[ad_1]

[ad_1]

- General market conditions did not show any significant momentum in Tuesday’s market session as Bitcoin appears to be holding above the $ 15200 support level and Ether is looking to have a positive and sustainable breakout above $ 450.00

- Global cryptocurrency market cap reached $ 441.02 billion, resulting in a -0.66% drop on the day

- Total volume traded in the cryptocurrency market over the past 24 hours is $ 122.31 billion, an increase of 20.62% over the day

- The dominance of the cryptocurrency king falls by -0.22% over the day and is currently at 64.18%

General market conditions that provide mixed feelings

Bitcoin’s price levels have developed a support point at $ 15200.00 over the past two days as it was able to avoid plummeting below the level. On the other hand, Ethereum was unable to maintain stability above the crucial $ 450.00 mark. The altcoins moved sideways during Tuesday’s market session as coins like Chainlink, Cardano, Tezos, etc. They performed positively, while coins like EOS, Bitcoin SV, Binance coin performed negatively.

Bitcoin price predictions

The Bitcoin intraday chart highlights the attempted price levels of another attempt to reestablish the resistance point of $ 15800.00. BTC again faced negative reversals from the resistance point which led to a negative breakout below the crucial $ 15,000 mark. However, price levels quickly boosted the buying volume and climbed above the mark. Currently, the price levels are building a support point around $ 15200.00. The CMP is positioned at $ 15388.49 with an overall gain of 0.49% which brings the market cap to $ 285,277,413,479 and the 24-hour trading volume at $ 34,988,390,946.

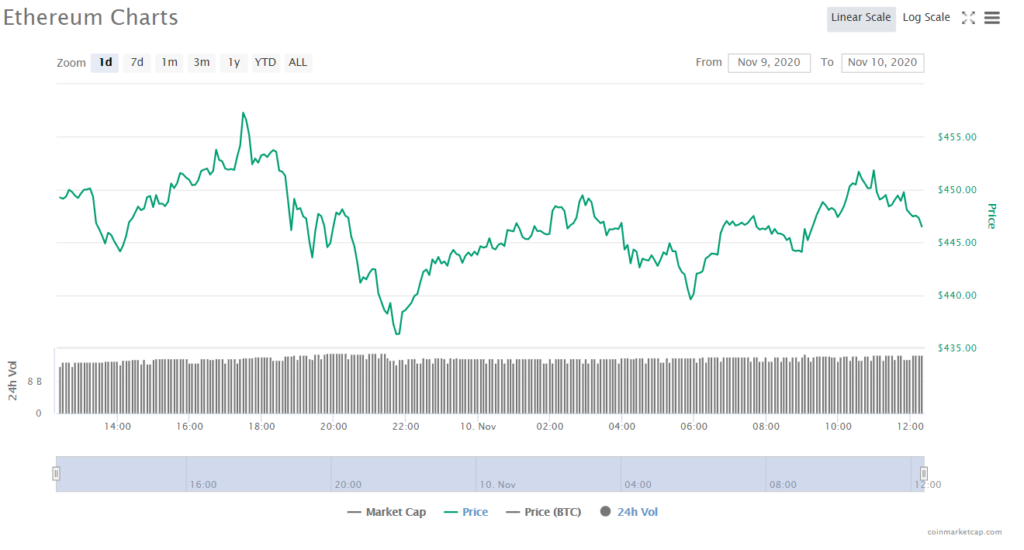

Ethereum price predictions

Ethereum is looking to have a positive and sustainable breakout above the crucial $ 450.00 mark in Tuesday’s market session. The ETH / BTC pair also performed positively with an overall gain of 0.87%, taking the current level to 0.02934469 BTC. Current levels face major resistance at $ 470.00, with minor support points at $ 430.00. The CMP is positioned at $ 452.59 with a market cap of $ 51,308,408,592 with the 24-hour trading volume of $ 14,415,715,193. A sustainable price move above the crucial $ 450.00 mark will help the crypto asset retest the aforementioned resistance point.

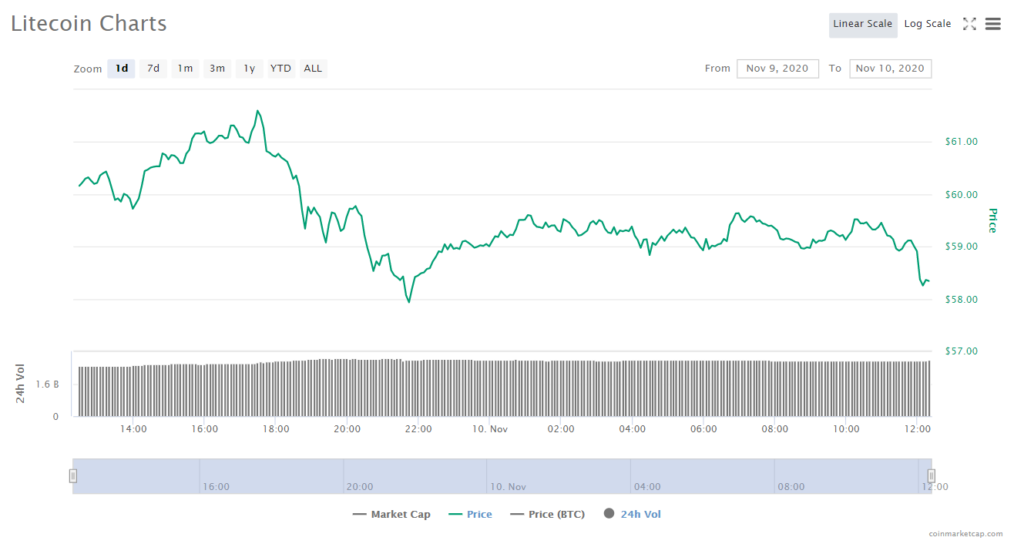

Litecoin price predictions

Litecoin’s price levels were unable to hold above the crucial $ 60.00 mark, resulting in a drop. Current price levels are below the mark and trading is negative with a marginal loss of -0.86%. The CMP is trading at $ 59.39, with a market capitalization of $ 3,911,153,389 and 24-hour trading volume of $ 2,745,986,607. The negative performance of the LTC / BTC pair could create significant concerns about price levels as it suffered a loss of -1.635, taking the current level to 0.00385124 BTC.

