[ad_1]

[ad_1]

- General market conditions were finally able to revive its positive momentum with Bitcoin and Ethereum both performing positively in Sunday’s market session

- The overall market cap stands at $ 400.28 Bitcoin with a 1.00% increase over the course of the day

- The overall trading volume of the market stands at $ 79.25 Bitcoin with a drop of -5.00% over the day

- The dominance of the cryptocurrency king reached 63.58% with a 0.12% increase over the day

The bulls finally got a comeback after Crypto Assets reached their critical support levels

General market conditions are reviving its positive sentiment after facing price corrections in late October. However, BTC looks intact or it can be said that it has had no effect on the overall price correction activity in the market as the world’s largest crypto asset is targeting $ 14k this month. Ether has been one of the hardest hit digital assets during the past bearish trend as its price levels hit the main support level of $ 370.00. Other altcoins also reached their first critical support areas during the downtrend and were respectively able to revive their bull run.

Bitcoin (BTC)

Bitcoin started this month breaking above $ 14k and holding the level for a very short period of time. This indicates that the bulls will strongly aim to break out of the limit again and reach significant levels for this month. The CMP is positioned at $ 13780.97 with an overall gain of 1.47% with a market cap of $ 255,361,517,978 and 24-hour trading volume of $ 30,634,621,485. Exceeding $ 14k can result in a weakening of the $ 13800 resistance level, which is a positive sign for further price growth action.

Ethereum (ETH)

Ether is currently facing the $ 395.00 resistance level with the $ 388.50 CMP. The resistance level is not expected to be able to provide significant negative reversals to the price levels and the bulls are strongly aiming to reclaim $ 400 again. However, sustainability above $ 400 still remains doubtful for Ether as we have seen multiple failures to above the level. The market cap is $ 43,995,347,773 with the 24-hour trading volume of $ 10,988,781,745. On the other hand, if the Ether bulls are unable to break out of the resistance level, we could expect BTC to absorb its positive sentiment in the market. The ETH / BTC pair trading negative with a loss of -0.37% with the current level of 0.02821163 BTC is giving similar signals.

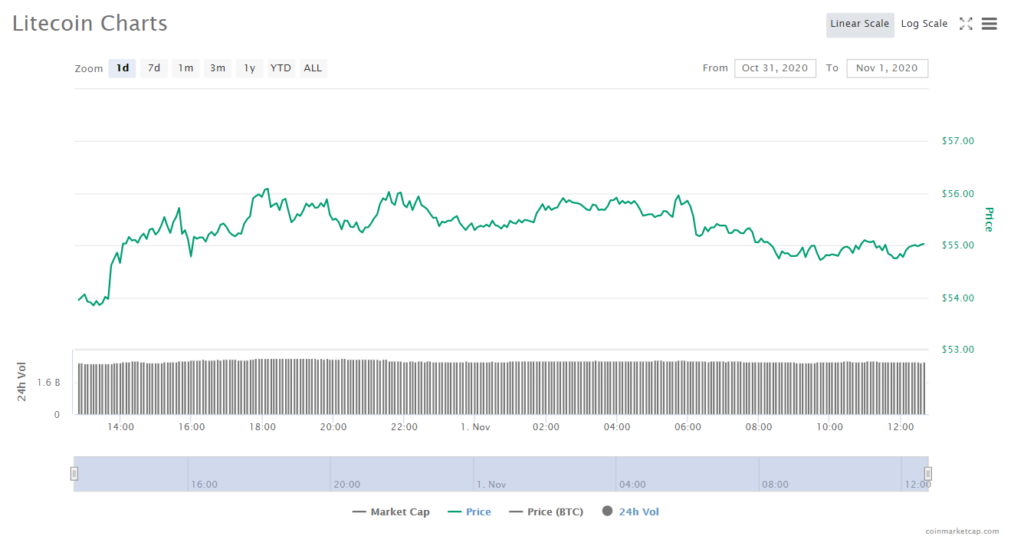

Litecoin (LTC)

Litecoin was able to avoid any drop below the crucial $ 50.00 mark during the past bearish trend, giving positive signals for its sustainability above the price. The CMP sits at $ 55.26 with an overall gain of 2.30% which brings the market cap to $ 3,635,132,290 and the 24-hour trading volume to $ 2,505,445,107. The LTC / BTC pair also turned green with a profit of 1.005 taking the current level to 0.00401581 BTC. If the digital asset is able to sustain the current positive move, it will aim to retest the $ 60.00 resistance level further in the market.

Ripple (XRP)

The positive momentum in XRP was triggered after price levels dipped below $ 0.230. The positive upside provided momentum at $ 0.240 before the resistance level of $ 0.245 kicked into action. The CMP is positioned at $ 0.238 with a marginal profit of 0.05% which brings the market cap to $ 10,821,746,552 and the 24-hour trading volume to $ 2,103,740,559. The XRP / BTC pair still behaves negatively with a loss of -1.17% taking the current level to 0.00001739 BTC. The pair’s negative performance is giving the bulls a hard time for taking price recovery action in the market.

Chain (LINK)

Chainlink managed to avoid any drop below the crucial $ 11.00 mark that could have caused significant price damage. The CMP is positioned at $ 11.21 with an overall gain of 1.15% which brings the market cap to $ 4,376,847,920 with the 24-hour trading volume of $ 1,432,163,790. The LINK / BTC pair is performing negative with a marginal loss of -0.20% bringing the current level to 0.00081553 BTC. Price sustainability above $ 11.00 can certainly provide LINK with positive momentum in the coming trading sessions.