[ad_1]

[ad_1]

Latest news from Ripple

It is true that the blockchain will find widespread use in the multibillion-dollar cross-border payment industry. Leading this unit is Ripple and although it is a for-profit company that uses XRP as an on-demand liquidity tool for one of its key solutions, the Ripple team is working overtime to ensure regulatory compliance.

To read: The effect of January and the new capital: because Bitcoin (BTC) and other Cryptos are in the green

Launched during the highly anticipated SWELL conference in which Bill Clinton held his keynote, xRapid has not yet left as planned. The xCurrent 1.4 upgrade is an improvement that makes use of an option for financial integration to easily incorporate xRapid, but so far, most of these banks and payment processors that use xCurrent still have to opt for for access.

Read also: New York Lawmaker announces Crypto Taskforce via Facebook

Nonetheless, Ripple's vision is undeterred and already three trading platforms – Bittrex, Bitso and Coins.ph- and Cuallix, Mercury FX and Catalyst Corporate Credit Union will leverage xRapid for convenience. This is positive and in tune with Ripple's ambitions, as cited by Chris Larsen, co-founder and executive president of Ripple, during the Crypto Finance Conference in September 2018. According to Larsen, Ripple will always defend and use XRP to pay power across the world:

"For payments, we think it has additional requirements.You must have settlement predictability.You must have constant low costs.You must have a high return.xRapid, this is a component of RippleNet.This allows payment providers to reduce the cost and liquidity for their global payments. "

Ripple (XRP) Price analysis

Overview

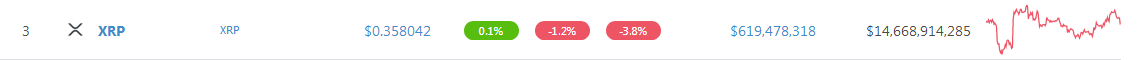

At prevailing rates, XRP is in third place, but relatively stable against the dollar on the last day. Even with this, XRP / USD rates are fluctuating and go within a range of 6 cents in the daily chart.

Now, in sync with previous business plans, we will maintain a bullish prospect as long as the XRP is trading above 25 cents in the short term with an opportunity for further disadvantages more if prices rise above our immediate resistance and we buy the trigger line at 42 cents.

Remember, if the bulls can not build enough momentum and push more than 40 cents, then bears in mid-November and early December are likely to be able to push prices below 34 cents or September lows to 25 cents.

Trend: bullish, range-bound

Note that, despite the sharp rise in the short and medium term, the XRP / USD is actually trading within a range of 10 cents larger with limits to 40 cents on the upside and support at 30 cents . The reason why the resistance zone between 40 cents and 42 cents is important because it coincides with the Fibonacci retracement level of 61.8 percent when the instrument is anchored to the low of September 2018.

Therefore, with the definite trend, it is up traders to trace this pair pending a solid break and close over resistance.

Volumes: low

Apart from the ecstatic purchases of 24 December, when prices closed temporarily above 40 cents, volumes were small and this justified the current intense trade. If the bulls should have control, we must see the confirmation of the bulls of December 17-24 with prices that exceed 40 cents in comparison to high volumes that exceed 24-123 million December compared to 54 million. Subsequently, we will operate as established in the previous XRP / USD business plans.

Meanwhile, our business plan is as follows:

Buy: 40 cents-42 cents

Stop: 37 cents

Objective: 55 cents, 60 cents, 80 cents

All graphics courtesy of Trading View-BitFinex

This is not an investment tip. Do your research.