[ad_1]<div _ngcontent-c15 = "" innerhtml = "

[ad_1]<div _ngcontent-c15 = "" innerhtml = "

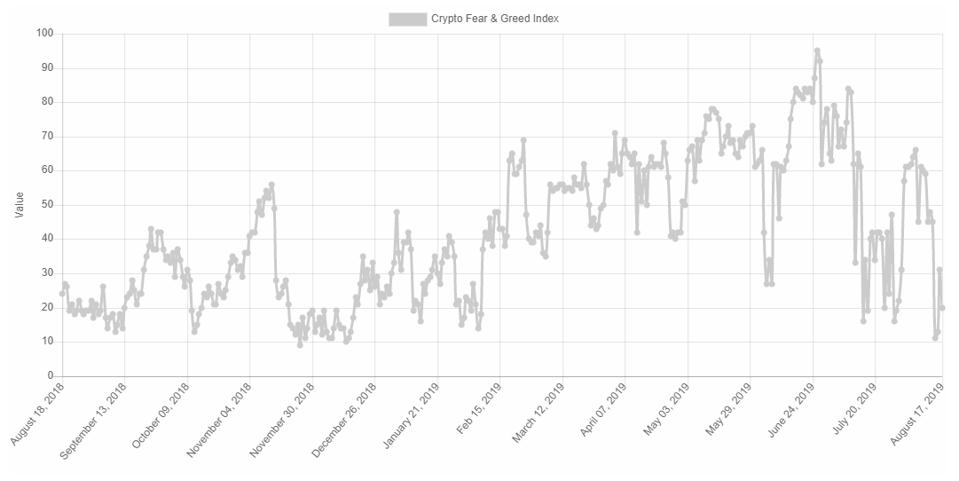

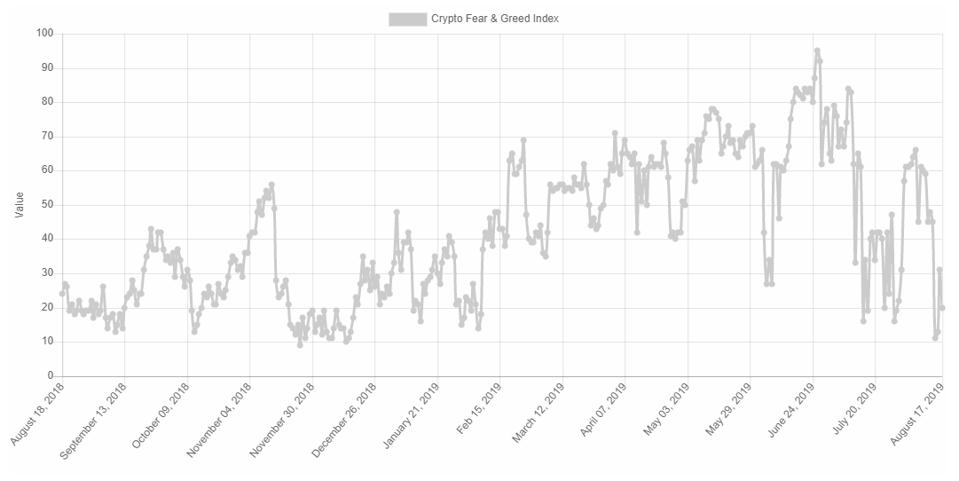

Bitcoin and cryptocurrency traders and investors nervously observe prices after market sentiment seems to worsen, falling to its lowest level since December 2018.

The bitcoin price has been pending around $ 10,000 per bitcoin for several weeks, with many hopes bitcoin was becoming a safe haven from the turbulent markets.

Bitcoin and crypto investors are concerned, however, with the Crypto Fear and Greed Index showing "extreme fear", and at the beginning of this week going down to the minimum of 244 days seen last time when bitcoin fell to around $ 3,000.

The price of bitcoin has continued to trample water for months as traders and investors wait to see how global regulators will react to the cryptocurrency of Facebook's planned balance and bitcoin competition.

Getty Images

The fear index hit historic highs at the end of June when the excitement for Facebook's plans for its bitcoin rival reached the peak of the fever but it has since plunged as regulators signal their dissatisfaction with the social media giant.

"The current regulatory block on Facebook's digital token plans has dampened investor sentiment for cryptocurrencies," said Christel Quek, commercial director of Bolt Global.

The fear index currently shows a reading of 20, but at the beginning of this week it fell to a minimum of 11 after falling sharply during August.

Since the index hit the year low, the bitcoin price has dropped by a further 2%, while the global cryptocurrency market has seen over $ 30 billion erased from it in the last week.

Meanwhile, the bitcoin price has fallen below the psychological mark of $ 10,000 per bitcoin this week, further troubling traders and investors.

Some in the bitcoin and cryptocurrency sector have pointed out that the broader cryptocurrency market has decreased along with the bitcoin price.

"Bitcoin and Ripple's major cryptocurrencies including litecoin, ethereum and XRP have declined" this week ", weighed down by concerns over a slowing economy," Quek added.

The crypto-fear index has not been so low since bitcoin traded at just over $ 3,000 per bitcoin.

Alternative.me

The CFGI, created by the software company Alternative.me, calculates the value of the index daily on a scale from 0 to 100 using volatility, market volume, social media, survey, dominance and trends. Zero means "extreme fear", while 100 means "extreme greed".

">

Bitcoin and cryptocurrency traders and investors nervously observe prices after market sentiment seems to worsen, falling to its lowest level since December 2018.

The bitcoin price has been pending around $ 10,000 per bitcoin for a few weeks, with many hoping that bitcoin is becoming a safe haven from the turbulent markets.

The bitcoin and crypto investors are worried, however, with the Crypto Fear and Greed Index showing "extreme fear" and at the beginning of this week it fell to a minimum of 244 days since the last time the bitcoin collapsed to around $ 3,000.

The price of bitcoin has continued to trample water for months as traders and investors wait to see how global regulators will react to the cryptocurrency of Facebook's planned balance and bitcoin competition.

Getty Images

The fear index hit historic highs at the end of June when the excitement for Facebook's plans for its bitcoin rival reached the peak of the fever but it has since plunged as regulators signal their dissatisfaction with the social media giant.

"The current regulatory block on Facebook's digital token plans has dampened investor sentiment for cryptocurrencies," said Christel Quek, commercial director of Bolt Global.

The fear index currently shows a reading of 20, but at the beginning of this week it fell to a minimum of 11 after falling sharply during August.

Since the index hit the year low, the bitcoin price has dropped by a further 2%, while the global cryptocurrency market has seen over $ 30 billion erased from it in the last week.

Meanwhile, the bitcoin price has fallen below the psychological value of $ 10,000 per bitcoin this week, further caring for traders and investors.

Some in the bitcoin and cryptocurrency sector have pointed out that the broader cryptocurrency market has decreased along with the bitcoin price.

"Bitcoin and Ripple's major cryptocurrencies including litecoin, ethereum and XRP have declined [this week], weighed down by concerns over a slowdown in the economy, "added Quek.

The crypto-fear index has not been so low since bitcoin traded at just over $ 3,000 per bitcoin.

Alternative.me

The CFGI, created by the software company Alternative.me, calculates the value of the index daily on a scale from 0 to 100 using volatility, market volume, social media, survey, dominance and trends. Zero means "extreme fear", while 100 means "extreme greed".