[ad_1]

[ad_1]

Bitcoin (BTC) has reached new highs of 2020, approaching the price of 14,000 USD, and is “ready for take-off”, according to the crypto analytics firm Coin metrics this provided three reasons why this could be the case.

In the past 24 hours, BTC had broken above USD 13,800, or the level last seen in January 2018, before dropping back below USD 13,000 and subsequently bouncing back to USD 13,116 (15:59 UTC). While bitcoin’s volatility is hardly surprising, “this time something is different,” the Coin Metrics team said in the recent report. He added that,

“Since the cryptocurrency slump in March, BTC has grown in ways we haven’t seen in previous bull runs. Fundamentals on the chain suggest it may be poised for its biggest breakout yet.”

The company has provided 3 arguments to support this claim.

1. Correlation with gold / dollar and increase hodling

After the March 12 crash, now known as Black Thursday, BTC’s usually low correlation with gold and the US dollar has changed. Since then, BTC’s correlation with gold has been near historic highs and its correlation with USD has been at historic lows, the report says.

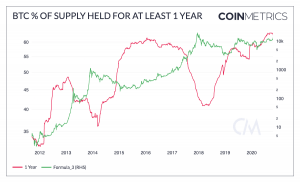

According to on-chain data, BTC’s holding since March 12 has risen as the price has risen, “signaling that BTC is increasingly being used as a store of value, similar to gold.” As of October 25, around 62.5% of BTC’s total supply was held for at least 1 year, close to all-time highs.

The speed of BTC, which measures the amount of times an average unit of supply has been transferred over the past year, is at its lowest since 2011, suggesting that “BTC tends to be used as a store of value against to a medium of exchange. ”

2. “More owners than ever”

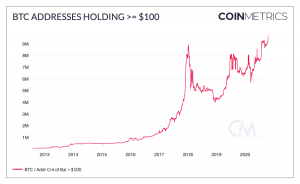

Continuing the above argument, the report states that “there appear to be more holders than ever”, with the number of addresses holding at least USD 100 worth of BTC reaching a new all-time high of 9.74 million on October 22nd. This is a positive sign for the long-term adoption of BTC, Coin Metrics said.

Following the good old saying “ not your keys, not your money ”, it seems that more holders want to keep their coins, as BTC supply is increasingly shifted from centralized exchanges.

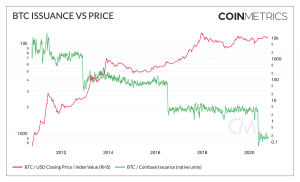

3. Decrease in BTC supply inflation

The issuance of supplies has decreased, especially if we take into account the bitcoin halving, the third of which took place in May.

“Historically, the price of BTC has reached a local peak within 1.5 years of any previous halving,” Coin Metrics said. “With the increase in holding activity and the halving of less than six months in the rearview mirror, all signs indicate that BTC is ready for takeoff.”

Great investor-led rally

Nic Carter, co-founder of Coin Metrics, is quoted by Bloomberg as saying that “this rally appears to be more driven by allocators with larger balances involved, rather than a flurry of retail investors.”

This comes later PayPalThe decision to include crypto in its offering, as well as Squareis and MicroStrategyinvestments in BTC.

Coin Metric’s weekly network status report further added that bitcoin transaction fees have exploded, increasing by 82.5%. “On October 22, BTC’s average transaction fee rose to [USD] 6.35, eclipsing ETH’s average commission of [USD] 1.69. “And while Ethereum’s (ETH) average transaction fee was higher than BTC’s for most of September due to the boom in decentralized finance (DeFi),” momentum has returned to BTC. “

Meanwhile, the Bitcoin bulls have used the recent rally to share their optimism about bitcoin’s present and near future. Raoul Pal, CEO of Real Vision Group, for example, described currency as “a supermassive black hole that sucks up everything around it and destroys it”, including silver, gold, banks, bonds, commodities, etc. “This narrative will only grow in the next 18 months,” Pal said.

Bitcoin’s performance is so dominant and so all-encompassing that it will suck in every single asset narrative and spit it out.

Never before in my career have I seen a trade so dominant that holding other assets hardly makes sense.

– Raoul Pal (@RaoulGMI) October 27, 2020

Meanwhile, others expected a correction before the rally continued.

I think, at best, the bulls have an extra leg before a decent retreat here.

I’d be quite surprised if we didn’t correct before convincingly spending $ 14k. pic.twitter.com/fgc90BnFo9

– Holidays (@LomahCrypto) October 28, 2020

@CryptOrca We’ll see what’s next. But I agree that nothing really changes in this regard. Shake it to wake it up. Than break it.

____

To know more:

Bitcoin has outperformed Ethereum but has even more profits for holders

US elections: withdrawal possible, but neither Trump nor Biden won’t stop Bitcoin

“Bitcoin on Track for USD 100,000 in 2025” – Bloomberg Intelligence

Imagine Regulators Shutting Down Tether: What Happens to Bitcoin?

[ad_2]Source link