[ad_1]

[ad_1]

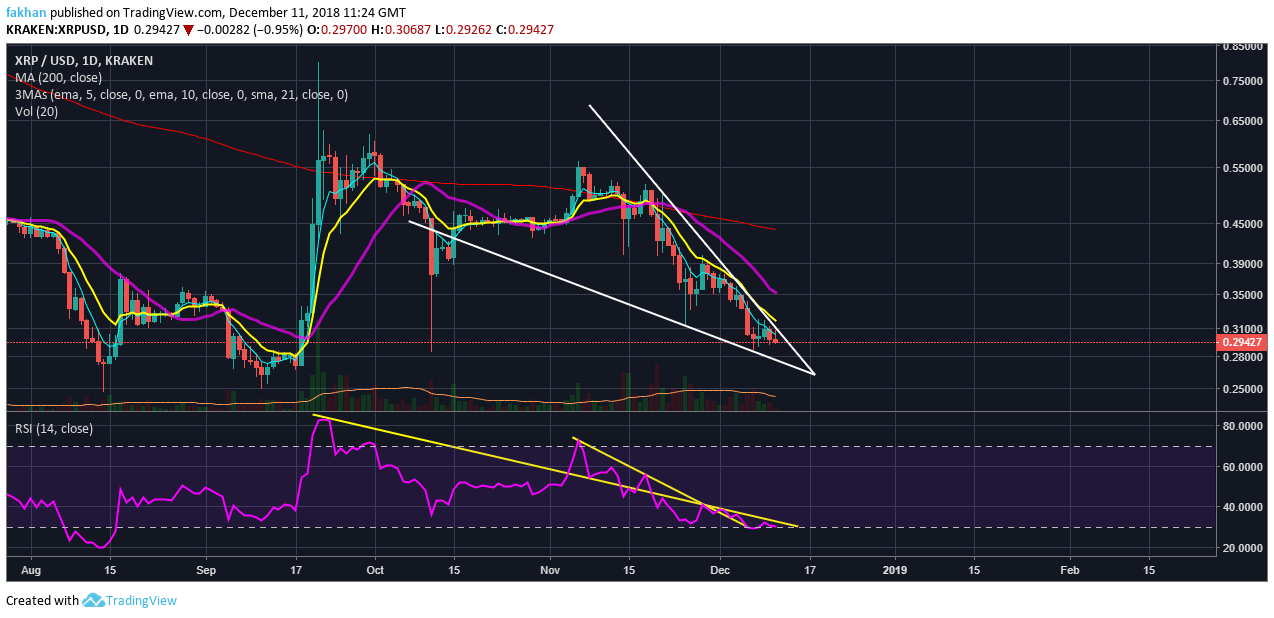

Ripple (XRP) fell below $ 0.30 today after being rejected at the 5-day EMA. The price has fallen aggressively since mid-November, but there is still room for further disadvantages. The daily chart for XRP / USD shows the price trade in a falling wedge. Having just been rejected at the top of this wedge, the price is likely to fall to the bottom of this wedge to find a temporary fund before the inversion. The volume started to decline again and it would not be surprising to see Ripple (XRP) make an aggressive downward move to set a new annual low before the end of the week. RSI for XRP / USD also met with historical resistance and should continue to decline until mid-December.

Ripple (XRP) seems to have broken his challenge model and now moves with the rest of the market. The daily chart for XRP / USD shows that Ripple (XRP) still has plenty of room for a rally in 2019. The price could go up to $ 0.50 and even higher by the beginning of 2019. This causes current price levels are good long-term points. That said, the sentiment is currently overly bearish and it is unlikely that new retail shoppers will be able to return to the market anytime soon. Many of them crowd only when they start to see large successive movements on the daily chart. 2017 was the year when a large majority of new traders and investors entered the market. Most of them joined in late 2017, when prices were already too high.

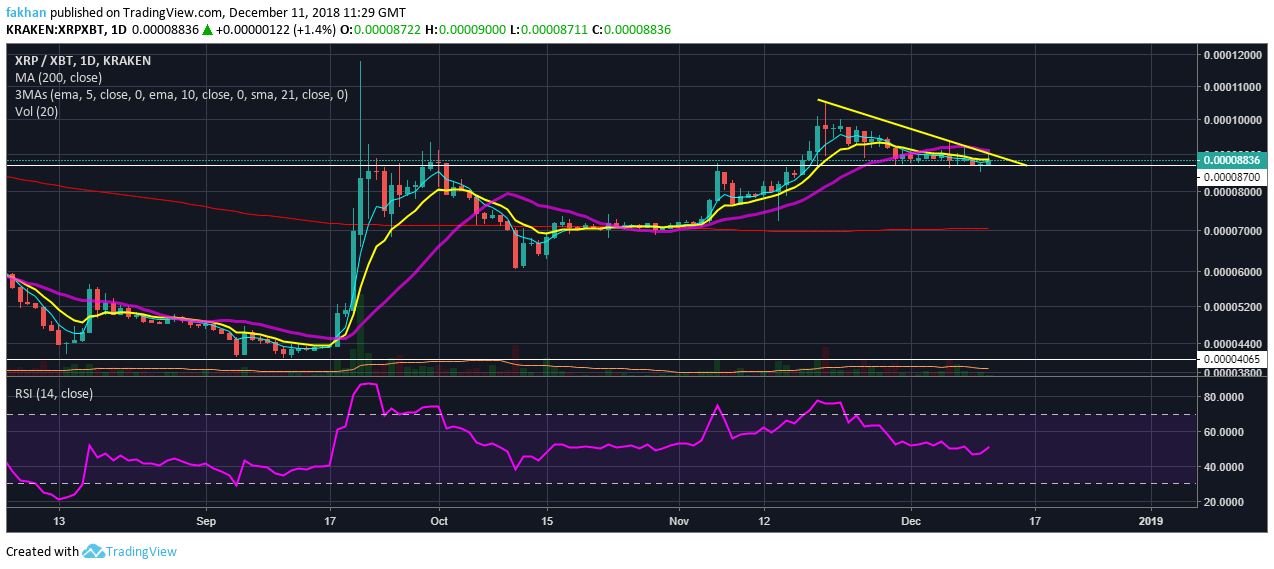

Chart for XRP / XBT (1D)

They saw the great gatherings and thought that this could go on forever. When prices began to fall, they did not sell in the hope of a recovery. Then, when the recovery did not start, most of them panicked thinking that the cryptocurrency bubble had exploded. Now, it may be true, the bubble has actually appeared. However, what is most important is that it is not new. This particular bubble has popped up four times before and will continue to tick again in the future. This does not mean that Ripple (XRP) or the cryptocurrency market is dead. If anything, this should be seen as a wonderful opportunity to buy more. There is a way of thinking about all this, and this is to throw everything as a failure thinking you made a big mistake by buying near the top and now you've lost everything.

However, this is not the only way to think about it. You can also be grateful for having the opportunity to see a whole market cycle in such a short time. A lot of people can not see it. Cryptocurrencies have made it possible. The learning that you acquire following a whole market cycle is simply priceless. In my opinion, it counts more than the short-term profits you make at a certain time. Being lucky and buying lows and selling highs during the bull market is like someone giving you a fish. However, being careful and learning from your experiences during the bull and bear markets is like someone who teaches you how to catch a fish. It is not difficult to understand which will help you more in the long run.