[ad_1]

[ad_1]

The Bitcoin Cash (BCH) community is expected to start another hard fork on November 15, 2020.

The division of the blockchain represents the culmination of a series of disagreements and tensions regarding the proposed changes in the underlying code and the future of Bitcoin Cash.

Learn more about why BCH, the fifth largest crypto network by market cap, is about to fork and what you can expect to happen next.

Ironic story

Bitcoin Cash was created as a result of strong disagreements between members of the Bitcoin (BTC) community. The tensions were mainly centered on the proposed changes to Bitcoin’s block size. Unable to reach any agreement, the field of “big blockers” led by Roger Ver forked to create Bitcoin Cash on August 1, 2017.

Dubbed “The Real Bitcoin”, BCH had a hard time when a year later, similar tensions led to another hard fork in its field. Tensions between a Ver-led faction and the Craig Wright / Calvin Ayre-led group led to the creation of Bitcoin SV (BSV) (now 12th by market cap) after a hard fork.

Ironically, the Bitcoin SV hard fork took place on November 15, 2018 and now two years later, Bitcoin Cash is preparing for another controversial hard fork.

The conflict over Satoshi’s vision

The conflicts that led to the November 2020 BCH hard fork are related to Amaury Séchet’s ABC node (a developer of BCH) and the differences of opinion his camp has with the rest of the BCH community.

From its inception, BCH’s goal was to become a global peer-to-peer digital currency for low-cost, high-speed and borderless transactions.

This guiding philosophy, the Bitcoin Cash community believes, is in line with Satoshi Nakamoto’s vision. However, the BCH community is unable to agree on architectural changes to the blockchain that are in line with this ideal.

Numerous implementations are currently active in BCH. However, the most popular are Bitcoin ABC, BCHN, is Bitcoin Unlimited.

The Bitcoin ABC camp, led by Séchet, is credited with creating the mining node in BCH, which has garnered its fan base and solidified bitcoin cash’s place among the market’s leading digital currencies. The ABC node is technologically advanced and supports a number of innovative changes, creating the fundamental architecture for future enhancements.

The BCHN camp, led by Roger Ver, is largely responsible for BCH’s notoriety or fame in the cryptocurrency market due to the controversial but somewhat popular character of Ver. The BCHN node, along with other implementations, is also in favor of the changes technological, albeit in a much slower way.

Due to differences of opinion regarding the speed (or whether) changes need to be made to the Bitcoin Cash code to support technological advances such as Merklix-based sharding, adaptive block size and Mitra, the BCH community is divided into camps opposites.

The two main factions are led by Séchet and Ver.

ASERT vs. GRASBERG

The November 2020 update was supposed to be a blockchain update of the BCH Difficulty Adjustment Algorithm (DAA) to a new algorithm called ASERT, proposed by developers Jonathan Toomin and Mark Lundeberg.

However, according to J.Stodd, a former BCH developer who moved to Avalanche (AVAX), Séchet announced in August that the ABC implementation would use an algorithm called GRASBERG. The algorithm is identical to ASERT except it has also corrected a historical drift. Unfortunately, Séchet’s move was met with considerable contempt by the BCHN camp.

Stodd said that,

“Since Bitcoin ABC did not attribute the new development to Jonathan Toomim, and since there was no discussion of Grasberg prior to the announcement, BCHN decided to go ballistic on this move and reported all the anti-ABC rhetoric.”

Following the hype after GRASBERG’s announcement, Séchet has reverted to the initial ASERT algorithm scheduled for update on November 15th. However, it added a component that further ignited tensions and escalated the disagreement to a somewhat irreconcilable level, triggering a hard fork. Séchet added a Coinbase rule that dictates that “all newly mined blocks must contain an output that assigns 8% of the newly mined coins to a specified address”.

This update would mean that miners would only receive 92% of the block reward on the ABC implementation. Additionally, the funds would be sent to an address that, as some worry, could be controlled by Séchet, given his leadership position at ABC.

Séchet affirmed this

“The November update of the Bitcoin ABC software will have a Coinbase rule that fully aligns the incentives of Bitcoin ABC with the sustainability and security of the network.”

The ABC camp believes that aligning development team wealth is essential for blockchain growth. This is because it ensures that developers will always act in the best way for the blockchain as it will also be in favor of the growth of their wealth.

Furthermore, Séchet believes it is important for the development team to have access to funds that are not tied to other authorities that could undermine the security of the blockchain. This practice is not new to the industry and is known as the Infrastructure Financing Plan (IFP).

