[ad_1]

[ad_1]

As a resource for cryptocurrency information, we receive many questions. We strive to provide useful answers in simple English and of course, users' questions give us a lot of information. They let us know what newcomers are in space that they find important, difficult or confusing.

A question that has come a long way is …

How do I get my ripple (also known as XRP)?

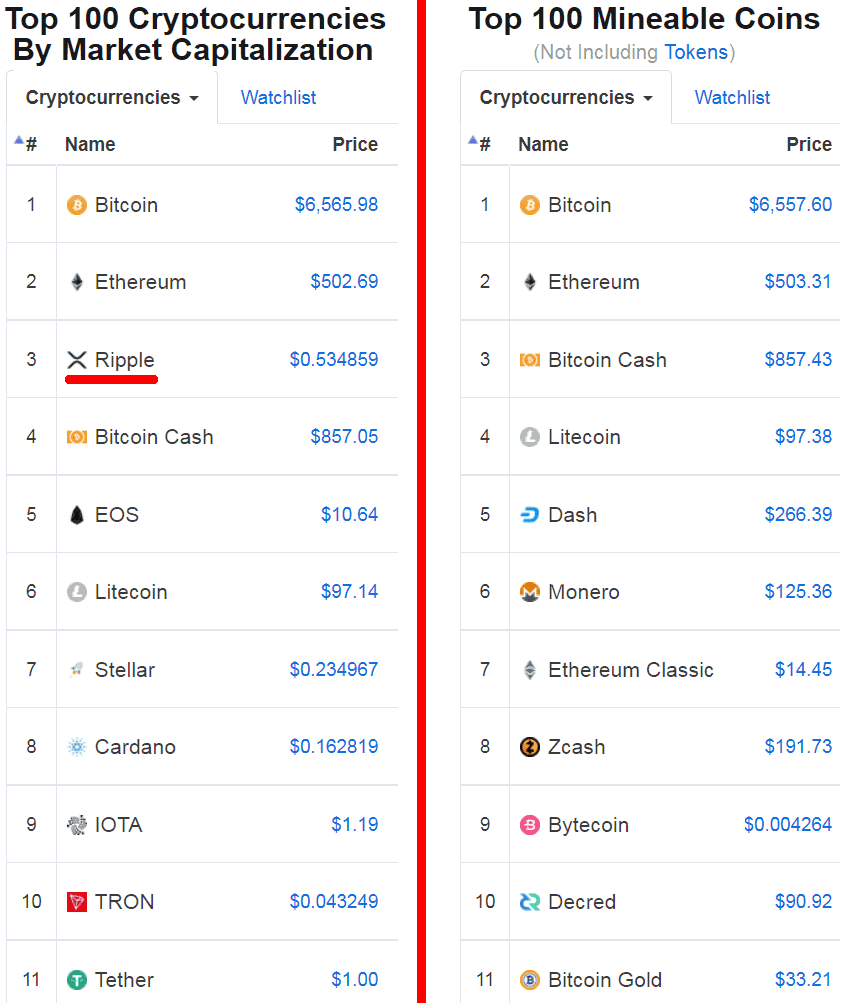

Well, to answer simply, you can not. In fact, many of the coins we are used to seeing in the coin price list are not tiny. Compare these two lists from CoinMarketCap, showing all coins and coins mininable:

Why Ripple can not be extracted?

Mining is mainly essential in the case of fully decentralized cryptocurrencies, such as Bitcoin. Remaining open to anyone with the necessary skills and resources for mine, Bitcoin theoretically prevents any entity from controlling the blockchain.

Unlike Bitcoin, XRP is released by Ripple, with most of the distributed servers related to Ripple, thus making independent mining non-essential. In much the same way that AMZN shares are issued by the Amazonian company, XRP was issued directly by the Ripple company rather than being mined. The only way to acquire Ripple is therefore to buy it or earn it.

