[ad_1]

[ad_1]

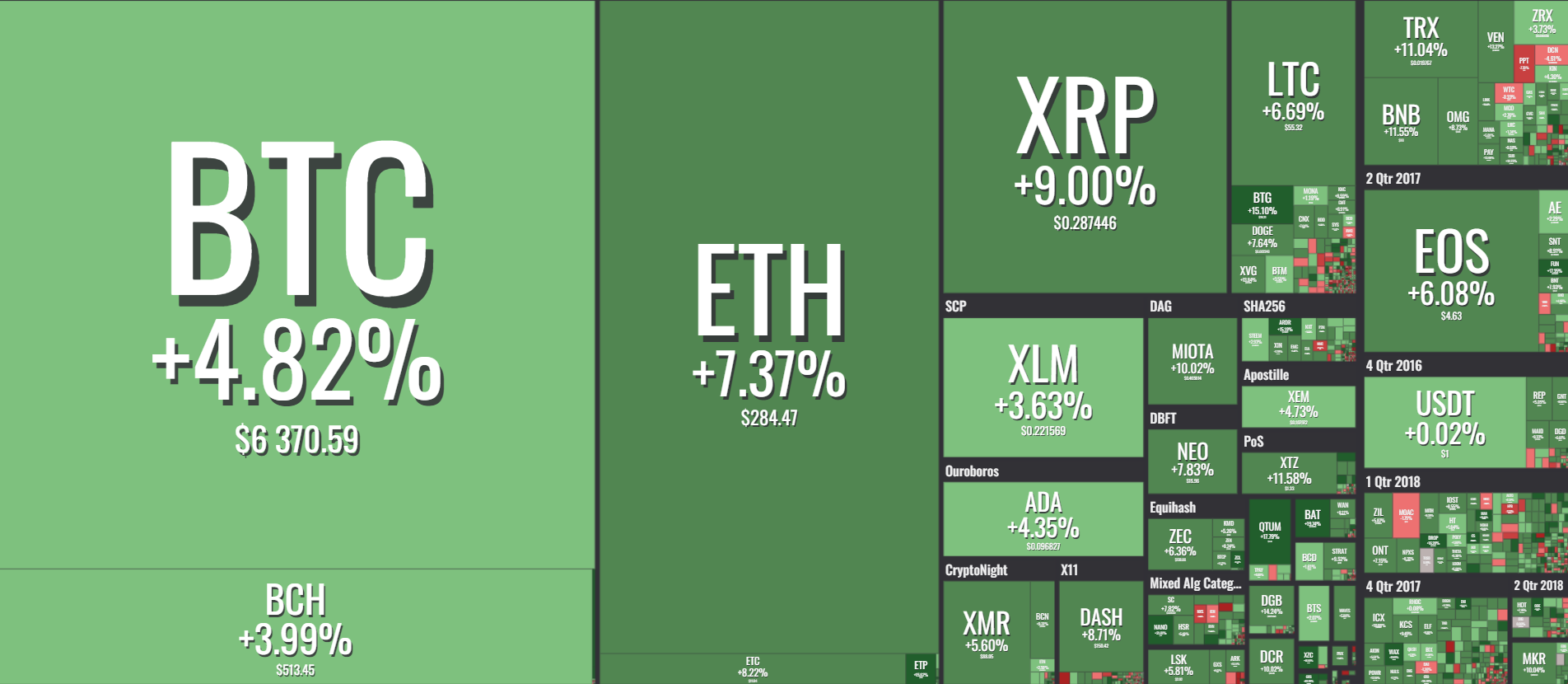

The scrambled pendulum swung back almost immediately. After a horrible and bloody Monday, even for the current bear market standards, sellers seem to run out of steam and the green roars loudly. Once the market has noticed that buyers are taking over, a small rebound of alts has begun, followed by a fair recovery by BTC itself. BTC went from less than $ 6,000 to $ 6,424.95 in just a few hours, proving that the bulls are not willing to let those annoying bears take over with no repercussions. Just as the market begins to lick its wounds, is there any possibility that this recovery is possibly long-term? Let's see what some experienced people have to say.

