[ad_1]

[ad_1]

A report from the Royal Bank of Canada says Ripple and XRP can save banks and financial institutions a significant amount of time and money.

According to the report, blockchain in general can address the sore points in the remittance sector by eliminating intermediaries, reducing costs and increasing transparency.

Ripple and XRP in particular, the Royal Bank of Canada indicates both the software suite of Ripple and the XRP ledger as examples of how the blockchain can destroy the industry.

"Ripple has created an open source, peer-to-peer, decentralized protocol with a network of financial institutions (RippleNet) and a series of individual technology solutions including payment processing (xCurrent), liquidity support ( xRapid) and access to payments (xVia).

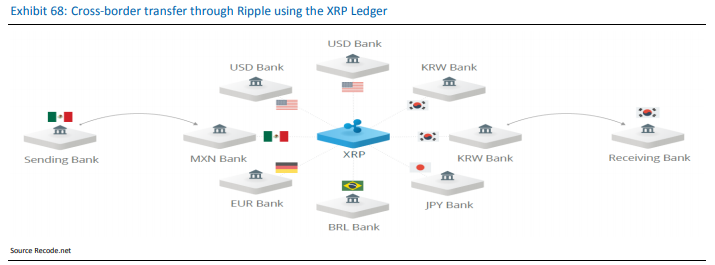

Although it is not necessary for xCurrent and payment processing, we believe it is useful to use the "complete" solution as an example of how blockchain could break the remittance market. , including the use of XRP and its corresponding register In this solution, XRP is used as a bridge asset, ie it is a reserve of value that can be transferred between the parties without a central counterparty and therefore supports liquidity between Two currencies: As a result, banks can consolidate their liquidity into an XRP account instead of holding local currency in accounts around the world. banks' domestic lows and XRPs, banks reduce the number of intermediaries to a minimum. "

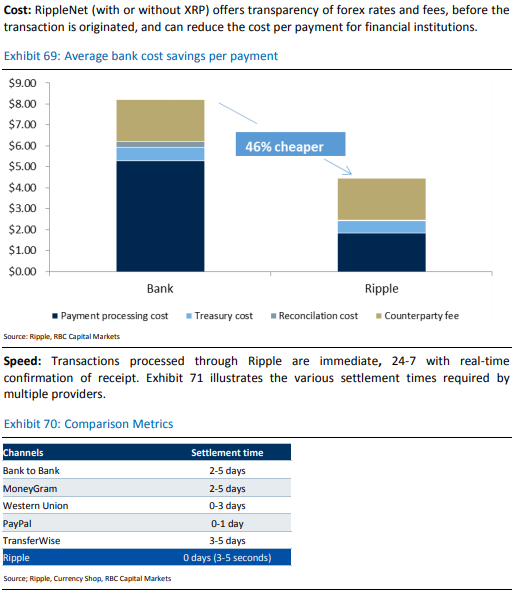

The June report also states that Ripple, with or without XRP, can save banks on average by 46% for payment.

Royal Bank of Canada is the largest bank in Canada by market capitalization, with over 16 million customers.

You can check the full report here. [19659010] Join us on Telegram

Disclaimer: The opinions expressed at The Daily Hodl are not investment advice Investors should do their due diligence prior to making high risk investments in Bitcoin or cryptocurrency.Your transfers and exchanges are at your own risk.You may lose any losses you may incur. The Daily Hodl participates in affiliate marketing.

Check out the latest news