[ad_1]

[ad_1]

Pakistan’s Securities and Exchange Commission has released a position paper on the regulation of cryptocurrency trading platforms

SECP document takes the harmless approach to digital asset regulation and stresses the need for innovation and stifling it with over-regulation

Sumit Gupta, co-founder of Mumbai-based cryptocurrency exchange CoinDCX, tells Inc42 that the approach taken by the SECP document should be replicated in India

In a recent development, the Securities and Exchange Commission of Pakistan (SECP) published a position paper on the regulation of virtual asset (cryptocurrency) trading platforms.

The document briefly defines the two types of digital assets, namely, utility tokens and security tokens. While utility tokens are those used for purchasing goods and services within an application, such as the in-game currency for a video game, security tokens are closer to cryptocurrencies, as they have an investment size ad they connected.

The paper notes that the tokenization of real assets on distributed ledgers “or the issuance of traditional asset classes in a tokenized form with the application of smart contracts has the potential to offer a number of advantages over the traditional system.” These include transparency, near-impossible duplications, and efficiency gains from removing middlemen and automating transactions, among other things.

The SECP document further describes the regulatory approaches taken towards cryptocurrencies in five emerging markets, namely Australia, Singapore, Canada, Japan and Thailand.

The document talks about two possible approaches for regulating cryptocurrencies in the country. The first approach would see the country regulate and restrict new products under existing regulations, which could even result in an outright ban. “With this approach, innovators are forced to adapt to the prevailing regulatory environment”, the document reads.

The second approach – on which the document is based – is described as a “harmless approach” by the Commodity Futures Trading Commission (CFTC). It is stated that the financial sector is dynamic underlines the need for innovation.

“The harmless approach is highly aware of not letting over-regulation suffer innovation and supports the search for the optimal balance between innovation, concomitant risks and broader security of the financial system,” the document reads.

Sumit Gupta, cofounder of Mumbai-based cryptocurrency exchange CoinDCX, tells Inc42 that the approach taken by the SECP document to propose a way forward for regulating cryptocurrencies is encouraging for the broader crypto ecosystem. “From describing the inefficiencies of the traditional financial system that can be solved by cryptocurrencies to adopting the harmless approach to cryptocurrencies and recognizing the need for innovation, the document would be encouraging for cryptocurrency players in Pakistan,” says Gupta.

“The approach taken by SECP is something that India should seriously consider, as it also speaks of the need for discussions with industry stakeholders.”

It is worth noting that Gupta’s CoinDCX is a major player in the Indian crypto ecosystem, which is working with the Internet and Mobile Association of India (IAMAI) to develop a self-regulatory code for cryptocurrency exchanges in the country.

Gupta adds that the document does well in defining the need to license cryptocurrency trading platforms and Initial Exchange Operators (IEOs), suggesting that they are placed under the purview of existing or new regulations in the country and work in partnership with SECP. in ensuring that due diligence is performed in their operations.

An initial exchange offer (IEO) sees a crypto startup partner with another crypto exchange, to list its coin or token for fundraising. IEOs are different from Initial Coin Offerings (ICOs) in terms of where the coin or token is issued. While ICOs offer tokens directly to potential investors, IEOs offer tokens on a fundraising platform of a popular exchange, such as Binance Launchpad.

The paper notes that to minimize the risks associated with cryptocurrencies, SECP could work with the IEO operator to first evaluate the company that is trying to raise funds through an exchange offer, before licensing it to do so.

“This would require the design of regulations to register initial exchange operators (IEOs) and prescribe a criterion for operating as such by the Commission. As a result, IEOs can only be offered by registered operators who meet the eligibility criteria, ”adds the document.

Gupta points out that while the document does not elaborate on some crucial aspects such as the cybersecurity infrastructure for cryptocurrency exchanges, it is clear that the document is intended to spark initial discussions for what could be a holistic regulation for cryptocurrencies in Pakistan. .

Sathvik Vishwanath, co-founder and CEO of Unocoin, one of India’s oldest cryptocurrency exchanges, tells us Inc42 that he was impressed by the newspaper’s plain language and the depth of understanding the SECP demonstrated on cryptocurrencies.

“This is the exact approach India needs to take and I hope our regulators will also choose such workflows if they work in Pakistan,” he says.

The SECP regulates Pakistan’s financial services markets and oversees governance in the corporate, insurance, capital markets and non-bank finance sectors. It can be equated with the Securities and Exchange Board of India (SEBI) of India.

The SECP intends to hold more discussions in its paper or look for a way forward for cryptocurrency regulation in the country.

Days after the SECP released its paper, David Lewis, executive secretary of the Financial Action Task Force (FATF), underlined that the private sector is the first line of defense against money laundering and terrorist financing and has called on countries to limit the risks of cryptocurrencies.

It is worth noting that Pakistan has been on the FATF gray list since June 2018 for failing to crack down on terrorist financing. FATF is an intergovernmental organization that seeks to develop policies to combat money laundering. Countries have long had to regulate emerging technologies such as cryptocurrencies and blockchain to mitigate the risks associated with them.