Although there are definite ideological differences between the opposing camps, it is important to note that there are also personal differences that influence the split. Séchet has had a long history conflict with FreeTrader, another developer that runs in the same environments. As Stood said, Séchet is likely to be fed up with the dynamics surrounding BCH.

Following Séchet’s announcement, the BCH community has further fractured along ideological lines. Ver published in tweet announcing the upcoming hard fork saying, “Bitcoin ABC and deadalnix have announced that they are moving away from BitcoinCash on November 15. We wish them luck with their new coin and thank them for the free airdrop to all BCH holders.”

However, only a day earlier Ver had done so declared:

“Diverting part of the Bitcoin Cash block reward to pay a single development team is a Soviet-style central planner’s dream come true.”

This sentiment encapsulates the prevailing response to the ABC announcement. Furthermore, there are valid concerns that the Coinbase rule was not a discussion rather a one-sided decision. On the developer front, some support ABC, while some argue that Séchet should step down.

According to data from coin.dance, out of 1,250 public nodes on the BCH network, 505 of the nodes use the Bitcoin ABC client, 559 use Bitcoin Unlimited, and only 146 use BCHN. Despite this, at present, it looks like the BCHN field has the most support and will likely end up with the BCH ticker.

The Ver-led BCHN camp garnered the most support from miners, exchanges and the community at large. Binance, Huobi, BTC.Top, Hashpipe, P2Pool, F2Pool, Easy2Mine, is Bitcoin.com are adding “powered by BCHN” in the Coinbase parameters of the blocks extracted through their platforms.

If you have bitcoin cash, make sure the wallet provider you are using supports the fork. If not, transfer your funds to an unsecured wallet where you keep your private keys. Thus, you will be able to receive your forked coins.

Also, be aware that many service providers may terminate BCH transactions at the time of the fork. Major manufacturer of hardware wallets Ledger, for example, it will stop its bitcoin cash services on November 15th to prevent replay attacks.

Preparation of exchanges

How Cryptonews.com reported, a number of major Japanese cryptocurrency exchanges, perhaps driven by their previous experiences with forking, revealed that they would pause withdrawals and deposits in BCH in the days leading up to November 15, as well as leverage trading.

Many of the other major exchanges around the world have made similar announcements.

OKEx announced its support for the hard fork, stating that, if successful, OKEx users who hold BCH prior to the fork will receive the two new assets, BCH ABC and BCHN. In the days leading up to the fork, the BCH margin lending feature, spot and margin trading services, and the deposit feature will all be suspended.

Huobi Global he made similar statements, adding that “after the community reaches a consensus on the BCH naming, we will end the transition period and rename BCHA or BCHN.”

Binance will suspend BCH’s deposits and withdrawals on the day of the hard fork, then act depending on which of the two presented scenarios comes true: there are two competing chains or there is no new currency.

FTX he also discussed the competing chain scenario, stating, as Binance did, that “users will be credited with the BCH from the chain with the most work done.”

Meanwhile, Poloniex told its users that they can keep their BCH which will be converted to BCHABC and BCHSV after the fork, or they can convert their coins to BCHABC and BCHSV before the fork and trade those tokens in the BTC and USDC markets. Both chains will be supported, but if only one remains technically and economically viable “we could rename it BCH,” they said.

BitMEX he said that the products and indices affected by the fork “will only follow one side of the fork and we aim to keep the markets open when the fork occurs,” adding that the product and index names will remain unchanged.

Meanwhile, other exchanges, such as Bitfinex, which supported the previous fork, as well as Coinbase, seems to have not yet issued a statement on this fork. But in 2019, and citing BCH’s previous hard fork, Coinbase said that while it is an “important tool for innovation in the ecosystem,” a fork can also be a security risk. Therefore, “during controversial hard forks,” they implement their own replay protection strategy to mitigate replay attacks. Finally, Kraken previously stated that “customers should not assume that Kraken will list or credit any forks, airdrops or any other cryptocurrencies.”

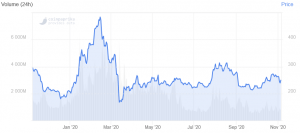

On Thursday, 17:16 UTC, BCH was trading at USD 250 and was up 3.6% in one day, reducing its weekly losses to 6.5%. The price went up 10% in one month and dropped 17% in one year.

BCH Price Chart:

____

To know more:

Give Cash to Cat: A New Attempt to “Make Bitcoin Great Again”

Bitcoin Bull Tim Draper finds himself in Bitcoin Cash Shilling Mystery

Buterin’s “Ethereum + Bitcoin Cash” scaling solution draws criticism

[ad_2]Source link