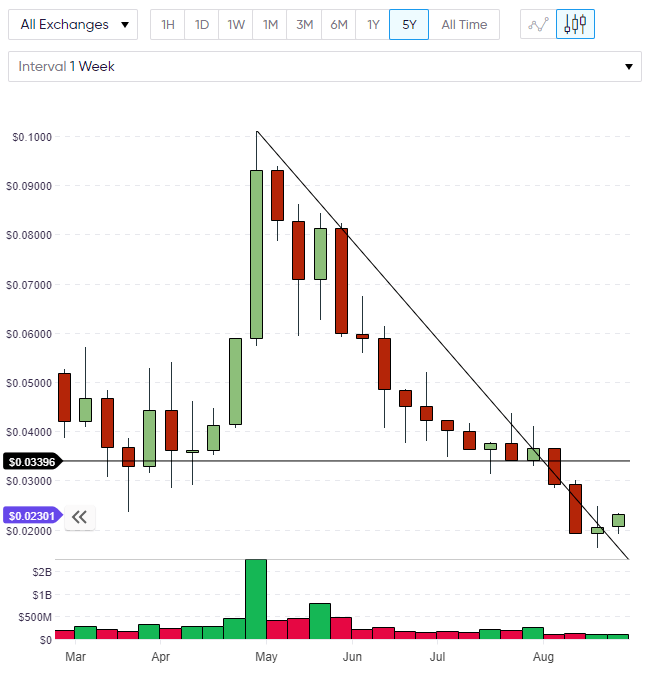

TRX

Tron is another coin that has stabilized in recent weeks. A doji bar two weeks ago was followed by a positive closing for last week and although the volume is low, it is possible that TRX can push it further. The next target for TRX is around the $ 0.0300 level and a close over the next few weeks should set TRX for a $ 0.400 level test. There is little resistance above $ 0.400 and it is very likely that the decline is over for Tron.

Tron's founder, Justin Sun, recently brought to Twitter to share the news that TRX has now extended its coverage to 2.2 million businesses with the integration of CoinPayments. CoinPayments is a payment gateway for the use of cryptocurrencies and offers plug-ins for e-commerce carts such as Shopify.

Tron also saw a surge in use through a new platform that allows TRX transactions via Twitter and Telegram. Over 11.6 million TRX have changed hands through the Seedit platform. I noted in previous articles that Justin Sun had also commented on a meeting between the executives of Twitter and Tron so it could be linked to Seedit, which is a peer-to-peer loan platform, and developments like these suggest the type of mass adoption that it could occur with a coin like Tron. Online retailers may offer payment options in multiple currencies and consumers could take advantage of market fluctuations to look for cheaper products, giving them more power over their money.

Since platforms such as Seedit would also allow the option of siding with traditional lenders and the high commissions of lenders, then you will begin to understand why traditional financiers, such as Jamie Dimon of JP Morgan, hate the criptovalute.

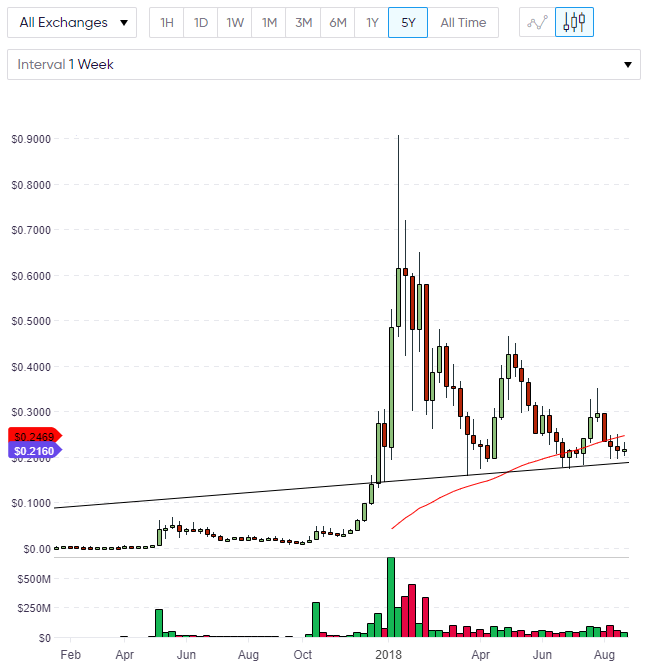

XLM

Lumens' price was quite weak last week and is worrying under the moving average 50. We are still keeping the uptrend line for the 39; year and we could test it, but the price must shake off the bearish tone and put in a rally if it comes to mounting a challenge for the five-place number held by EOS.

The first resistance for XLM is the moving average at $ 0.25, support is at the trendline just below $ 0.200. That level provided three rallies this year, so if we see buyers emerge, it may be the last time we trade this low to medium term.

Disclaimer: the information contained in this document is provided without considering personal circumstances, therefore it should not be interpreted as financial advice, investment recommendation or offer or solicitation for cryptocurrency transactions.

[ad_2]Source link