Crypto prices

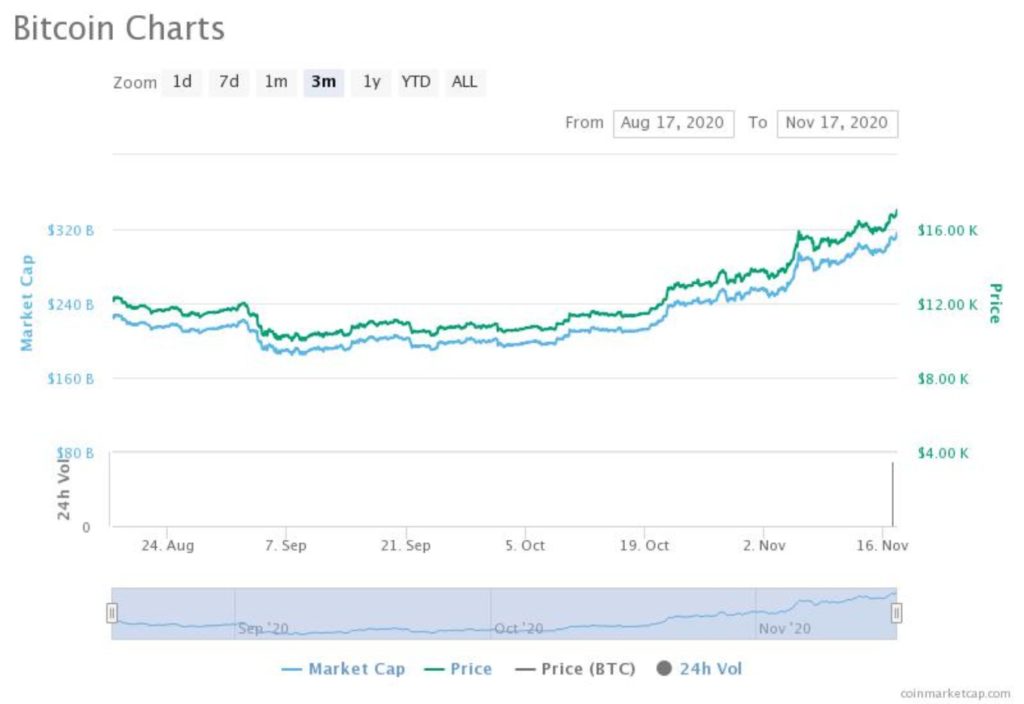

At the time of writing, Bitcoin was trading at $ 17,029, a nearly 12% increase from last week’s price of $ 15,242. Bitcoin’s market capitalization was around $ 315 billion.

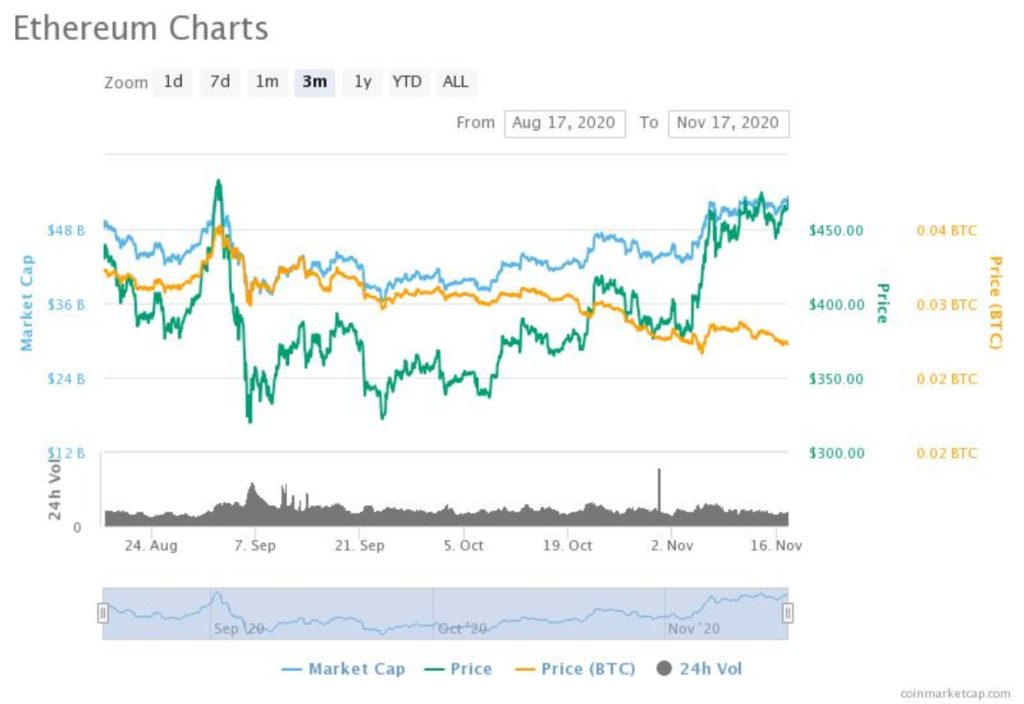

Ethereum was trading at $ 469, a nearly 5% increase from last week’s price of $ 445. Its market cap was around $ 53 billion.

More news

Diwali 2020: can Bitcoin challenge gold as an asset class? Experts weigh

On November 13, when India celebrated Dhanteras, a festival that Hindus consider auspicious for buying gold, we asked some of India’s leading cryptocurrency exchanges such as WazirX, CoinDCX and CoinSwitch Kuber s and Bitcoin – lately it has had a bull run – could challenge gold as an asset class. Read the whole story Here.

Central bank of the Kyrgyz Republic working on the cryptocurrency bill

According to a announcement on November 13th, the National Bank of the Kyrgyz Republic is developing a bill that would regulate cryptocurrency exchanges in consultation with industry stakeholders. The bank said the draft law will regulate the sale and purchase of cryptocurrencies with the aim of tackling cryptocurrency fraud schemes and financial crimes, as well as safeguarding the rights of consumers and investors.

[ad_2]Source link