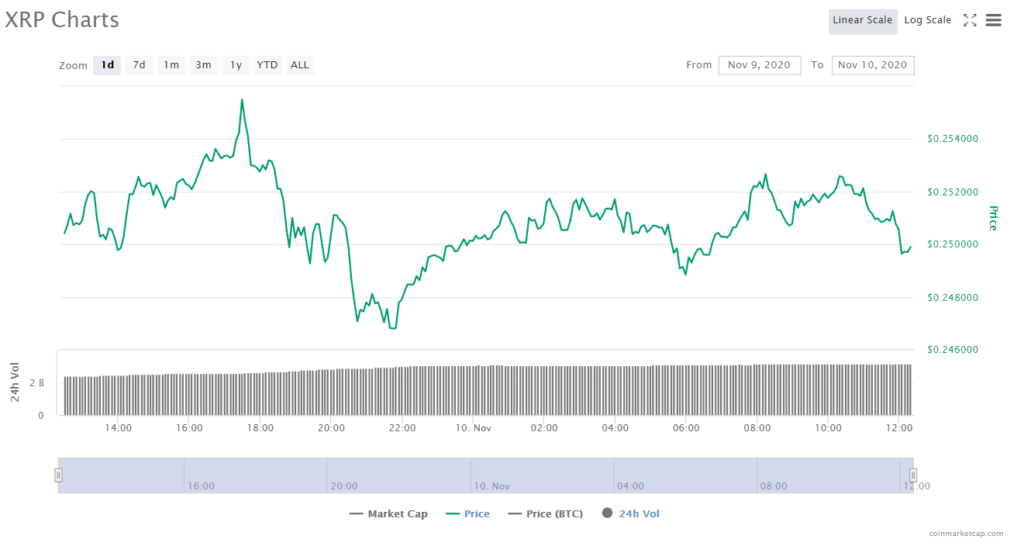

Ripple price predictions

Ripple was able to revive its positive momentum and currently holds the $ 0.260 resistance level with the CMP of $ 0.259898, making an overall gain of 4.15%. The positive rebound may be the result of Ripple’s $ 46 million repurchase of XRP in Q3 2020. The XRP / BTC pair also performed significantly positively with an overall gain of 3.09%, leading the current level at 0.0001688 BTC. The market cap is $ 11,775,278,937 with the 24-hour volume trading at $ 3,495,559,647. If the levels can sustain a sustained break above $ 0.260, we can expect XRP to take significant price recovery action.

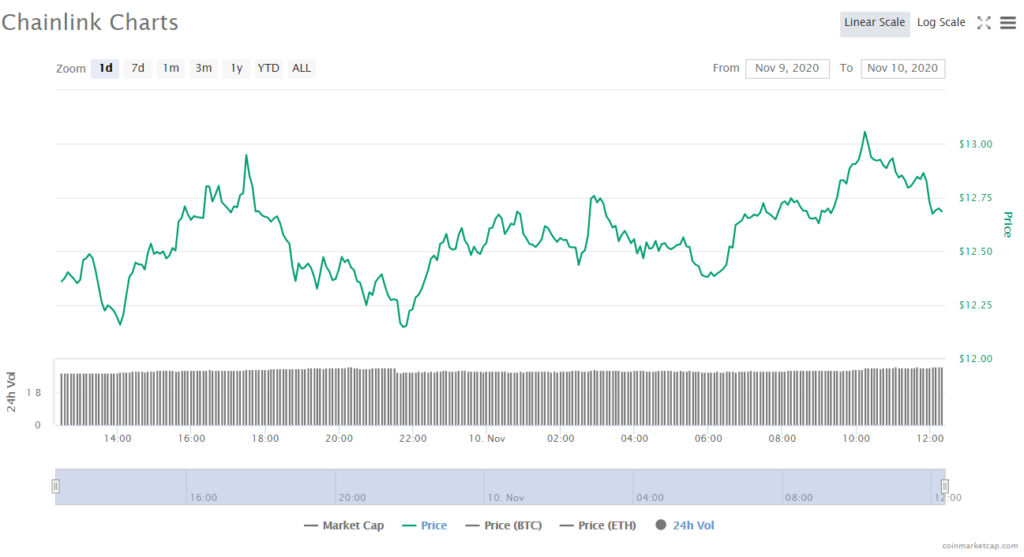

Chainlink price predictions

Chainlink managed to break out of the $ 13.00 resistance level with a significant bullish move of 6.02%. The CMP is now positioned at $ 13.14, bringing the market cap to $ 5,143,139,697 and the 24-hour trading volume to $ 1,856,692,672. The LINK / BTC and LINK / ETH pairs performed positively with an overall gain of 5.82% and 4.84%, respectively. The levels quickly returned from $ 13.40 during the previous bullish attempt and is the level to watch out for.