[ad_1]

[ad_1]

So you thought the Bitcoin Cash (BCH) hashwar was over? Not so fast.

While Bitcoin and the rest of the market crashed this weekend there was one, perhaps surprising, bright spot in the rubble – Bitcoin Cash SV, the forked coin of the original BCH, which in turn is a fork of bitcoin (yes, it's getting silly).

Bitcoin Cash SV (BCHSV) is 3% above the dollar for $ 65 in the last 24 hours and 20% higher than in bitcoins. Compare this with BCH, which is down 21% over the same period to $ 163, according to coinmarketcap. BCH is now trading at its historical lows.

Calvin Ayre and Craig Wright get married

Calvin Ayre (pictured above), the multimillionaire behind the CoinGeek mining pool that lifted the SV network, seemed to have declared the end of the hashwar as EWN reported a few days ago, pulling back from the threats of lawsuits against exchanges for the assignment of the BCH ticker to the "official" BCHABC fork.

The SV field seemed to have given up the short-term goal of being "the real Bitcoin Cash", although it is maintaining the long-term goal of being "the real bitcoin".

With this in mind, CoinGeek and nChain, the startup owned by Craig Wright, formed a formal partnership on the Teranode project to bring 1 block of Terabytes to the SV chain, to provide a network throughput of seven million transactions per second. If achieved, it would be a fundamental network to get out of bed, assuming that the non-negligible technical issues can be overcome and that people start using it to buy goods and services.

The leader of nChain, Steve Shadders, said about the link:

"Teranode is my baby." The first prototype iteration of Teranode has just been born after November 15th hard fork by BCH. As we look at the Bitcoin SV in real-life action, we are studying performance barriers and building new solutions for enterprise-class Teranode. "

He added: "It's time for Bitcoin to grow and become more professional.We appreciate CoinGeek's support in this journey that makes Bitcoin usable for the world's leading companies."

Hashwar revisited

Mentioning BCH and BSV is a bit like swearing in the newly encrypted community, with the hashwar blamed for triggering the latest crash episode in the cryptopus market. But aside from the politics of the industry and the game of guilt, the SV is trying to build something useful.

And if prices are anything to go by then, market participants could take note.

In truth, hashwar was not actually won by BCHABC.

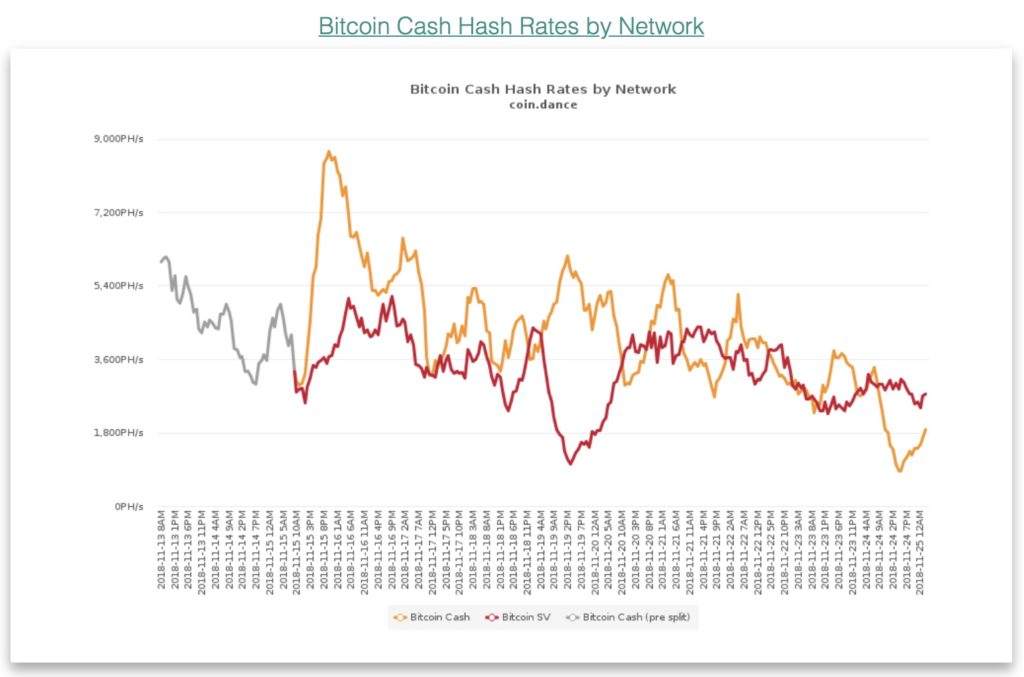

As can be seen in the table below by coin.dance, the mining pools controlled by Bitmain have emphatically won the war until 20 November. From that date, however, it was a different story.

But a healthy chain does not live or die with the hashrate alone. There are other factors such as knot density, industry support and adoption to consider.

I took all those as a whole, practically all major exchanges decided that BCHABC is the real BCH. This is quite right, but what if the price of BCHSV rises above BCH? Exchange? Probably not because it would create even more confusion than it already exists.

The Crypto equivalent of stock repurchases on the stock market

But here is a bigger question about how BCH – both versions – are valued and valued based on the losses suffered by the miners.

Both the Bitmain and CoinGeek-nChain complexes have lost money in their mining operations, totaling $ 10 million, assuming that the search for BitMEX is accurate.

According to coin.dance, mining on BCH is now more profitable than 1.1% compared to bitcoin mining. For BCHSV it is a different image. Currently it is 237% less profitable for my BCHSV than for my bitcoin. Let's put it another way: the mining losses in the SV field are growing while those of BCH are decreasing.

Of course, the mining losses of BCHSV can be offset if the price rises, as it is currently doing, although it may not last.

The biggest problem however is how miners can indirectly manipulate the price through their network activity. CoinGeek, simply by launching hashrates on the network, was able to stay in the game long enough to care for day traders, even if, to be honest, it was not necessarily the primary goal.

And of course the same could be said for the efforts of Bitmain and Roger Ver to promote and support BCH since the beginning of last year.

It is somewhat similar to what happened in the stock markets in recent years, with companies that borrowed money to buy back their shares, artificially pumping the price.

Internal encryption style

Before the BCH bulletin board it was said that SV supporters had "a lot of hidden hashras".

Hidden or not, there are broader implications for cryptography regarding the decentralization (or lack thereof) that market participants have certainly reconsidered in recent days, with a handful of wealthy individuals able to exercise centralized control.

In this unregulated space there are no rules on the trading of privileged information, but the suspicions of many, justified or not, were that some insiders would have positioned themselves to make a homicide by selling before the fork to buy back cheaper later .

A source of nChain mentioned in the comments to Ethereum World News that this may have been the case.

On the day of the fork, November 15, our source revealed:

"I sold all my crypto before a few days ago, everyone out of the war was [sic] happy to see the price of BTC and all BCH forks collapse in the short term "

If you want to learn more about CoinGeek and presumably on nChain's plans to upgrade the SV network, or just to gather some gossip, the CoinGeek conference starts in London on November 28th, which will end on November 30th. The only problem is that tickets are priced between £ 800- £ 1,500, so you may need to ask one of your billionaire mining friends to contribute to the costs.