[ad_1]

[ad_1]

The Chicago Board Options Exchange has announced that it will soon launch the Ethereum futures on the Gemini platform

Content

The implementation of futures on Ethereum is on the horizon: the CBOE will launch them a year after the offer of future Bitcoins. How will it influence the value of Ethereum?

Less than a year has passed since the first futures contracts with Bitcoin and Ethereum were stipulated, it could be the second cryptocurrency to be included in regulated futures. This will be possible thanks to the CBOE (Chicago Board Options Exchange), the platform that launched the Bitcoin futures in December 2017, which is anticipating the approval of the Commodities Futures Trading Commission (CFTC) to introduce the Ethereum options in December 2018 What does it mean for the cryptocurrency market and what changes can we observe later?

The future of Ethereum: general forecasts

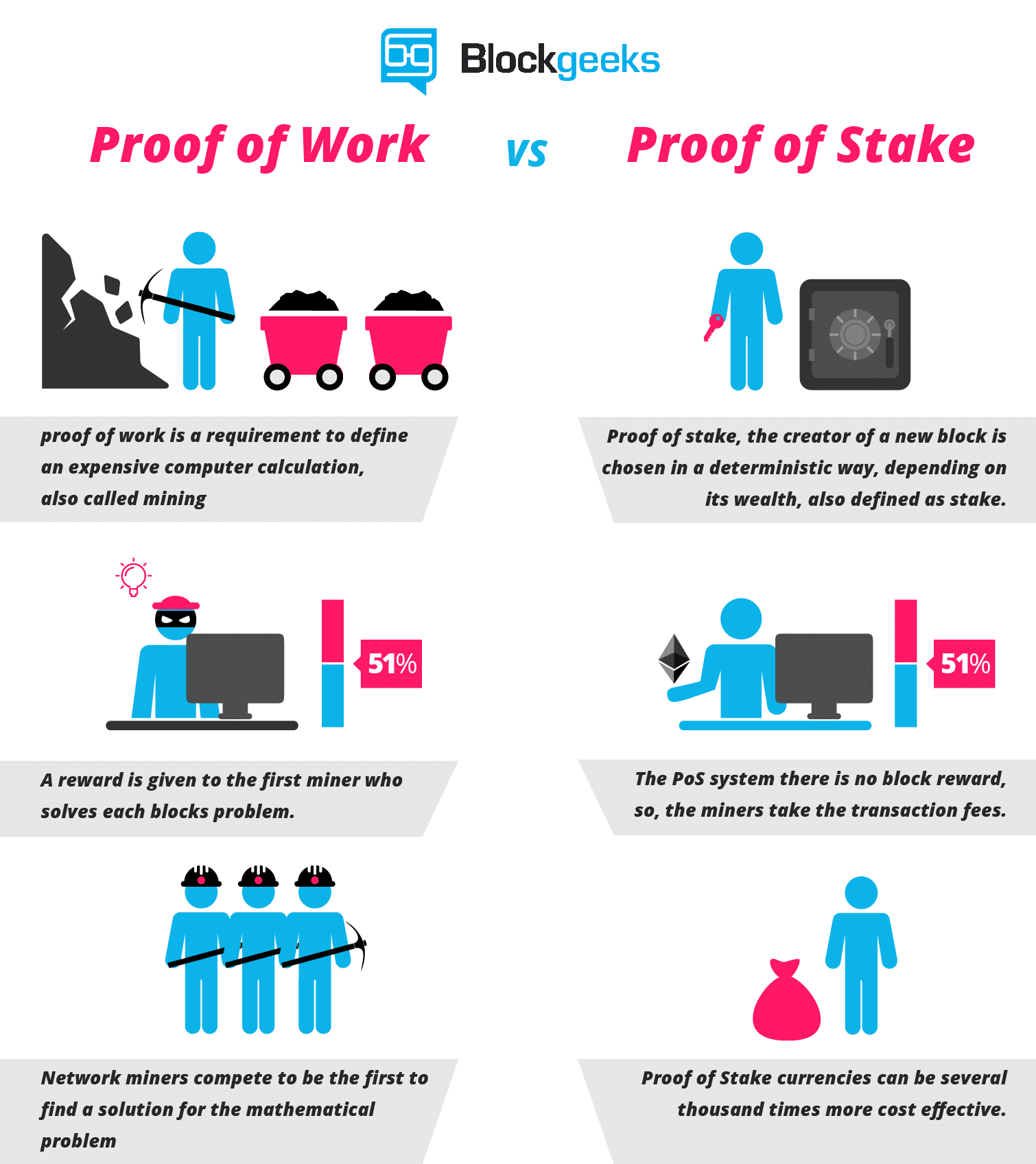

At the moment, we are facing a serious fall in Ethereum: its price has dropped to $ 203, and it does not seem that the value of Ethereum will grow in the near future. However, it is not yet time to write the eulogy of Ethereum: its team is ready to push Ethereum by introducing a Proof of Stake protocol. Vitalik Buterin promises to make Casper technology more user-friendly with the following Proof-of-stake benefits at your fingertips:

-

It is more energy efficient.

-

It is even more decentralized.

-

Offers better financial scalability.

Vitalik Buterin also notes that both PoS and PoW can be combined. Better availability and more advanced dApp can also drive future growth in ETH prices.

What does Ether say?

It is said that the ETH contracts from CBOE will be based on the Gemini cryptocurrency exchange market, which is already used for Bitcoin futures. In June 2018, the US Securities and Exchange Commission (SEC) formally declared that Ethereum is not classified as a security, which paved the way for future ETH contracts.

