[ad_1]

[ad_1]

- XRP’s average daily volume increased more than 107% according to Ripple’s third quarterly report.

- Total XRP revenue after deducting purchases was $ 35.85 million in the last quarter, an increase of more than 10%.

Ripple released its third quarterly report a few hours ago. XRP’s average daily volume increased more than 100% to $ 403.58 million in the third quarter from $ 196.28 million in the second quarter. This shows a significant increase in network usage and a growing adoption of Ripple’s On-Demand Liquidity (ODL) payment solution.

Additionally, total XRP net sales amounted to $ 35.84 million, an increase of more than 10% from $ 32.55 million. Ripple says the company has focused solely on over-the-counter (OTC) sales and leases as part of providing sufficient liquidity to certain ODL clients. The following table provides an overview of the figures just described.

Additionally, total XRP net sales amounted to $ 35.84 million, an increase of more than 10% from $ 32.55 million. Ripple says the company has focused solely on over-the-counter (OTC) sales and leases as part of providing sufficient liquidity to certain ODL clients. The following table provides an overview of the figures just described.

Source: https://ripple.com/insights/q3-2020-xrp-markets-report/

Additionally, Ripple released a total of 3 billion XRPs for sale in the third quarter, of which 2.4 billion XRPs were returned to the escrow account. The company pledged to freeze 55 billion XRPs in an escrow account in December 2017 and release one billion XRP for sale each month.

This measure has been criticized several times by the community in the past and is considered a possible reason for XRP’s rather average performance. However, several Ripple representatives, including Brad Garlinghouse, argue that Ripple does not or cannot influence the price of XRP.

As the report also states, Ripple recently introduced Line of Credit, a new service that allows RippleNet customers to raise capital on demand. By providing this credit product, customers can quickly acquire capital in the form of XRP from Ripple. The service is currently in beta and is only available to select ODL customers.

According to initial feedback, however, the results of the work are consistently positive, so Ripple will soon expand this service to other markets and customers. Through the line of credit, customers can use their capital to run their daily business, but also to develop new markets or reach new customers. In some cases, XRP is provided directly by Ripple for particularly large transactions when partner exchanges do not have sufficient capacity.

For healthy market growth and thanks to the introduction of the new product, Ripple has repurchased large quantities of XRP, as the table above shows. Ripple says these measures stimulated the market and promoted growth and adaptation. Due to this strategy it must be continued for the time being, hence Ripple.

XRP is the preferred base currency for arbitrage trading

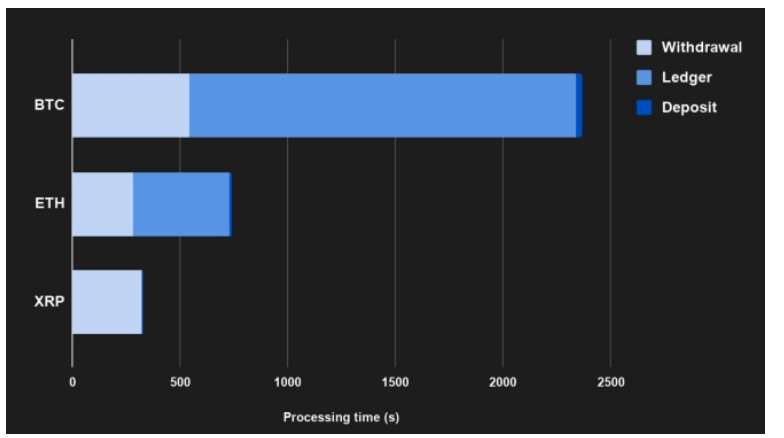

XRP’s fast transaction times and low fees make it an ideal base currency for arbitrage trading. As a result, XRP can be shipped quickly from one exchange to another, allowing small price differences to be used for short-term gains. The chart below shows that XRP is one of the fastest crypto currencies and that transactions are processed much faster than Bitcoin and Ethereum.

Source: https://ripple.com/insights/q3-2020-xrp-markets-report/

[ad_2]Source link