[ad_1]

[ad_1]

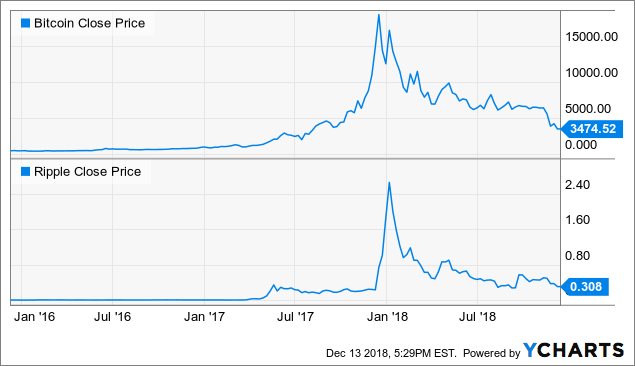

Compared to his colleagues in the crypto community, Ripple (XRP-USD) resisted the decline of 2018. Of course, it is down nearly 90% from its all-time high, while Ethereum (ETH-USD) and Bitcoin (BTC-USD) ) decreased significantly (50% -plus) in the last three months, Ripple's XRP price is almost exactly where it was. And surely it has seen a peak almost double compared to October, but it was the only big coin to tick, a sign that the market could be interested in XRP, if only it could "decouple" from its main trading pair with BTC.

Ripple Close YCharts pricing data

Ripple Close YCharts pricing dataAnd that's what it will take for XRP to retreat in 2019, days and weeks when Ripple's prices shift to the value created by the company based in San Francisco, and not just how Bitcoin is moving. Because the reality is shown below: where the two – and Ripple are no exception among the other coins here – have moved in correlation with each since XRP started trading in early 2017.

Bitcoin Close Prices given by YCharts

Bitcoin Close Prices given by YChartsBut there are some references to a division, in which Ripple can operate alone and with an investment opportunity that focuses on the idea of u200b u200bthe company to revolutionize the monetary movement, and not just as a another investment in the "crypto" category. This is mainly good, with perhaps an exception.

Decoupling from Bitcoin

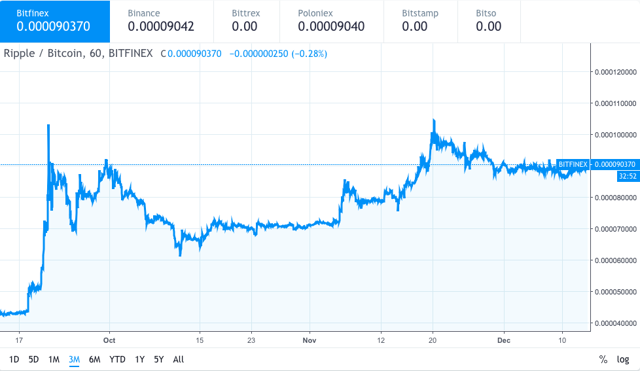

The first sign of decoupling arrived in November this year, when XRP increased the gains we see above in the middle of a falling Bitcoin. We saw this again this month when XRP remained relatively immune to the battles within the Cash Bitcoin hash war, showing perhaps that investors were not worried about what was happening elsewhere. But the real positive sign is the use of xRapid, a blockchain product that has nothing to do with Bitcoin, Ethereum or smart contract, much of what the rest of the market is based on.

The graphs also show things moving in that direction. Despite the downward trend in the USD price, Ripple has gained its trading relationship with Bitcoin since October, and steadily even after its recovery from the mid-month peak.

But xRapid and adoption, not by the masses, but by the banking institutions they will use xRapid, it's vital. And this week has seen other good news, as well as an impressive list of partners that Ripple has accumulated this year.

But xRapid and adoption, not by the masses, but by the banking institutions they will use xRapid, it's vital. And this week has seen other good news, as well as an impressive list of partners that Ripple has accumulated this year.

As reported by Reuters this week, Ripple will help the UAE to make cross-border payments in Asia from the start of 2019. This is a big step forward. Ripple already has an impressive list of partnerships, but many lack concrete dates or details about the partnership. This is great and the UAE exchange claims to be actively seeking to address a 10% market share of a cross-border remittance market that sent $ 613 billion across Asia last year.

Furthermore, as this article points out, "the United Arab Emirates is one of the oldest and largest money transfer agencies in the Middle East, and is one of the increasingly numerous financial institutions in the region to join Ripple, including the National Bank of Ras Al Khaimah and the Kuwait Finance House. "

Now, if you read the article linked above by listing some partners (link here again), you will see that we have written some doubts about the financial opportunity that xRapid can provide to XRP investors. This is still valid, but the short-term opportunity is still there. And if Ripple can show the adoption by the banks, and any paying customer who chooses to use the benefits of buying xRapid, it could be a short-term advantage that increases the XRP / BTC ratio to Ripple . Do not forget that Ripple once had a "market capitalization" of almost 10 times that in which it is now, so there is money waiting in the margins to see if the innovative remittance technology can work.

The threat: normative uniqueness

I said before that a Ripple decoupling would have good and bad implications. Above is the good one. The bad guy is a possibility: that if Ripple moves away from the rest of the cryptocurrency, he opens himself up to the analysis of "what" exactly. And, in particular, whether or not it is a security.

That problem has weighed on Ripple's head and in the early court discussions since last year. No verdict has been reached. But the debate has again developed.

Binance CEO Changpeng Zhao said: "The judicial process could take years. But if the XRP is considered as a security, it will severely damage many US users and, to a certain extent, other users around the world. Certainly it does not seem to me a certainty, but this is only a person's opinion. "

He is right. The "security" question is one of the remaining questions for Ripple, and certainly the most existential. It could bring down a rising star if US courts choose to limit their potential as an investment. An important perspective on this is from Coinbase. The largest trading platform in the United States added coins quickly this quarter, but did not add XRP. Why? Many are speculating because the legality of what the XRP is, in terms of US regulation, is not yet clear.

Conclusion

Ripple continues to drive cryptographic space in adoption and the UAE swap transaction does nothing but sweeten the pot and the timeline. It is possible that we will see the XRP trade for its merits, away from the rest of the cryptographic market, in 2019, in particular with any announcement by a banking institution making a big game in the ownership of the XRP. The only thing at this point that could ruin that fun is a piece of legislation focused exclusively on XRP that slows its progress. Everything must be monitored.

Bitcoin may have descended from the stratosphere, but there is still an abundance of opportunities in cryptocurrencies. At Coin Agora, our focus is on altcoins – small-cap crypts that have enormous potential to upset corporate ecosystems. Invest with us for the opportunity to enter the ground floor. Our mission is to help you find small, new and growing coins and collect rich returns. Let us help you overcome the noise and find the winners – join the Coin Agora community today!

Revelation: We are / are long XRP-USD. I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

[ad_2]Source link