[ad_1]

[ad_1]

- Cryptocurrencies had a "mini flash crash" that woke them up.

- After the stops were canceled and the market rebounded, some coins have upside potential.

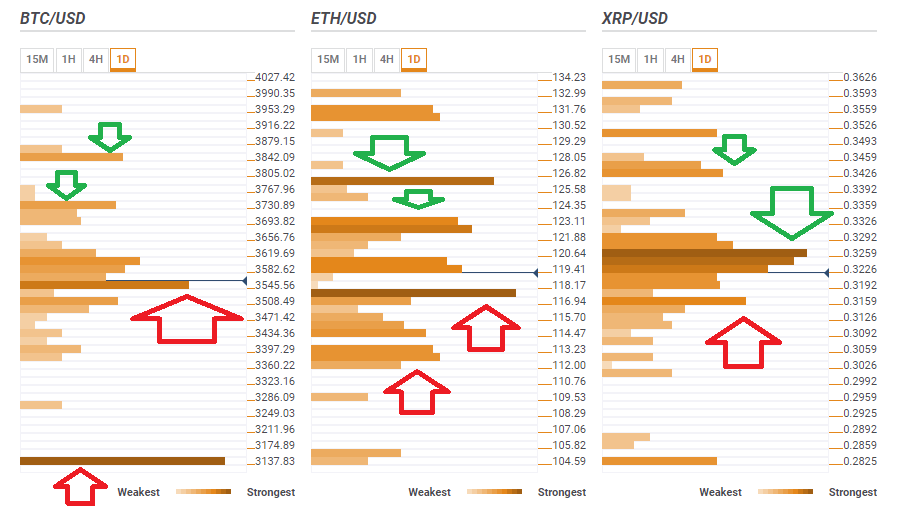

- Here are the levels to look at according to the confluence detector.

After a few days of low volatility in the encrypted markets, we saw a sudden drop before, with rapid multi-percentage declines. It did not last too long though. It seems that weak hands have been shaken by their assets and buyers have jumped to collect crypto coins at bargain prices.

This bearish revolt, in the midst of a cold period in vast regions of the United States and Europe, was rejected. But are the bulls at the height of the task of pushing the markets higher?

Some cryptocurrencies have better prospects than others.

BTC / USD has regained support and looks to the highest ground

Bitcoin, quickly managed to reacquire the critics3,545 level which is a dense mass comprising the simple moving average 5-4h, the SMA 200-15m, the SMA 50-1h, the SMA 50-15 minutes, the Fibonacci 23.6% a week, the Bollinger Band 1h-Middle, the SMA 10-1h, MSA 10-4h, Fibonacci 61.8% of a day and more.

The move above this level represents a clear rejection of the bear's attack and gives hope to the bulls.

The next upward target is $3,730 it is the convergence of SMA 50-one-day, Pivot Point of one week Resistance 1 and BB of one day.

The next target for BTC / USD is $3842 where we see the PP meeting a week R2 and the Fibonacci of 61.8% a month.

If the above support has been lost, the grandfather of criptos has significant support only at $ 3,137, where the one-month S1 in PP and the last week's minimum converge.

ETH / USD has support, but also resistance

Ethereum has recaptured the $117 level after a fright sent below that line. The area includes SMA 10-1h, SMA 50-15m, BB 1h-Middle, SMA 100-15m, central BB 15 minutes, SMA 5-1h, SMA 10-4h, SMA 200-15m, SMA 50-1h and Fibonacci 61.8% of a day.

The first upside goal is $122 which is where the PP 1d-R2, the SMA 10-1d, the SMA 200-1h and the SMA 50-4h converge.

Higher, $126 is a hard line in which we see 61.8% of Fibonacci at one week and PP on a day of Resistance 3.

Vitalik Buterin's genius has suffered from the delay in updating Constantinople and if there is another delay, the next level of support is $112 where we see 61.8% of Fibonacci at one month, the BB 4h-Lower, the PP one month S1, the PP one-day S2 and more.

XRP / USD is blocked

Ripple recovered, but has a fierce resistance to $.3250 which is a minefield of lines that includes the previous daily high, the one-day PP R1, the SMA 5-one-day, the Fibonacci 38.2% a week, the Fibonacci 23.6% a day, the BB 15min -Upper, the Fibonacci 23.6% at one month and SMA 100-1h among others.

It will be hard to break this line, but if it happens, the third digital currency will target $.3426 where we see the PP a week R1, the SMA 50-1d and last week's maximum.

Support for XRP / USD is $.3159 where we see the confluence of last week's minimum, the BB 1h-Lower, the PP one month of support 1 and the BB 15min-Lower.