[ad_1]

[ad_1]

Latest news from Ripple

According to McKinsey's forecast, the cross-border payments market is expected to reach $ 2 trillion by 2020. Citing robust growth especially in the Asia-Pacific corridor, the report goes on to say that global payments will swell and even exceed $ 5 trillion. of dollars over the next five years. This means that at spot prices, Ripple through xRapid has to control only five percent for XRP to increase by 500 percent.

To read: RippleNet now has over 200 global customers with 5 others using XRP

True, the figures are solid, but the truth is that SWIFT, based in Belgium, formed by banks and improving the flaws, is still the dominant platform for banks. Despite the advantages offered by the speed of ripple, efficiency and cost cutting, SWIFT is working to deal with liquidation time and HSBC is experimenting with a solution that will reduce transaction time to two hours.

On the other hand, Ripple is growing. Although partner institutions prefer xCurrent to xRapid, a solution that leverages XRP for liquidity, the number of companies connected to RippleNet is up to 200. In addition, two months after the launch of xRapid during the SWELL conference, another 12 companies including JNFX, SendFriend, Transpaygo, FTCS and Euro Exim Bank enjoy the XRP cost and speed advantages.

Read also: Kuwait Finance House confirms the use of Ripple Tech. For cross-border remittances

Furthermore, there has been a peak in use with 350% more transactions sent via Ripple since last year. Combined, these are the kind of details that XRP owners must feel as labeled as 2019 the year of the encryption of adoption.

XRP / USD price analysis

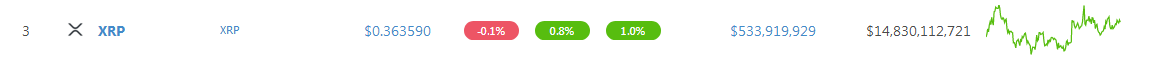

In third place, XRP's market capitalization is $ 14.7 billion, $ 800 million less than Ethereum and an increase of 1% over last Wednesday. However, XRP prices are within a limit of 6 cents with a maximum limit of 40 cents: 61.8 percent Fibonacci retracement and 30 cents and 34 cents lower.

Nonetheless, the recovery from mid-November 2018 strengthens our bullish position, but until there are solid and high-volume gains above 40 cents – 42 cents of resistance, short-term bears can bring prices to 25 cents or more in low at the end of the month.

Trend formation and candlestick: neutral, accumulation

From a top-down approach, buyers have control and consolidation by September 2018. Even with this, the 80 cents drops have been steep and prices are around 13 cents away from the September 2018 lows of 25 cents.

Regardless, this proximity should not be a basis for bears' projections, but each time it should technically be a buying opportunity now that we have higher higher levels after prices have fallen momentarily below 30 cents to mid-December.

Too much, what we have now is an accumulation within a wider range of 55 cents – a double bull bar – where XRP / USD is accumulating in a bull's flag after the 29-cent rally. From the point of view of the effort with respect to the result, the bulls have control and the possibilities of increases are more than falling.

Volumes: low, bullish

As already mentioned, the XRP / USD is bullish from the point of view of the effort with respect to the result. In support of this vision there is the widest confinement of the price by September 2018, at high low, three months after the reversal of 25 cents.

In addition, the short-term trend is bullish and below December 17 the bar was above average volumes: 52 million against 28 million, exceeding the current level of volumes at the time of printing.

Conclusion

Considering technical and fundamental developments, XRP bulls have an advantage. However, before recommending longs, we must see convincing pauses above 40 cents. Next, we will operate as follows:

Buy: 40 cents

Stop: 30 cents, 34 cents, 37 cents – depends on risk-averse levels

Objective: 60 cents, 80 cents

All charts have been kindly granted by Trading View-BitFinex

This is not an investment advice. Do your research