[ad_1]

[ad_1]

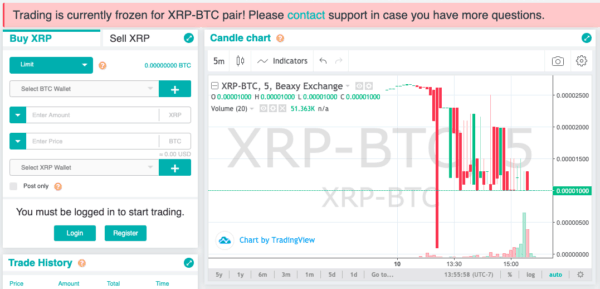

A cryptocurrency swap called Beaxy interrupted line trading on August 12th after a high volume of XRP (Ripple token) sales increased the price of tokens on the exchange:

The exchange corresponds to the suspension in a blog post, stating:

"We recently experienced unusual activities (low volume) on XRP-BTC. As a consequence and precaution, we are temporarily suspending all trading activities and withdrawals through exchange while we investigate ".

At the time of writing, the XRP negotiations are still suspended on the exchange.

On Twitter, Beaxy reported on the evening of August 12 that the incident occurred following a "XRP partial payment exploit":

The exchange also promises to return all the stolen funds and states that negotiations will remain, "frozen while we work to return to the previous state".

Some commentators in the Twitter thread accuse the exchange of not correcting an exploit identified some time ago.

Others are questioning Beaxy's claims that other exchanges were also affected:

Second The block, shortly before the launch of Beaxy about two months ago, a member of the Beaxy team was subjected to SIM swap hacking.

In a SIM exchange attack, hackers in general "phishing" (solicit by deceptive emails) personal information from a targeted individual, then use that information to convince a telecommunications company to transfer control of the victim's phone to hackers.

Once this happens, hackers can often exploit many other information and / or access many sensitive accounts.

Regarding the SIM swap hack, said Artak Hamazaspyan, CEO of Beaxy The block:

"The incident we found was a SIM attack on a team member involving a fake ID and social engineering … As a result, our individual security practices have improved throughout the company . "

According to the outlet, the new cryptocurrency platforms enter a market already populated by 258 incumbents.

Rising exchanges must also cope with a dangerous amount of hacking activity performed by both private and state-sponsored attackers.

Security companies claim that state-sponsored hackers have targeted cryptocurrency exchanges for years after having partially shifted their efforts from attacks on banks in developing countries.

An anonymous source recently said Crowdfund Insider that his bank is rejecting 300 cyber attacks a day.

[ad_2]Source link