Bitcoin (BTC)

MarcPMarkets a TradingView power plant, published the following analysis:

"BTCUSD: The price breaks the psychological support 6K just to close above .This kind of price action one thing: squeeze.The lack of low formation of this important support is a significant sign especially in an environment where the sentiment is strongly bearish.Many people do not realize that while the alts were selling off, this market has refused to push the minimum of 5750. If the weakness was dominant in this market, the price would have to close below 6K to a minimum. "

Recognizes that there are downward structures below the levels of 6300 and 6879 (resistance of .382 compared to the Height of 8500). He also emphasizes the extremely high number of short films, pointing out that the crowd tends to be wrong at the top / bottom of the price movement. When everyone bets on the short because it is the obvious trade, the market tends to respond in the opposite direction. We are all aware of the fact that the market may fall (most believe that the $ 5,000 – $ 5,400 USD is the real fund) and a daily closing of $ 5900 USD or lower will suggest that this last run is reversing. He suggests that the major alts that break major media on Monday were followed by BTC which he managed to avoid, so it is an important signal of the strength that current levels bring and advises against shorting current BTC prices. Check the complete analysis here.

Other traders noted that the rebound was initiated by a model of a "hammer" candelabrum, a well-known sign of inversions.

$ BTC daily update:

Closed with a hammer as I suggested before.

Demand below 6k prevented it from falling below 5.8k.

Market sentiment was the lowest.

I do not know about you, but I'm not going to make it short. pic.twitter.com/uphTmbnK30– The Crypto Monk ⛩ (@TheCryptoMonk) 15 August 2018

With the rumors that some very wealthy investors have moved $ 190 million USD In the cryptography market, there are clearly people who feel that this is the time to buy. Or in a scenario more like a destiny, this is just Tether that manipulates the market. A certain confirmation of a strong reversal would require you to close above $ 6500 USD on the daily basis. If the price closes below the consolidation zone of $ 6000 – $ 6500 USD area, we can expect to see the bearish sentiment and moves towards $ 5,000 low to continue.

Ethereum (ETH)

After suffering some of the worst oversold conditions in more than a year, Ethereum managed to recover as planned. PRO_Indicators of TradingView expects this to be the time to buy and keep the king of altcoins:

"Again the warnings here are the same: Buy & Hold can not be done with the lever. Buy & Hold is a psychology of investment and nothing is close to speculative rumors.You must be prepared to invest in something that could go to 0. Never leave this trade until it reaches that value 0 … or to your goal! "

Recommends that investors may perhaps only change smaller parts of their portfolios in ETH, clearly feeling that the fund has been almost found. He says that while it is certain that ETH has found its fund, BTC remains very different. TraderCobb, another TradingView veteran, believes we may be looking for short-term shorting opportunities:

"With many in the top 10 divergent in the 4 hours my focus is on ETHUSD 1.30%. still close before I could go through the checklist, however I wanted to warn the community that this is something that stalked for a short time. "

XRP

cheynos from TradingView has had this to say about XRP:

"I think we'll drop to about 0.16 if we follow the downtrend line.This level is for me the buying zone.All between 0.16 and 0.20 is buy-zone: I expect a rebound from the downtrend line to our first resistance at 0.40, if they were pushed back to that level and rebounded, it would be very healthy, if we bounce back to 0.40 and create a higher minimum, I would be extremely optimistic about Ripple. "

With an RSI est Remotely oversold on the newspaper, these new annual lows could soon be overturned. It also offers an hourly analysis, which is a little bit bullish:

Check out its complete analysis to see details about the XRPBTC coupling and some extra information it provides regarding the XRPUSD shorts / side members.

Bitcoin Cash (BCH)

Crypto_ocean gave us the following chart regarding BCH:

The currency suffered a significant drop during this bear market and may be looking to reach the lowest areas of all time if the drop continues. Traders believe it is unlikely to happen and cites $ 490 USD / $ 550 USD as replacement support / resistance zones.

EOS

EOS managed to overcome XLM as the 5 th most precious currency on the market. A user of TradingView alanmasters believes that the currency has great potential and thinks that the EOSBTC coupling could take some positive action in the near future:

"It's just a question of time Our falling wedge, shared by a previous business idea, is almost complete Looking at the past story, the EOS vs BTC pair is preparing for some bullish action … The potential is huge! "

Conclusion

It's only a matter of time … how many times have we heard about cryptotempt races? For now, it seems that the BTC is still relatively strong, with rubber alts as usual. The last rally is probably just a small rebound that will soon be followed by another fall in the $ 5,000 low. More volumes of purchase and a crazy amount of hopium will be needed to overcome the current downward trend in which the market is still present.

The writers and authors of CapitanAltcoin may or may not have acquired an interest in any of the projects and activities mentioned. None of the contents on CaptainAltcoin is an investment advice nor a substitute for advice from a certified financial planner.

[ad_2]Source link