[ad_1]

[ad_1]

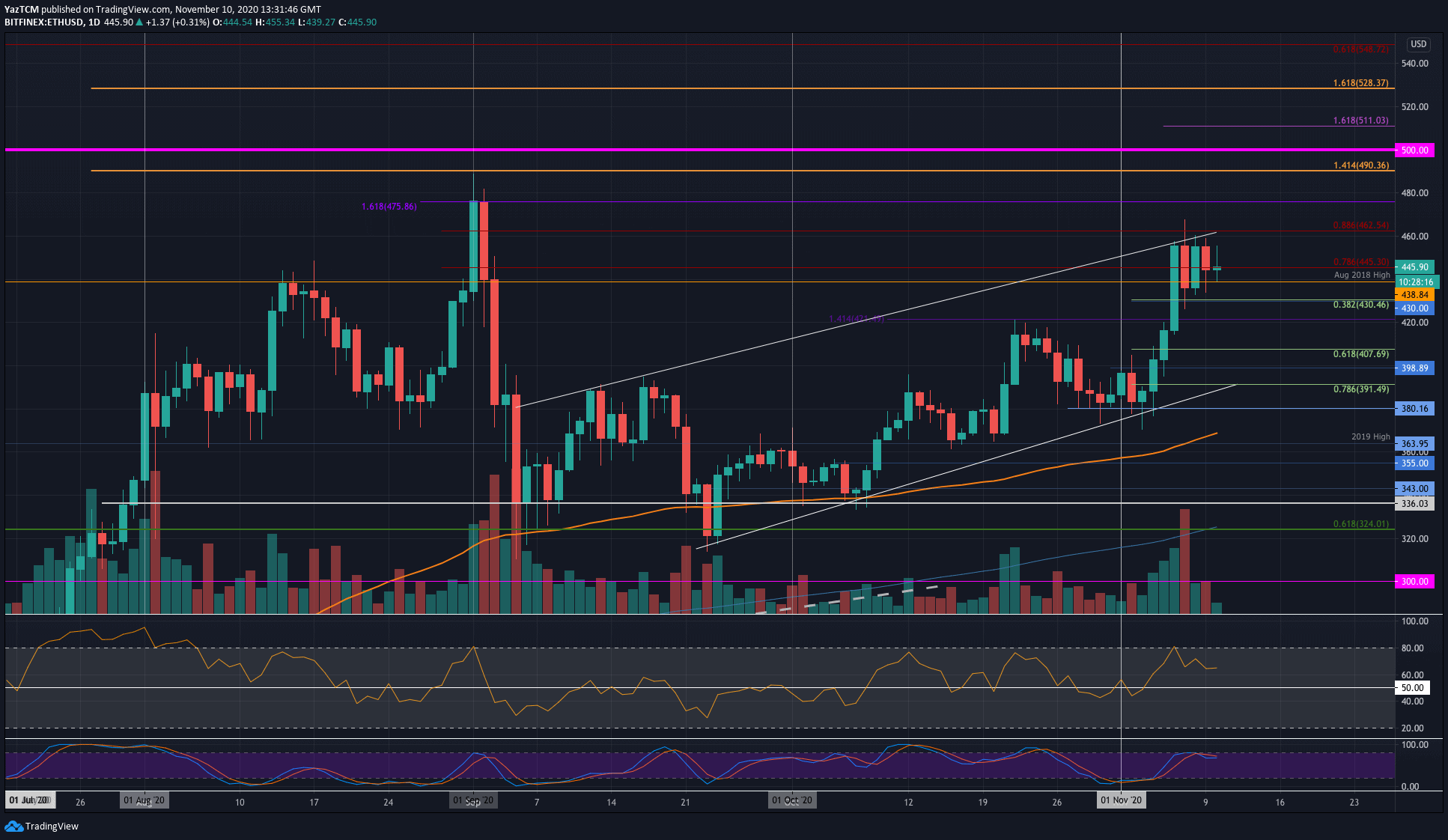

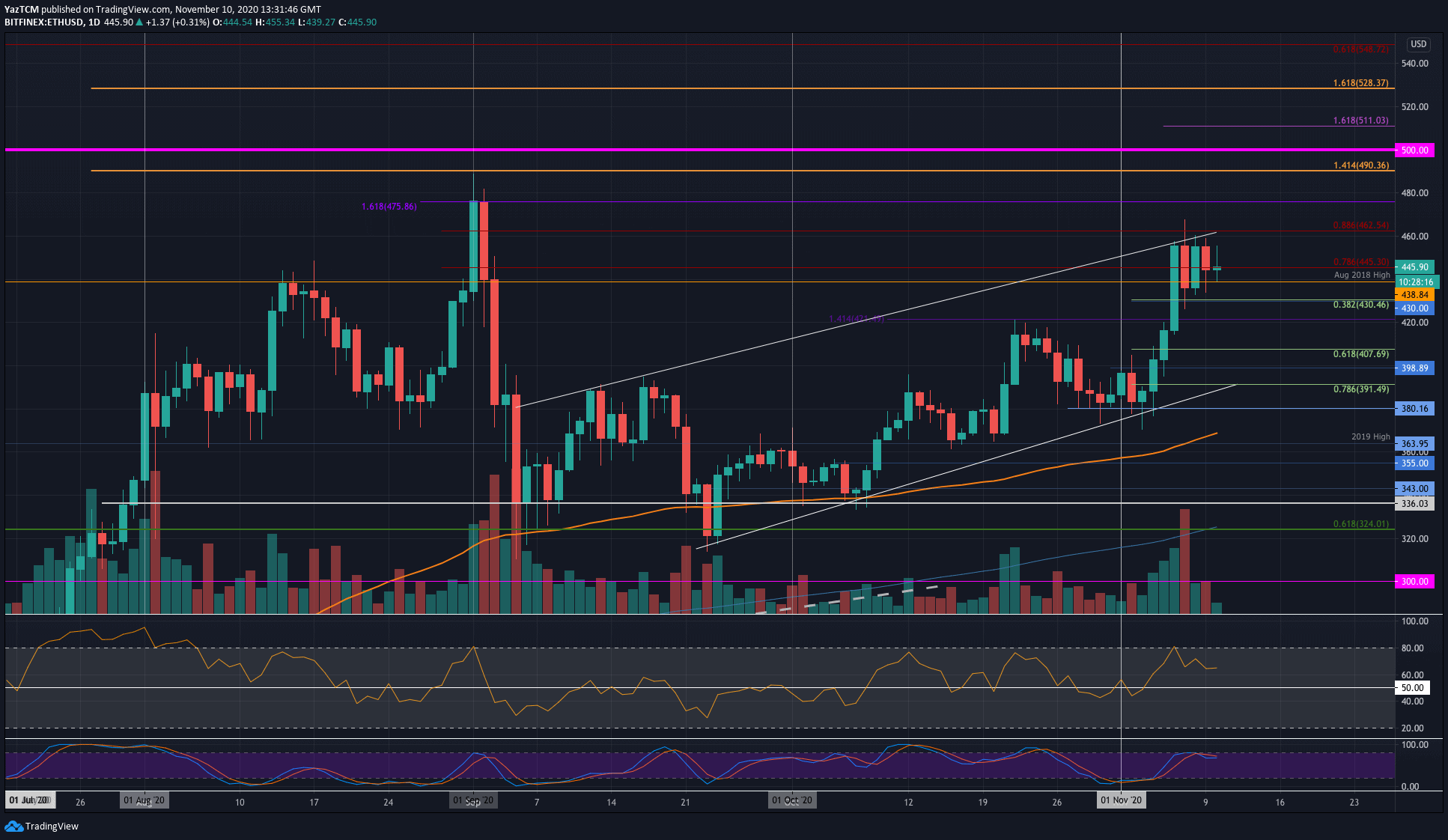

ETH / USD – Ethereum struggles to break out of the $ 456 resistance

Key Support Levels: $ 438, $ 430, $ 421.

Key Resistance Levels: $ 456, $ 462.50, $ 475

On Friday, Ethereum rose to $ 456 where it met resistance at the upper limit of a rising price channel. It failed to close a daily candle above this level as it moved sideways between $ 456 and $ 435 over the weekend.

Ethereum failed to close the daily candle above $ 456 yesterday. The coin found support today at the $ 438 level (August 2018 highs) as it continues to struggle to break out of the resistance at $ 456.

ETH-USD short term price prediction

Looking ahead, if buyers manage to break out of $ 456, the first resistance level is at $ 462 (bearish retracement .886 Fib). Thereafter, resistance is found at $ 475 (September high closing price), $ 490 (1,414 Fib Extension) and $ 500.

On the other hand, the first support level is found at $ 438 (August 2018 highs). Below that, support is found at $ 430 (.382 Fib), $ 421 and $ 407 (.618 Fib).

The Stochastic RSI is poised for a bearish crossover signal that may suggest that buyers may not be able to break out of the $ 456 resistance. Despite this, the RSI remains above the midline to indicate that the bulls are still in control. market momentum.

