[ad_1]

[ad_1]

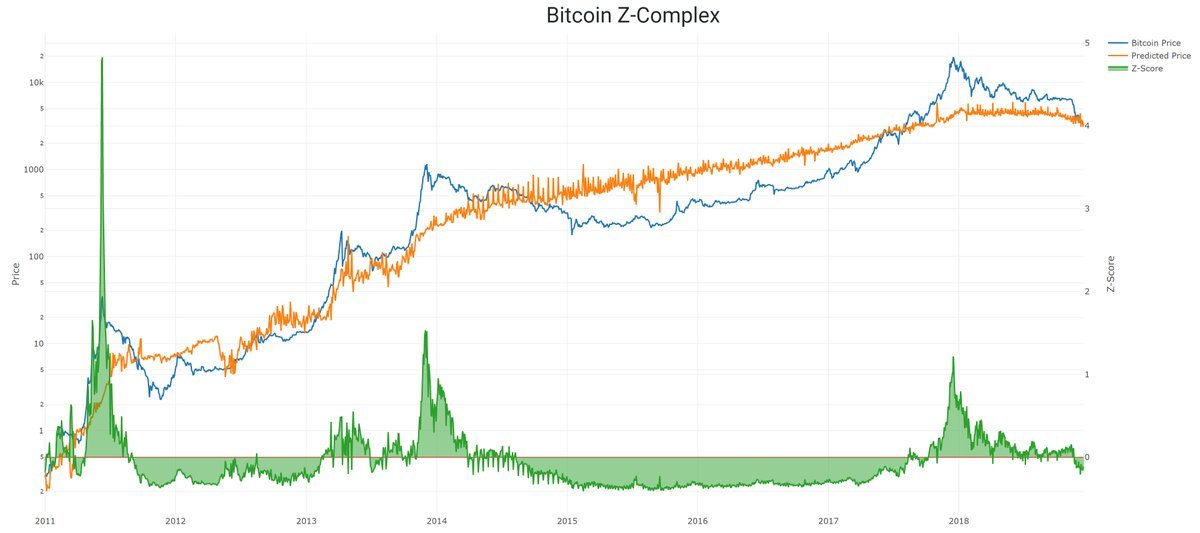

The 2019 forecasting season is approaching and we have asked one of our most interesting Crypto contributors. Mr. Hauge is the creator of the Z-Signal and Z-score indicators.

Hans HaugeVision – The Z-Signal indicator.

– What particular features does Bitcoin have when it technically analyzes it? Do you think that classical technical analysis is valid? If you do not find it valid, what advice would you give our readers to improve their analysis?

I think technical analysis is like voodoo. If you think it works, then it does. In a group context, if enough people believe that the price will behave in a certain way, then you could actually see that manifest in the market. Since many people do not know the fundamental approach (which is my goal), I am not aware of any alternative. I would just like to broaden the scope of the conversation a little, and maybe exchange some technical traders to look at the fundamental models, which I believe are the best long-term tool we have today.

– Can you explain your Bitcoin Z-Signal indicator in a way that an unaccustomed reader can understand?

Sure. I believe the value of Bitcoin is in the network. Think about Facebook and Twitter. How much are those companies worth if they have zero users? Not much, right? What happens if Facebook and Twitter have many users or all users? How much are they worth now? Very right?

It's the same thing with Bitcoin. If no one has it, sends it, accepts it, works it, extracts it; so it's practically useless. However, if we see increasing levels of participation (which is what I follow), then it is a good sign for future prospects. What Z-Signal does is that it takes the raw data from the network and combines it with a time element. The theory comes in three parts.

1. We need users to have a network, the more they are, the better.

2. Users have to do something, or they are not helping a lot. The more transactions, the better.

3. The longer Bitcoin survives, the larger the user base becomes, the more likely it is to persist (this is called the Lindy Effect).

When we combine these three elements and observe the data in the log scale, magic happens. All of a sudden we can see some very powerful relationships between the number of users (I use the number of unique addresses as proxies here), the activity level of users (I use daily confirmed transactions on the blockchain here, not false transactions from exchanges ) and the total number of transactions also confirmed (this is a way to conceptualize the age of Bitcoin).

Z-Signal creates a predictive model that attempts to anticipate the "fair" price of Bitcoin at a certain point in time based on these three inputs. So, I take the actual price and divide it by the expected price.

This is the price / expected ratio. The price / expected ratio indicates when the price may be too high or too low based on the model's prediction. Then I standardize these reports, and that's where the Z scores come from.

At any time, the Z score tells you how far the price is from the forecast. This is practically everything.

– From what I have observed in your articles, the indicators you have created are quite reliable when it comes to predicting movements. Could you give us your predictions for the Bitcoin price for next year?

Sure. First let me say that the floor of the Bitcoin price and the ceiling are changing every day. This means that a low price at this time may have been a high price in the past. Furthermore, a high price may seem low in the future. So when we get to the bottom of the market, I think it's more likely that we'll see a low price in December 2018 of what would see the same price in July 2019.

Going down the low Z scores of the last two bubbles and the fact that the bubbles have the strange property of deflating just above the last peak, I would say that the floor for Bitcoin in the short term is probably about $ 2000 (the bubble before this peaked at $ 1,100).

2019 It could be a year of silent gains, or we could see things going crazy. The most likely scenario, if I had to guess, would be that we see a positive movement in 2019, but then real big gains in 2020. Generally, after a bubble, people burn psychologically. It takes time before they resolve and come back. Furthermore, the next block premium will be halved in 2020, and this event is eagerly awaited. The halt of the premium by half will send a supply shock through the system, while the new Bitcoins issued every ten minutes suddenly halve.

The last thing is that futures contracts are becoming more popular month by month, and we should see the launch of Bakkt in January 2019. This will add an option for futures regulated in Bitcoin, rather than just cash. If we see the same pattern of growth with these contracts as cash-settled versions, it could be a key driver growth.

Sometimes in 2019 or in 2020; I predict that Bitcoin will reach $ 100k for a single currency.