Here are some basic principles of Ripple

Symbol: XRP

Current supply: 39.245.304.677 (39 billion) XRP

Feeding cap: 100,000,000,000 (100 billion) XRP

Ripple Pro:

- Ripple transactions are extremely fast, confirming in a few seconds,

- Ripple can reach 50,000 transactions per second in throughput,

- The Ripple network does not require significant electrical consumption.

Ripple Cons:

- The system can potentially be turned off or changed by the state.

- Transactions take place at the discretion of the company and can be reversed or frozen.

What is Ripple's goal?

Ripple is more focused on improving the existing banking system rather than replacing it. The success of Ripple therefore ultimately depends on the acceptance of the main banks and central banks. However, according to Ripple themselves and fintech NYT reporter, Nathaniel Popper, they still have a long way ahead of them, as the highly conservative banking sector will hardly make the leap quickly

Another point of concern is Ripple remains unsupported from the major American trade, in addition to Kraken. A list of Coinbase would probably do a lot for Ripple.

If you have any further questions on how to get Ripple, see our complete guide to the process, How to buy Ripple in 3 easy steps. I hope this clarifies some things about Ripple and why it can not be extracted.

The Ripple story

RipplePay was created by Ryan Fugger in 2004, 5 years before Bitcoin was published, with the intention of replacing banks. It allowed loans and peer-to-peer payments but users could default on obligations. RipplePay was an interesting model but did not take hold.

Inspired by Ripplepay, Jed McCaleb founded the eDonkey file sharing network. McCaleb was also the creator of the Monte. Gox. In 2011, the eDonkey team started working on a cryptocurrency in which mining work was replaced by social consensus (similar to the approach of modern cryptodes such as EOS). In 2012, McCaleb purchased RipplePay and renamed the project to OpenCoin.

OpenCoin has implemented the Ripple Transaction Protocol (RTXP) as a means of sending money directly and quickly between users. The customs tokens, representative of real world resources, were made possible within RTXP, raising the question of the purpose of XRP. Regulatory-compliant Ripple gateways, such as the Bitstamp exchange, manage interchange between the RTXP network and other resources. These gateways have shifted trust from network colleagues to authorized financial institutions.

OpenCoin conducted an important tribute to the XRPs at the beginning of 2013, assigning 1000 XRP to any BitcoinTalk forum user requesting it. This year marked the point where the current XRP resource was implemented. OpenCoin also managed to raise a lot of venture capital funds in 2013. McCaleb left the company during this period and went on to create Stellar, which is similar to Ripple. OpenCoin then changed its name to Ripple Labs, shortening it to Ripple in 2015.

Towards the end of 2013, Ripple transformed from a transaction protocol for users to a network of specialized settlements for banks. Ripple then added a number of features to promote compliance, such as the ability to block user resources. The first bank to be involved was the German Fidor Bank, followed by the American bank CBW. Several other banks and payment services have been involved in the Ripple project.

Update of the author:

This article proved to be rather controversial and received highly critical feedback. I would like to address some of the points raised in the comments section, which are also summarized on the XRP FUD Bingo website.

Some clarification on the difference between XRP coins and Bitcoin-like coins: Ripple uses HashTree rather than a standard blockchain. According to Global Coin Report, HashTree is a "functional programming data structure that provides consent to the ledger by comparing and validating the summarized data". Although HashTree can be considered a blockchain, it is not considered decentralized.

Regarding the existence of validators that show that Ripple is distributed; while this is really correct, I would like to point out that from the writing of this article there are only 2 non-Ripple validators. You can create a custom list of non-affiliated validators, however, a Ripple client must download 5 keys from Ripple.com to work.

Regarding the state censorship of the Ripple network, it was stated that this is impossible because Ripple is considered decentralized by many. while non-ripple validators help decentralization, they are known and therefore subject to state pressure.

As regards the possibility of freezing assets, there is a precedent. Some of Jed McCaleb's XRPs have been frozen by Bitstamp at the behest of the Ripple company.

In summary, the objective perspective on Ripple in this article fits largely with those of respected industry experts, who have studied this topic in depth. As such, I do not think these points can be safely dismissed as mere prejudices or FUDs.

[ad_2]Source link