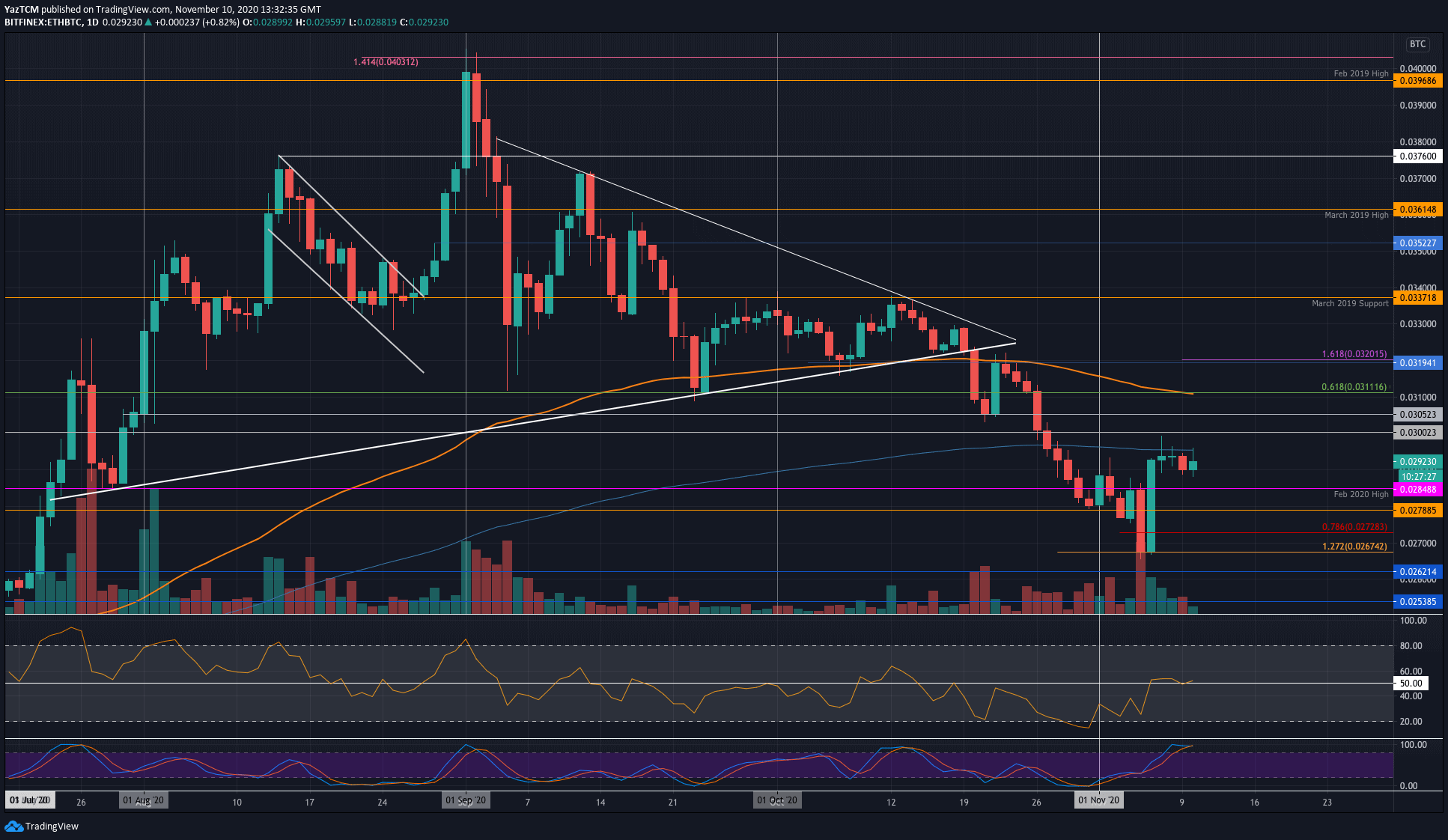

ETH / BTC – The battle of the bulls continues with the 200-day EMA

Key Support Levels: 0.029 BTC, 0.0284 BTC, 0.0278 BTC.

Key Resistance Levels: 0.0295 BTC, 0.03 BTC, 0.0305 BTC.

Against Bitcoin, Ethereum found support at the 0.0267 BTC level (downward extension of FIb 1.272) towards the end of last week, which allowed the coin to bounce higher.

After the reversal, ETH moved higher to reach resistance at 0.0295 BTC at the 200-day EMA. The bulls have not been able to break the resistance at the 200-day EMA since Friday and the market has moved sideways between the 200-day EMA and the support at 0.029 BTC.

ETH-BTC short term price prediction

Looking ahead, buyers can break out of the 200 day EMA, the first resistance level is located at 0.03 BTC. Above this, resistance is found at 0.0305 BTC, 0.0311 BTC (100-day EMA) and 0.032 BTC.

On the other hand, the first support level is found at 0.029 BTC. Below that, support is found at 0.0284 BTC (Feb 2020 highs), 0.0278 BTC and 0.0272 BTC.

The RSI is on the midline to indicate indecision within the market. However, the RSI is breaking out of the midline to show that buyers are fighting to gain control of the market momentum. However, the Stochastic RSI is poised for a bearish crossover signal that could bring the market down.

Binance Futures 50 USDT FREE Voucher: Use this link to register and get 10% commission discount and 50 USDT when trading with 500 USDT (limited offer).

Disclaimer: The information found on CryptoPotato is that of the writers mentioned. It does not represent CryptoPotato’s views on whether to buy, sell or hold investments. It is recommended that you conduct your own research before making any investment decisions. Use the information provided at your own risk. See Disclaimer for more information.

TradingView Cryptocurrency Charts.