"We are pleased with the SEC's decision to provide clarity over Ether's current transactions. This announcement clarifies a key obstacle to Ether futures, the case we've been considering since we launched the first Bitcoin futures in December 2017 . "

The CBOE president, Chris Concannon.

Since there is a strong demand for Ethereum, the launch of futures is a justified decision. In addition, the CBOE has the layout of the product design and the ready structure left by the Bitcoin futures, so this time the task will be easier. It is not clear when the Ethereum futures will be available for the world: the CBOE should provide a precise date a little later. But what results will it bring?

It is believed that the launch of futures on ETH on the US-regulated exchange market will trigger a broader exchange in the cryptic world and an unprecedented increase in institutional interest. The encrypted futures products will allow traders to exit the trading platform schemes.

Some specialists state that the generalized adoption of cryptographic futures will influence the future price of Ethereum. As soon as CBOE starts the process, the other institutions will not be exploited even with the increase in cryptocurrency prices. For example, Wall Street is already trying to establish the bridge to the encrypted market knowing that the launch of the Ethereum futures will be a major catalyst for the adoption of cryptocurrencies.

"Cryptographic prices are strongly correlated with one another, so all that is good for Ethereum should be good for Bitcoin and vice versa.To date, Bitcoin futures volumes have been relatively small and insignificant compared to to the rest of the market, but since the interest of institutional investors changes, we should see higher volumes and new ways of trading them. "

Mati Greenspan, market analyst.

But while Greenspan's predictions are quite positive, some expert opinions are contrary to this statement. For example, Phillip Nunn, CEO of Wealth Chain Capital, says the possibility exists for bears to start shorting Ether, which can have negative consequences for companies that set up ICOs based on Ethereum. Since the market capitalization of Ethereum is lower than that of Bitcoin, it may be less than $ 150 or even $ 100. So if an ICO that has raised funds in Ethereum suddenly loses 50% of its market capitalization, will trigger the sale of panic at BTC or fiat currencies by these companies that will surely want to protect their interests.

The coin has two sides

What is bad for Ethereum can be good for Bitcoin. Tom Lee, managing partner of Fundstrat Global Advisors, is confident that Ether futures will have a negative cost on the market. Making an analogy with the future of Bitcoin, states that Ether $ 203.411 + 0.01% could follow the same path of development. But what is behind this statement? Lee bases his predictions on how asset futures trading is organized: traders can bet on price fluctuations without having to own currency. Therefore, bears will have the opportunity to reduce ether. This consequently relieves the pressure on Bitcoin.

However, it should be noted that:

-

Bitcoin futures are settled in cash, e.g. The underlying asset is not transferred.

-

The futures market represents a small part of the cryptocurrency offer.

Therefore, future Bitcoins do not have a direct impact on the value of Bitcoin, which, in turn, means that the price of Ethereum is unlikely to be affected by its release at term.

So, what will happen to Ethereum and how will it affect the development of cryptography?

|

Innovation |

consequences |

|

Pole validation test |

Faster transaction speed Lower rates Widespread adoption of Ethereum |

|

Active development of dApps |

The disclosure of Ethereum Blockchain |

|

Availability of Ether in stores |

Ethereum becomes an international currency for international transactions Discount for ether instead of massive adoption |

|

Creation of a social network based on Ethereum |

Tokens can be used in the social network to pay for media, time spent, etc. |

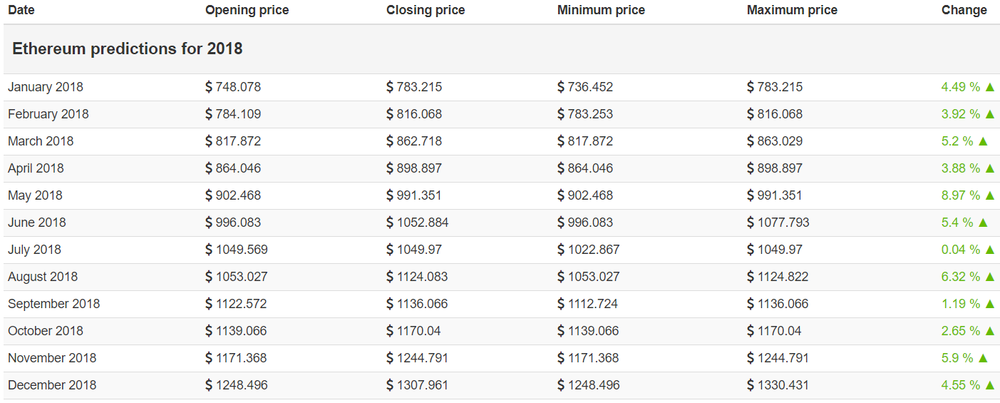

What is the future prediction of ETH prices?

Indeed, it is difficult to make precise predictions. The price of Ethereum is more likely to be affected by fluctuations in the US dollar and an increase or decrease in the value of ICO tokens. The future of Ethereum is still in the hands of individual traders because the Ethereum futures do not influence the price.

Bottom line

In the meantime, the introduction of futures on Ethereum is behind the corner: the CBOE should make an announcement soon. Ethereum will certainly continue to evolve; this is a smart contract essential for the development of dApp that provides the full range of useful tools. This Blockchain boasts legitimacy, technical supremacy and high flexibility. As soon as the new technological advances of Ethereum will be exploited by businesses and become public, the currency will increase in value. Investors are advised to cut the sails in the wind and bet on it, even if it remains on the current course.

[ad_2]Source link