[ad_1]

[ad_1]

- Litecoin’s price is at $ 55.88 after a noticeable drop to $ 53.44.

- The LTC / BTC chart shows a descending wedge pattern that is on the verge of a breakout.

LTC appears to be trading inside a descending wedge formed on the monthly chart and is currently at $ 55.88, after hitting $ 53.44. The model is on the cusp of a huge breakout. Furthermore, an essential technical indicator is about to present a strong buy signal.

Litecoin price prediction: the technical picture

One of the most important long-term Litecoin charts is the LTC / BTC monthly chart. The descending wedge that has formed here is on the verge of a breakout and the TD Sequential Indicator presents a red eight candlestick signal, which often precedes a strong buy signal.

LTC / BTC monthly chart

Looking at the last two instances where the TD sequential indicator flashed buy signals on the 1-month chart, the Litecoin price went through significant bullish gains. The first major price explosion occurred in February 2017, when LTC jumped 600% against BTC within five months after the TD configuration turned bullish. Similar price action was seen around December 2018 when the LTC / BTC trading pair rose more than 175% within five months.

Furthermore, it appears that the MACD is slowly turning bullish for the first time since April 2019. If all these positive signals are validated, Litecoin would have a price target of 1.28 million satoshi or around $ 154.

It is worth mentioning that LTC also appears to form a morning star pattern like the one we saw in November 2017. This is a notable sign of a reversal, especially when combined with the TD sequential indicator.

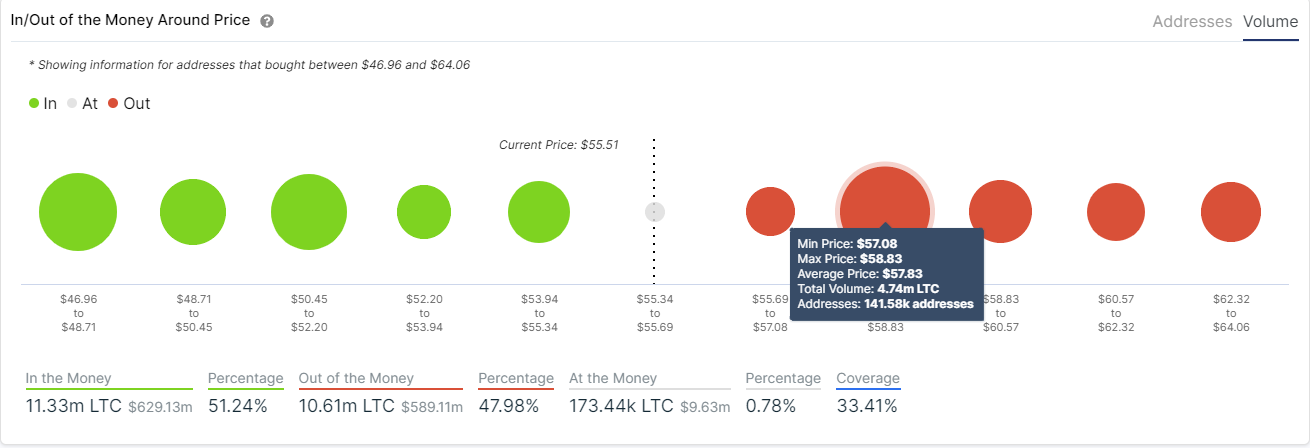

IOMAP LTC chart

While long-term price action for the LTC / BTC trading pair is rather optimistic, IntoTheBlock’s In / Out of the Money Around Price (IOMAP) pattern shows robust resistance ahead of the LTC / USD trading pair. About 141,500 addresses hold over 4.7 million LTC between $ 57 and $ 59. Such a massive supply barrier must be turned into support to add credit to the bullish outlook.

.[ad_2]Source link